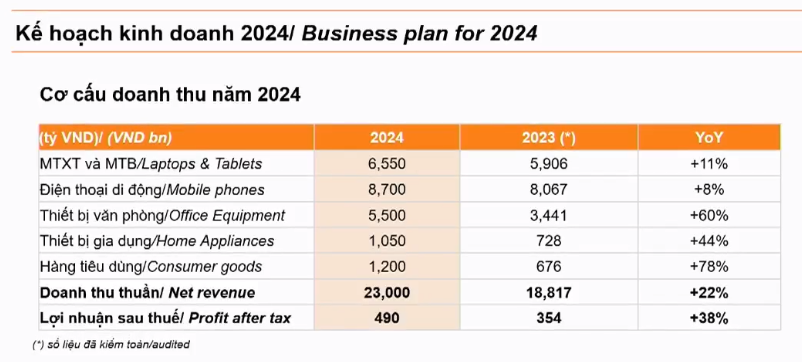

Digital World Corporation (Digiworld, stock code DGW) held its 2024 Annual General Meeting of Shareholders and approved a plan for net revenue of 23,000 billion VND (~1 billion USD) – an increase of 22% and a net profit of 490 billion VND – an increase of 38% compared to the actual figures for 2023.

In terms of revenue structure, the mobile phone segment is expected to contribute 8,700 billion VND – an increase of 8% and the laptop and tablet segment is expected to contribute 6,550 billion VND – an increase of 11%. Other operations, including office equipment, home appliances, and consumer goods, will increase by 60%, 44%, and 78%, respectively.

Chairman Doan Hong Viet shared: “DGW’s vision is to become a billion-dollar company, not just in terms of revenue and profit. This is the driving force for DGW to continue growing. Economies of scale will be increasingly leveraged to help DGW operate more efficiently and attract talent to shape the future. “

Q1/2024 REVENUE ESTIMATED TO REACH NEARLY 5,000 BILLION VND, NET PROFIT 92 BILLION VND

At the meeting, DGW’s management estimated that the Company recorded net revenue of 4,985 billion VND and net profit of 92 billion VND in Q1/2024, representing growth of 26% and 16% year-on-year, respectively. Notably, all of DGW’s business segments experienced revenue growth.

The strongest growth was in the smartphone segment (up 29%) and the office equipment segment (up 48%). The consumer goods segment also grew strongly, but the absolute value is still relatively low. In contrast, the laptop and tablet segment grew only slightly by 4%, to 1,139 billion VND.

The ambitious plan comes amid a relatively difficult year for DGW in 2023. During that year, the Company’s revenue fell to 18,817 billion VND, and its profit halved to 354 billion VND.

Based on the above results, DGW’s Board of Directors submitted to the AGM a dividend payment plan for 2023 with a total ratio of 35%, including 5% in cash and 30% in shares.

DGW also plans to issue 2 million shares under the Employee Stock Option Plan (ESOP), all of which will be subject to a one-year lock-up period. At a selling price of 10,000 VND/share, DGW is expected to raise 20 billion VND. Thus, through the two share issuances mentioned above, DGW plans to increase its charter capital to nearly 2,192 billion VND.

Another notable item on the agenda is the change of head office from 195-197 Nguyen Thai Binh, Nguyen Thai Binh Ward, District 1, Ho Chi Minh City to a new address on the 15th floor, Etown Central Building, 11 Doan Van Bo, Ward 12, District 4, Ho Chi Minh City. According to DGW, with the growing staff and scale of operations, the premises at 195-197 Nguyen Thai Binh can no longer meet the Company’s operational needs.

DISCUSSION: FMCG STRATEGY

1. DGW’s strategy is to diversify its product categories, reducing its revenue dependence on a single core business, but currently ICT still accounts for a fairly high proportion of DGW’s revenue structure. What are the plans for the near future?

Chairman Doan Hong Viet: The contribution of the two segments, phones and computers, is still dominant, but the proportion has been gradually decreasing over time, mainly due to stronger growth in other segments. Looking at the 2024 plan, the new segments are growing significantly compared to phones and laptops.

The ICT sector has been operating for many years, and its channels are quite well-established, so we will only continue to add products to make better use of the distribution channels.

For the FMCG sector, DGW is focusing on F&B products, home care, and personal care.

2. Does the Company plan to engage in M&A in the near future? What are the business plans for the acquired companies?

M&A is a key development strategy. One of DGW’s successful formulas is to provide target companies with a back-end platform and help them optimize their operations. Achison is a prime example. After the acquisition, DGW helped reduce costs and set a revenue target of 1,000 billion VND for 2024, an increase of 50%.

DGW always aims to have 2-3 M&A deals per year, as M&A will help DGW move faster, leverage its market knowledge, and its strong back-end platform.

3. How has the exchange rate affected the Company’s business activities?

CEO Dang Kien Phuong: The exchange rate is currently a hot topic for many businesses with foreign exchange related activities.

With nearly 30 years of business experience, DGW has developed a good exchange rate hedging plan. As a result, the exchange rate situation has not impacted DGW’s operations.

4. Please share the outlook for the pawnbroking segment?

Mr. Doan Hong Viet: Pawning is just one of Vietmoney’s activities. In addition, Vietmoney also provides credit to small businesses, which is in line with DCW’s FMCG distribution strategy. Vietmoney also has a system in place to sell used computers and mobile phones. According to DGW’s data, this market is very large. For example, the lifecycle of an iPhone can be up to 6 years, going through multiple owners, thus creating a large number of transactions.

5. Are there any current collaborations with Viettel Construction (stock code CTR)?

Viettel Construction has many activities that can be combined with DGW. In fact, DGW has already implemented several business activities with Viettel Construction.

6. What is the market size and expectations for the protective equipment and FMCG segments in 2024?

Achison specializes in providing accessories and protective equipment for factories. Currently, this company has a market share of 10%, which is not very high. Moreover, when compared to the much larger markets of Asian brands, Achison has yet to reach its full potential. And the fact that Vietnam is becoming a regional and global manufacturing hub will create long-term growth opportunities at a high rate in this segment.

7. Used products face problems with VAT invoices. How does the Company assess this issue?

This is the biggest problem with used products. Currently, about 99% of the market is in small retail stores and there is no tax, while DGW has to comply with legal regulations, which is a disadvantage.

DGW is still confident because we have D-Care and there are certain customer groups who are willing to pay a higher price to ensure quality.

8. Why has DGW set a growth target of 70% in the consumer goods sector in 2024?

Mr. Dang Kien Phuong: In 2023, the FMCG segment grew by 100% year-on-year and DGW is confident that it will grow by another 70%.

For FMCG, DGW has a clear strategy in the segments of Home care, Pernonal care, and F&B. DGW only entered the F&B segment in 2023, while this segment is very large and DGW has only been distributing in MT (modern distribution channel), while there is still a lot of room for growth in On-trade (distribution channels for on-site consumption) and expansion of distribution for FMCG.