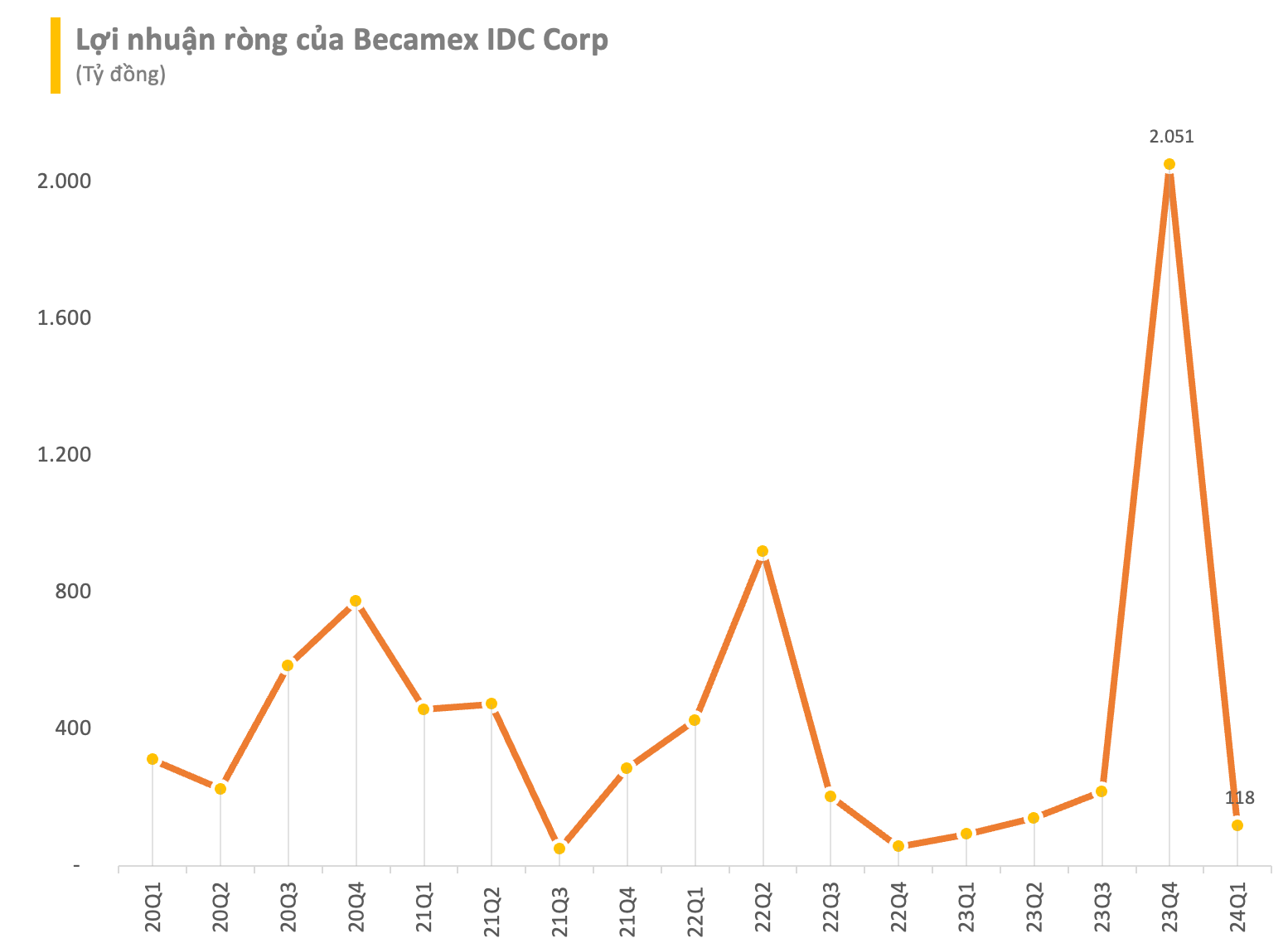

Becamex IDC Delivers 60% Profit Increase in Q1 2024

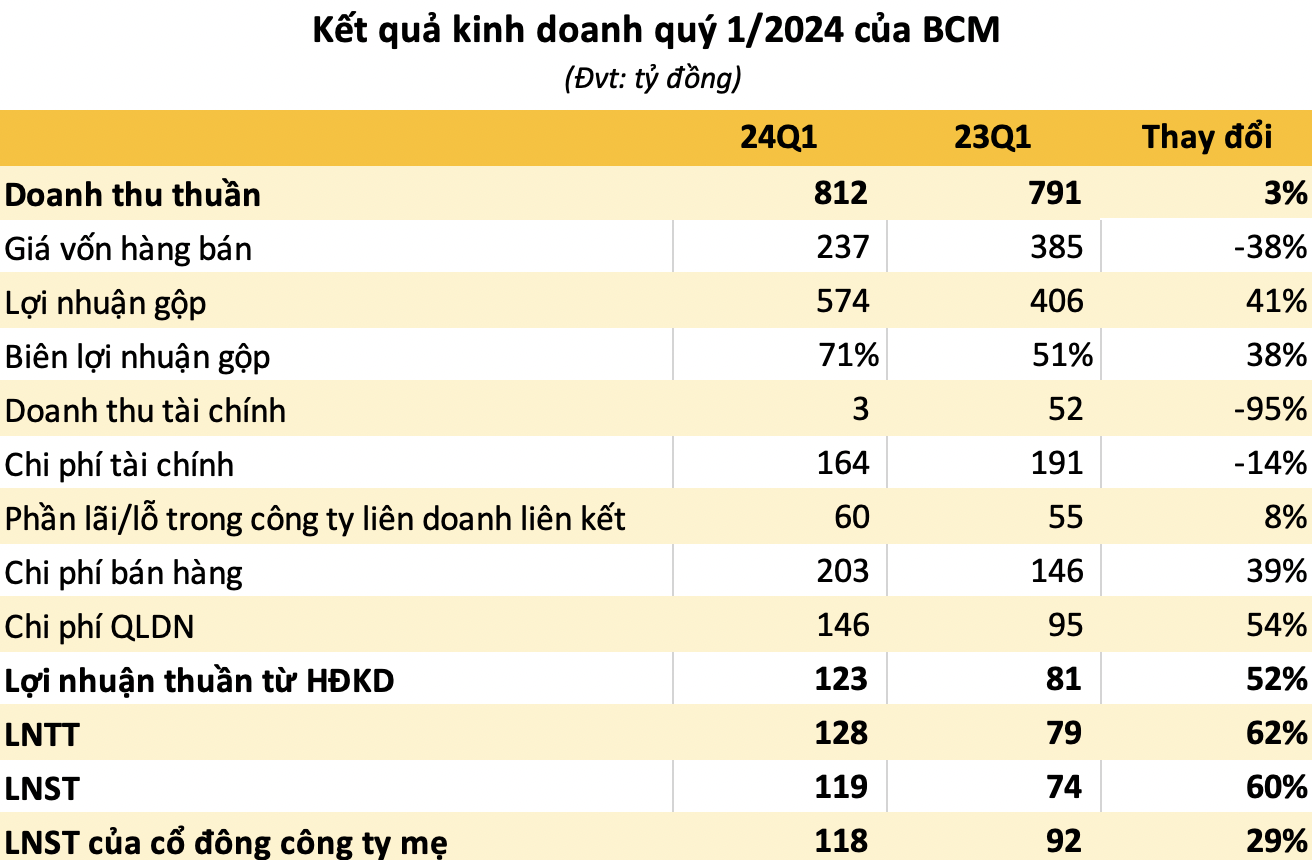

Becamex IDC Corporation (Becamex IDC, stock code: BCM) reported its first-quarter 2024 financial results, showing a 3% increase in net revenue to $35.2 million compared to the same period last year. Notably, a significant 38% reduction in cost of goods sold led to a substantial improvement in gross profit margin, rising from 51% in Q1 2023 to 71% in the current period, resulting in a gross profit of $24.7 million.

