On April 26, the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Eximbank) held its 2024 annual general meeting of shareholders and approved many contents related to the plan to increase charter capital, move the head office location, elect members Board of Directors (BOD) for the term 2020-2025…

Notably, the meeting elected Mr. Nguyen Ho Nam as a member of the BOD (approved by the State Bank). Mr. Nam is currently Chairman of the BOD of enterprises including: Bamboo Capital Joint Stock Company (stock code: BCG), Bamboo Energy Joint Stock Company, and Member of the BOD at Fides Vietnam Fund Management.

Meanwhile, Ms. Le Thi Mai Loan, a member of Eximbank’s BOD, was dismissed after submitting her resignation in late January 2024.

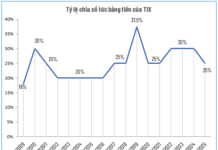

This year, Eximbank paid a total dividend of 10% in cash (3%) and shares (7%), from the remaining profit after setting aside funds. Regarding the option of paying dividends in shares, Eximbank plans to issue an additional 121 million shares, or 7%. If the issuance is successful, Eximbank’s charter capital will increase by a maximum of over VND 18,600 billion.

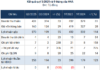

Eximbank continues to set a profit target of VND 5,000 billion this year

Despite the fact that the economic picture remains challenging, Eximbank is still setting its pre-tax profit target for 2024 at VND 5,180 billion, up 90% compared to the 2023 result. Previously, in 2023, this bank also set a profit target of VND 5,000 billion, but only achieved VND 2,720 billion.

“Great lesson” from the case of credit card debt of more than VND 8 billion

Responding to shareholders at the meeting about the recent incident involving a credit card holder indebted by more than VND 8.8 billion after 11 years, Mr. Nguyen Hoang Hai said that this was a great lesson. This has a significant meaning in rebuilding the system, creating a better image for Eximbank. There are many different ways to calculate interest and the bank is aiming for an interest calculation method that is in line with market practice, satisfying customers. Eximbank seriously reviews and learns from this incident in its card service operating policy.

“We will not let this happen again and work with respect for our customers. For inactive accounts, Eximbank will not charge any fees and will cut them to avoid waste” – said Mr. Hai.