FPT Stock Surges as Nvidia Partnership Fuels AI Ambitions

After a period of adjustment, FPT stock has swiftly regained its momentum with a strong upward trend in recent times. Notably, during the April 24th session, the leading technology stock surged by 5% to reach 118,000 VND/share (as of 10:30 AM), surpassing its historical peak. The market capitalization correspondingly increased by approximately 10,000 billion VND after a single session, reaching close to 150,000 billion VND (approximately 5.8 billion USD).

Remarkably, the surge in FPT stock coincided with a surge in trading volume. The matched order volume in the first half of the morning session exceeded 3.6 million units, surpassing the average liquidity over the past 10 trading sessions.

The stock’s positive momentum followed the announcement of a strategic partnership between FPT Corporation and Nvidia to establish an artificial intelligence (AI) factory.

Specifically, on April 23rd, FPT and Nvidia signed a comprehensive strategic partnership agreement to advance AI research. The two parties plan to construct an AI Factory, train high-quality personnel, and become development partners within Nvidia’s partner network.

According to the memorandum of understanding, FPT intends to invest 200 million USD to build an AI Factory that will provide a cloud computing platform for AI research and development with autonomy in Vietnam. The factory will feature supercomputing systems powered by Nvidia’s latest technology.

The factory is expected to enhance Vietnam’s capacity to provide advanced AI and cloud technology solutions on a global scale, while also elevating the capabilities of its technology workforce. “We are committed to making Vietnam a global AI development hub,” stated Mr. Truong Gia Binh, Chairman of FPT, at the signing ceremony.

In recent remarks, Mr. Do Cao Bao, a member of FPT Corporation’s Board of Directors, expressed that Nvidia is currently a global leader in AI, with the world’s largest AI ecosystem and the beating heart of the AI supercycle. Many of the world’s technology giants are enduring an 18-month wait to acquire Nvidia’s GPU AI chips. Nvidia is selective in who it sells to, choosing only partners who contribute to the global AI ecosystem, and FPT is one of the few domestic companies that Nvidia has chosen to collaborate with and support.

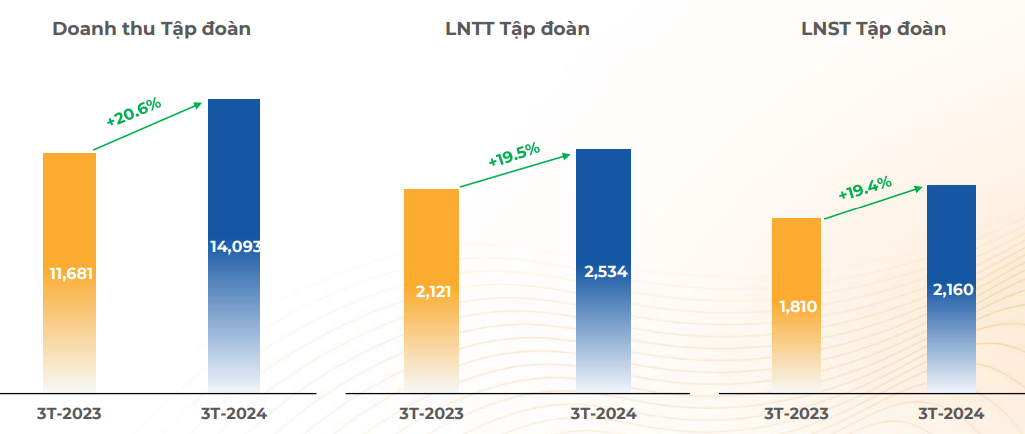

In addition to the positive partnership news, FPT’s growth is also supported by its robust Q1 financial results. FPT reported a Q1 net revenue of 14,093 billion VND and a pre-tax profit of 2,534 billion VND, representing increases of 21% and 19%, respectively, compared to the same period last year. Net profit increased by 20% to 1,798 billion VND, marking the highest quarterly profit in FPT’s operating history.

The company attributed its Q1 growth primarily to the technology segment, encompassing both domestic and international IT services. This segment accounted for 60% of revenue and 45% of pre-tax profit, contributing 8,472 billion VND and 1,155 billion VND, respectively.

Within the technology segment, international IT services contributed 6,999 billion VND in revenue and 1,115 billion VND in pre-tax profit, marking increases of 28% and 26%, respectively, compared to the same period last year. This growth was driven by sustained high growth in key markets such as Japan (+44.2%), fueled by substantial spending on IT, particularly digital transformation.

For 2024, FPT has set revenue and pre-tax profit targets of 61,850 billion VND (approximately 2.5 billion USD) and 10,875 billion VND, respectively, reflecting an approximately 18% increase compared to 2023’s results. With the results achieved in the first three months of the year, the technology leader has already accomplished approximately 23% of its planned targets.