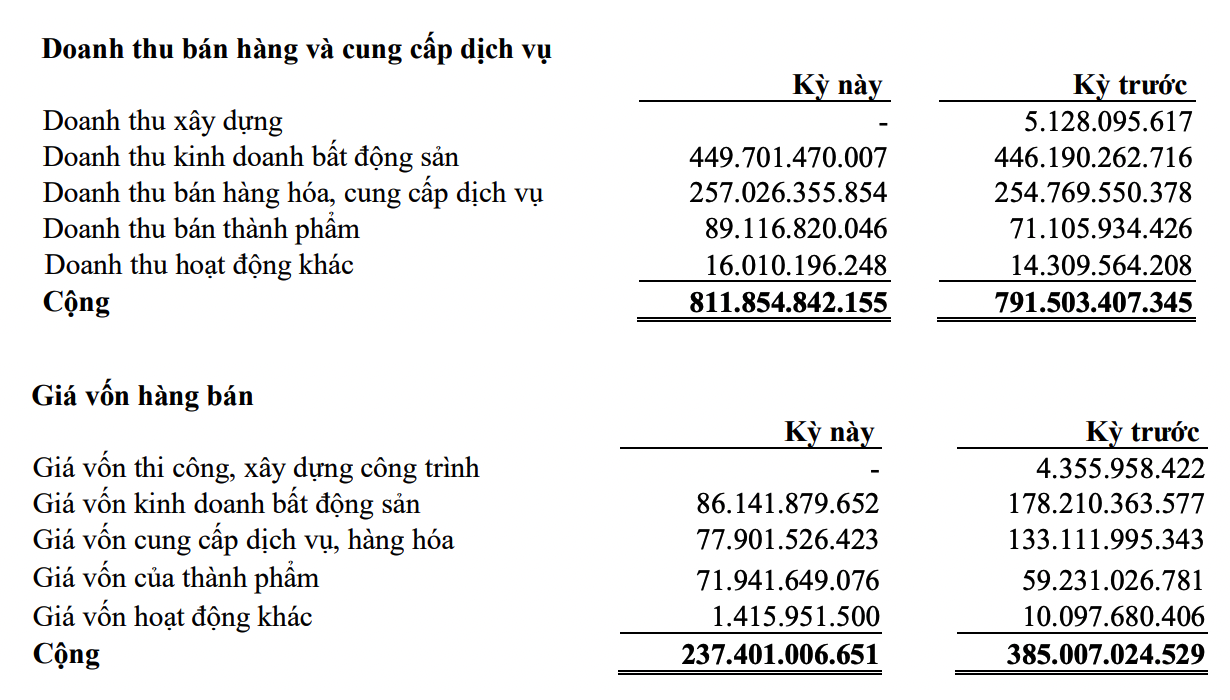

The company’s revenue structure indicates that 55% of BCM’s income, or $19.4 million, was generated from real estate activities, remaining unchanged year-over-year. Revenue from the sale of goods and services services also increased slightly to $11.1 million, while revenue from the sale of semi-finished products climbed 25% to $3.5 million.

Meanwhile, the substantial reduction in cost of goods sold was primarily driven by a 52% decrease to $3.7 million in real estate development and a 41% decrease to $3.4 million in cost of goods sold for services and products.

Financial revenue experienced a sharp decline of 95% to $0.13 million, with a moderate 14% reduction in financial expenses to $7.1 million year-over-year. The company recorded a profit of $2.6 million from its joint ventures and associates. However, other expenses for the real estate giant increased in comparison to the previous year.

Consequently, Becamex IDC reported a 60% year-over-year increase in net profit after tax to $5.1 million in Q1 2024, with a net income of $5.1 million.

Alongside the enhanced financial performance, Becamex IDC’s operating cash flow witnessed a substantial improvement of $38 million, as opposed to a negative $53 million in the first quarter of the previous year.

As of March 31st, 2024, Becamex IDC’s total assets amounted to $2.3 billion, indicating a year-to-date increase of $28 million. Inventory accounted for a significant portion (38%) of the asset structure, valued at $884 million, while long-term financial investments amounted to $792 million.

