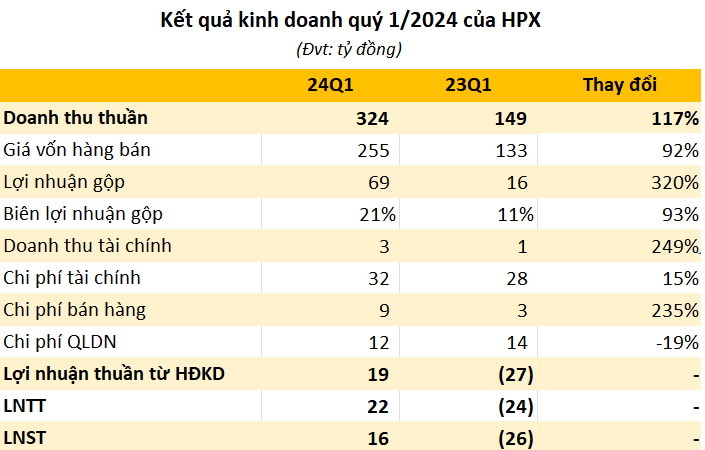

Hai Phat Invest Joint Stock Company (Hai Phat Invest, code HPX) has announced its Q1/2024 financial statements with net revenue 2.1 times higher than the same period last year, reaching 324 billion VND. Revenue structure recorded 285 billion VND from real estate business, an increase of 159%; the rest, nearly 39 billion, is from other activities.

Cost of goods sold increased at a slower rate of 92%, helping gross profit margin improve significantly from 11% in the same period last year to 21% this quarter, corresponding to gross profit of 69 billion VND.

In line with the revenue growth, financial expenses also increased by 15% to 32 billion VND, of which nearly 31 billion was interest on loans. Selling expenses increased by 235% to 9 billion, while general and administrative expenses decreased by 19% to 12 billion VND.

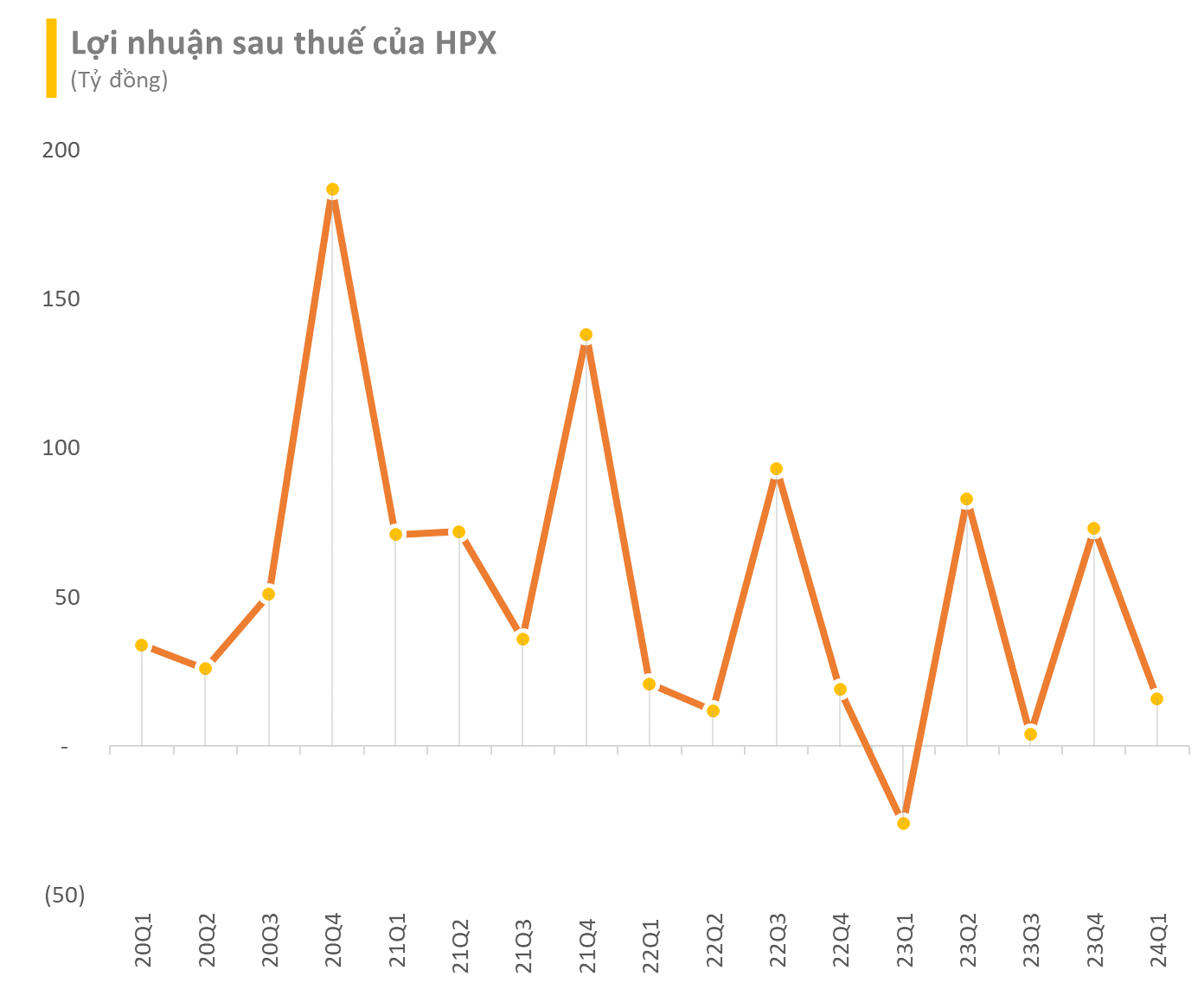

As a result, HPX had a pre-tax profit of 22 billion VND in Q1/2024, much better than the loss of 24 billion VND in the same period last year. The corresponding after-tax profit reached 16 billion VND.

Hai Phat said that the profit increase was due to the company delivering more products to customers than in the same period last year.

As of March 31, 2024, HPX’s total assets reached 8,712 billion VND, an increase of 415 billion (5%) compared to the beginning of the year, of which more than 2,895 billion VND was inventory, nearly 65 billion VND in cash and cash equivalents, plus nearly 3,700 billion in short-term receivables.

Liabilities at the end of the first quarter reached 5,108 billion VND, an increase of 8% compared to the beginning of 2024. Notably, financial debt decreased slightly compared to the beginning of the year to 2,390 billion VND, with 1,751 billion VND of short-term debt and 639 billion VND of long-term debt.

In the market, HPX stock, after more than 6 months of being suspended from trading, has been traded again since March 20, 2024. As of April 25, the market price reached 6,090 VND/share.

In related news, Hai Phat plans to hold its annual General Meeting of Shareholders on April 26, submitting to shareholders for approval the 2024 business plan with a consolidated revenue target of 2,800 billion VND, an increase of 67% and the highest level in the past 5 years (since 2020). However, the consolidated after-tax profit target decreased by 22% to 105 billion VND.

Just before the general meeting, the company announced that it had received resignation letters from a number of leaders, including Board of Directors member Mr. Vu Hong Son, Board of Directors member Mr. La Quoc Dat, and Supervisory Board member Mr. Bui Duc Tue. The reason for the resignation of these three people is that they are busy with personal work and cannot hold the position.

Of these, Mr. Vu Hong Son is from the shareholders group of Toan Tin Phat Investment Joint Stock Company – a group of shareholders who have just taken steps to divest after about 6 months as major shareholders of HPX.