Today, the market witnessed a surprising surge in buying interest, a stark contrast to the lackluster performance of the past few days. The market has followed through with the expected bounce, but stock performance will vary, and many tickers may struggle to return to their recent highs. This bounce presents an opportunity to take profits.

One notable change today was the trading volume of 21.5 trillion VND on the two exchanges, indicating increased buying activity and a positive price push. This could signal a new wave of investment after a few subdued sessions. The return of enthusiastic buying sentiment suggests that expectations remain buoyant.

However, we should temper our optimism when considering the standalone index. While a strong market provides a favorable backdrop for observing selling pressure, the relevant signals often contradict the prevailing trading sentiment. For instance, during a market downturn, we should focus on buying signals, and when enthusiasm reigns, we should shift our attention to selling indicators. Today, with a broad-based stock price increase and many robust gainers, it’s worth noting that sellers could still exert control over prices or face substantial resistance. Those who went against the tide during the market slump and pervasive fear will likely seize this opportunity to offload a large volume without incurring a significant “penalty.”

In summary, stocks will exhibit varying supply-demand dynamics, and trading strategies will depend on specific tickers. Today presented a favorable environment for profit-taking in numerous stocks, and indeed, we saw substantial selling. Others may continue climbing. Similar to the buying side, it’s impossible to catch the exact bottom or pinpoint the peak, so it’s advisable to trade individual stocks at different price levels. The buoyant buying sentiment provides an opportune moment to await more attractive entry points.

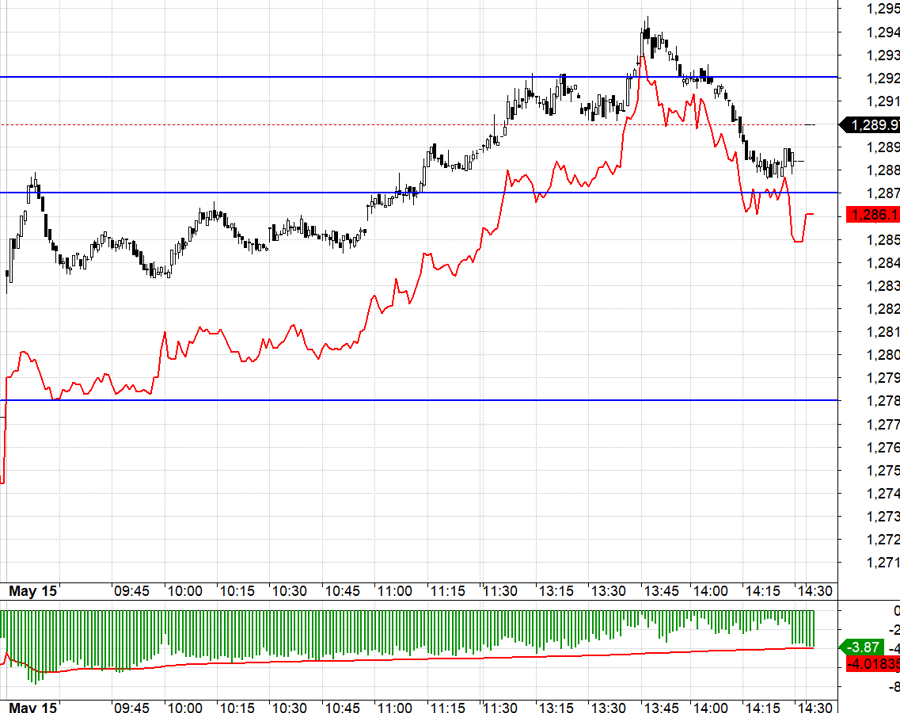

The robust performance of the underlying market today sets the stage for narrowing the basis in both F1 and F2. After the F1 expiry, a narrower basis will create favorable conditions for shorting. In the first half of the morning session, F1 maintained an average discount of up to 6 points. VN30 struggled to breach the 1287.xx level but held steady without retreating, hovering around this resistance. Approaching 11 a.m., an interesting development unfolded: the basis began to contract more forcefully. If VN30 had surpassed 1287.xx, it would have signaled an intraday high breakthrough, putting previous short positions under pressure. As VN30 advanced, the impending F1 expiry would have drawn more attention due to the unreasonable discount. Simply put, an excessively wide basis presents an irresistible “treat.”

In this scenario, going long seemed like a prudent bet, anticipating VN30 to breach 1287.xx and target at least 1292.xx. The risk mitigation lay in a basis of over 4 points. This strategy would be invalidated if VN30 failed to surpass 1287.xx, leading to two possible outcomes: VN30 could continue trading sideways while clinging to 1287.xx, likely resulting in a further basis contraction, or it could reverse course and trigger a stop loss of half the basis.

Subsequently, the market unfolded as envisioned, with the basis narrowing rapidly, especially as VN30 surpassed 1292.xx. Above this level lies a spacious zone up to 1299.xx. While the underlying market exuded enthusiasm, it was prudent to close half the long position in derivatives around 1292.xx and let the remaining half ride with the hope of a “superb” scenario where VN30 ascends to 1299.xx. The signal to exit the final position came when VN30 retreated below 1292.xx, confirming that the “superb” scenario wasn’t materializing.

Today’s robust market rally, with its unclear catalyst, doesn’t necessitate delving into reasons. Buying activity was solid, and we’re witnessing increased profit-taking. Tomorrow, with the F1 expiry, we can anticipate at least one more upward push. The underlying market’s ascent facilitates a rise in F2 and a narrowing of the basis. Short F2 and trade F1 based on the basis.

VN30 closed today at 1289.97. Tomorrow’s immediate resistance lies at 1292, 1302, 1307, 1314, and 1319. Supports are at 1283, 1279, 1271, 1262, 1259, 1254, and 1247.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The perspectives and assessments shared are solely those of the individual investor, and VnEconomy respects the author’s viewpoint and writing style. VnEconomy and the author disclaim responsibility for any issues arising from the published opinions and investment recommendations.