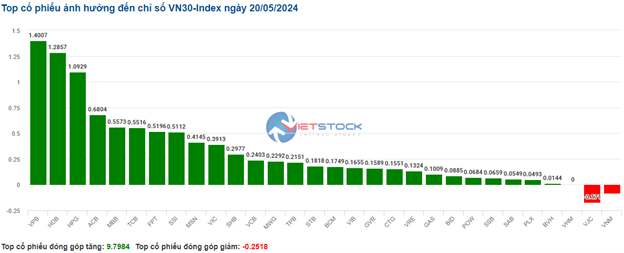

2024 Annual Shareholders’ Meeting of Imexpharm Pharmaceutical JSC (HOSE: IMP)

Held on April 26, the 2024 annual shareholders’ meeting of Imexpharm Pharmaceutical JSC (IMP) approved a revenue target of VND 2,365 billion, a 19% increase compared to the previous year, and a pre-tax profit of VND 423 billion, a 12% increase. The 2023 results were record-breaking for the company since its initial public offering in 2006.

Imexpharm plans to increase revenue from its OTC (over-the-counter) channel by 12% compared to the previous year and by 49% for its ETC (ethical) channel. Target EBITDA is expected to remain stable, with an EBITDA margin of 23%.

|

Imexpharm’s results and planned targets for 2024

Source: VietstockFinance

|

Regarding its strategic direction, based on an analysis of the macroeconomic situation and the pharmaceutical industry, the company plans to expand its EU MA Group 1. Currently, Imexpharm has 27 EU MA marketing licenses for 11 products and plans to expand this portfolio by identifying 30 additional potential target products.

The second plan is to expand into new therapeutic areas through partnerships with foreign pharmaceutical companies, targeting areas such as cardiovascular, diabetes, and digestion.

Third, IMP will accelerate the development of its global business, collaborating with multinational companies, and expanding its sales force to dominate the domestic market.

Finally, the company will focus on digital transformation and the development of a new factory.

2024 Annual Shareholders’ Meeting of IMP

|

Deputy General Director Nguyen An Duy stated that the 2024 target is to maintain a high profit margin of approximately 40-41%.

“We have been implementing various short-term and long-term cost-saving programs to increase pre-tax profits for shareholders. Additionally, we have transitioned to a centralized procurement model for raw materials and other supplies to obtain favorable pricing, in line with the international standards that IMP has recently adopted,” said Mr. Duy.

Increasing Dividends by 20%, Expanding OTC Channel to the North

Regarding profit distribution, after a record-breaking year, the Imexpharm Shareholders’ Meeting approved a dividend ratio of 20% for 2023 and 2024, comprising 10% in cash and 10% in shares. This is higher than the plan approved at the 2023 Shareholders’ Meeting (10% cash, 5% shares).

At the meeting, Chairwoman Chaerhan Chun stated that the 20% level may not necessarily be maintained in the future and will depend on business conditions. Ms. Chun emphasized that the Board of Directors is focused on strengthening the company’s fundamentals, as this will drive IMP’s growth and attract investment.

IMP Chairwoman Chaerhan Chun (left)

|

“We will also focus on increasing the company’s value and share price. In addition to dividends, we encourage investors to pay more attention to the potential value of the Imexpharm shares they hold,” said Ms. Chun.

With the approved 2023 dividend plan, the company will issue over 7 million additional shares, increasing its charter capital to over VND 770 billion.

Regarding plans for OTC and ETC channels in 2024, General Director Tran Thi Dao stated that IMP will focus heavily on both channels, particularly ETC.

“ETC is a traditional channel that we have been exploiting for over 20 years. The factories near the Dong Thap region have been fully depreciated, and this is one of the product groups that we first invested in back in 1997, achieving Asean-GMP standards with training from foreign experts. This is an essential channel that we must exploit 100%,” said the IMP General Director.

IMP General Director Tran Thi Dao

|

According to Ms. Dao, the OTC channel has been fully exploited for over 20 years at the two factories in Dong Thap and will continue to be maintained. Notably, OTC has not yet fully penetrated and expanded in the northern region. Therefore, the goal for 2024 is to expand the northern channel and maximize penetration in the central and southern regions, which will also drive growth in 2024.

“The IMP factory in 2023 was only the first step, generating 80% of revenue. From 2024 onwards, we expect revenue from this factory to increase, with its production lines for IV fluids and freeze-dried products. This is one of the first two factories in Vietnam to achieve EU-GMP standards for its production lines,” added Ms. Dao.

Chairwoman Chun emphasized the importance of the ETC channel. “Clearly, around 95% of hospitals today are public hospitals, and Vietnam still relies heavily on public hospitals. We have quality products to supply them.”