Hoa Binh Construction Group Corporation (stock code: HBC) released its Q1/2024 financial statement with revenue of VND 1,650 billion, an increase of 38.2% compared to the same period last year. After deducting the cost of goods sold, the company had a gross profit of VND 21.3 billion, while in the same period last year, it had a loss of VND 202.6 billion.

The company’s financial revenue increased dramatically, 45 times to VND 113.7 billion. According to the company’s explanation, the sharp increase in financial revenue was due to the recognition of gains from the sale of investment assets. In the past period, the company also collected VND 21.1 billion in reversed expenses on business management. This is a provision that Hoa Binh Construction has set aside for its allowance for doubtful debts.

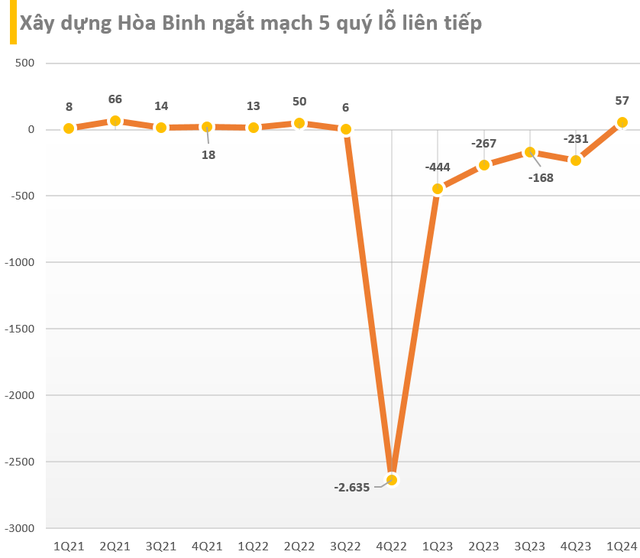

As a result, Hoa Binh Construction recorded a net profit of VND 57 billion in Q1/2024, while in the same period it had a loss of VND 443.8 billion. Thus, the company has broken a streak of 5 consecutive losing quarters.

As of March 31, Hoa Binh Construction still had an accumulated loss of VND 3,182 billion. Therefore, the company’s equity was only VND 149 billion. Hoa Binh’s financial debt is at VND 4,485 billion, 30 times higher than its equity.

Hoa Binh Construction’s total assets reached VND 14,892 billion, a decrease of nearly VND 350 billion compared to the beginning of the year. Of which, nearly 70% of the company’s assets are short-term accounts receivable, reaching VND 10,239 billion. The company has only VND 315 billion in cash and cash equivalents.