Services

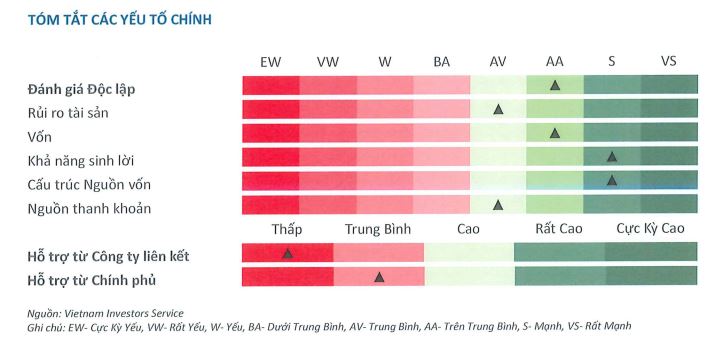

Vietnam Credit Rating JSC (VIS Rating) has recently announced long-term issuer credit ratings for several banks, with Tien Phong Commercial Joint Stock Bank (TPBank, HSX: TPB) earning the highest rating of AA- with a “Stable” outlook. This is the first time VIS Rating has evaluated TPBank, and the bank’s capital structure and profitability are key factors in its strong rating.

VIS Rating assesses TPBank’s capital structure as one of its primary strengths, rating it as “Strong,” the second-highest rating on their scale. This reflects TPBank’s success in strengthening and maintaining core customer deposits, largely due to its digital transformation strategy. Over the past five years, TPBank’s CASA (current and savings accounts) ratio has averaged 19% of total customer loans, significantly higher than the 11% average of its peer group. As a result, the bank’s average cost of capital during this period was 4.2%, approximately 50 basis points lower than its peers. According to the bank’s Q1 2024 financial report, the quality of TPBank’s CASA ratio continued to improve, reaching 23.3% as of March 31, an increase from the previous quarter.

VIS Rating expects TPBank’s CASA ratio to remain high over the next 12-18 months, attributing this to the bank’s successful digital strategy.

TPBank’s profitability is another area that earned a “Strong” rating from VIS Rating. Over the past five years, TPBank has maintained an average ROAA (return on average assets) of 1.8%, significantly higher than the industry average of 1.3%. From 2019 to 2023, the bank’s average NIM (net interest margin) was 4.1%, also higher than the industry average of 3.5%. While TPBank’s ROAA for 2023 decreased to 1.3%, the lowest in five years, due to increased provisioning expenses, VIS Rating remains optimistic that this ratio will improve in the next 12-18 months as provisioning costs decrease and credit growth and NIM stabilize.

|

Favorable Assessments

SSI Securities Corporation also published a report on TPBank, acknowledging that while the bank’s NIM may face pressure in 2024 and could narrow by 17 basis points to 3.45%, they estimate it to rebound to 3.77% in 2025 due to increased credit demand from both corporate and retail customers.

Regarding asset quality, SSI expects TPBank’s non-performing loan ratio to remain relatively stable in the near term as the bank continues its debt restructuring efforts, particularly for retail loans. They project the NPL ratio to hover around 1.7% in 2025, following a slight increase in 2024.

SSI forecasts that TPBank’s ROE (return on equity) will remain at approximately 16% in the medium term as the economy recovers.

In Q1 2024, TPBank recorded a relatively high ROE of 17.5%, with its pre-tax profit exceeding VND 1,800 billion, reflecting a 4% increase from the previous year and a threefold increase from Q4 2023.

Based on TPBank’s positive growth trajectory, SSI maintains a “Positive” outlook on TPB stock, with a one-year target price of VND 22,700 per share, offering a potential upside of 23.7%.

Earlier in May, VNDirect Securities Corporation also issued a “Positive” recommendation for TPB stock, with a target price of VND 26,800 per share. They highlighted TPBank’s strong Q1 2024 performance, particularly the 28% year-on-year growth in TOI (total operating income), driven by a 25.2% increase in NIM.

TPBank’s NIM improved by 59 basis points in Q1 2024 compared to the same period last year, reaching 4.1%. Despite a decrease in lending rates, the bank successfully enhanced its NIM by reducing deposit rates during the first three months of the year.

The bank also witnessed a 144-basis-point reduction in cost of capital compared to the previous year (a 91-basis-point decrease from the previous quarter), while asset yield decreased by only 81 basis points (a 167-basis-point drop from the previous quarter). Non-interest income rose by 36.4% year-on-year, driven by higher investment income. According to the Q1 2024 financial report, TPBank’s investment income from securities investments increased more than twelvefold compared to the same period last year, demonstrating the bank’s ability to capitalize on market opportunities.

At the 2024 Annual General Meeting, TPBank delighted its shareholders by announcing a 25% dividend for 2023, to be paid in cash and shares. This dividend was funded from undistributed profits after setting aside statutory funds, as per the audited financial statements. This is not the first time TPBank has rewarded its shareholders handsomely. In April 2023, the bank distributed nearly VND 4,000 billion in cash dividends, equivalent to a 25% dividend ratio (VND 2,500 per share).

Additionally, in 2023, TPBank issued nearly 620 million shares as stock dividends to existing shareholders, with a ratio of 39.19%. The source of funding for this dividend included retained earnings of VND 1,536 billion up to 2021, capital surplus of VND 2,561 billion, and VND 2,102 billion from retained earnings in 2022.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)