Total liabilities reached $1.5 billion as of the same date, reflecting a year-to-date rise of approximately $26 million. Short-term and long-term loans collectively exceeded $915 million, with bank loans amounting to $388 million and bond debt totaling $521 million. The company affirmed its ability to repay both short-term and long-term borrowings.

Becamex IDC has established itself as the leading industrial park developer in Binh Duong province, while also being recognized as the top infrastructure developer in Vietnam. Owned by the Binh Duong provincial government with a 95.44% stake, the company operates seven industrial parks covering over 4,700 hectares.

Holding a market share of over 30% within Binh Duong province and 3.6% nationwide, Becamex IDC ranks as the largest industrial park investor in the province and the third largest in Vietnam.

Notable affiliated companies within Becamex include Binh Duong Development and Trading Joint Stock Company (HoSE: TDC), Becamex IJC (HoSE: TDC), Becamex ACC (HoSE: ACC), and Becamex BCE (HoSE: BCE).

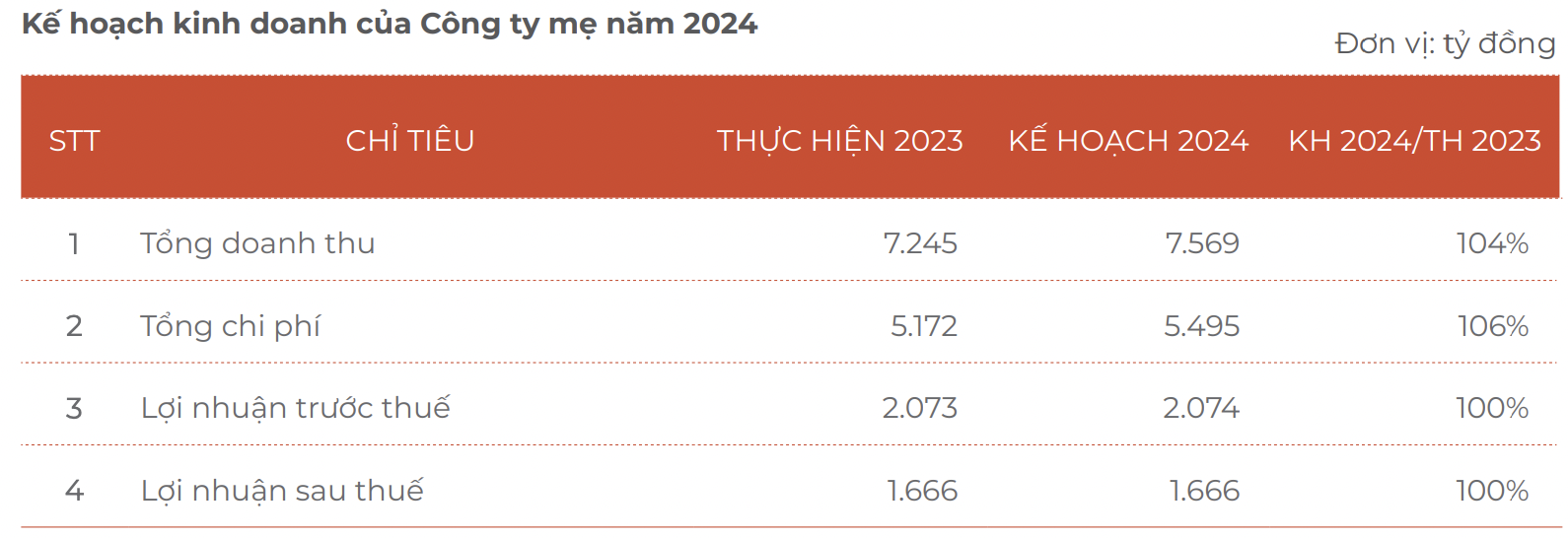

In its 2023 financial report, BCM set a target for its parent company’s revenue of $327 million and net profit of $72 million.

BCM shares have been traded on UPCoM since 2018 and were transferred to the HoSE in August 2020. As of April 26th, BCM’s share price stood at $2.26.