Perspective of the De Lagi project, with NBB as the main investor.

According to the consolidated financial report for Q1 2024 of Năm Bảy Bảy JSC (MCK: NBB), at the end of the first quarter of 2024, NBB recorded revenue of 27.7 billion VND, almost doubling that of the same period last year. After deducting the cost of goods sold, NBB’s gross profit was 10.6 billion VND, 2.5 times higher than in Q1 2023.

NBB’s financial revenue increased by 53%, reaching 62.8 billion VND. Financial expenses increased by 59% to 62 billion VND due to the sharp increase in interest expenses. Sales expenses increased by 15.4% to 538 billion VND; business management expenses decreased to nearly 4 billion VND; other expenses increased sharply to 6.5 billion VND.

As a result, NBB reported an after-tax profit of only over 49 million VND, compared to 133 million VND in the same period last year.

As of March 31, 2024, NBB’s total assets reached 7,299.5 billion VND, an increase of 5.6% compared to the beginning of the year. Short-term receivables decreased slightly to 1,014.5 billion VND. Other long-term receivables were recorded at 2,332.1 billion VND, mainly contributed capital for joint investment cooperation at 2,307.5 billion VND, including 1,150 billion VND in receivables for cooperation with Ho Chi Minh City Infrastructure Investment JSC (MCK: CII) for the investment and profit-sharing business of 152 Dien Bien Phu Building; 857.49 billion VND in cooperation with CII for the Ha Noi Highway investment project; and 300 billion VND in cooperation with Khu Bac Thu Thiem One Member Co., Ltd. for business activities in Thu Thiem urban area development projects. As of March 31, 2024, NBB’s capital contribution to Khu Bac Thu Thiem Company was 300 billion VND.

NBB’s inventories increased by nearly 84 billion VND compared to the beginning of the year, to 1,662 billion VND, mainly consisting of investment and development costs for projects such as the De Lagi high-end resort and residential area project (929.3 billion VND) and the Son Tinh-Quang Ngai residential area project (602.6 billion VND)…

Construction in progress was recorded at 1,680 billion VND, with 865 billion VND in the NBB Garden III real estate investment project, 813.6 billion VND in the NBB II real estate investment project, and 1.3 billion VND in other projects.

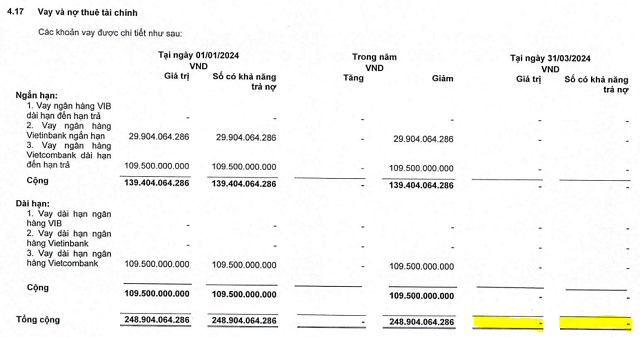

As of the end of Q1 2024, NBB had total liabilities of 5,478.8 billion VND, an increase of 7.6% compared to the beginning of the year, of which financial debt was 3,082 billion VND. Other short-term payables increased by 2.5 times compared to the beginning of the year, to 1,240.2 billion VND, due to an increase in capital contributed for investment from 291 billion VND to 1,042.5 billion VND. This is known to be the De Lagi investment project of CII, with a 12-month cooperation period. As of March 31, 2024, CII’s capital contribution to NBB was 1,042.5 billion VND.

Furthermore, other long-term liabilities also increased by 91% compared to the beginning of the year, to 575.6 billion VND, due to the recognition of CII’s De Lagi project investment cooperation with a cooperation period until December 13, 2030. As of March 31, 2024, CII’s capital contribution to NBB was 485 billion VND. The investment cooperation project for developing land in Ward 16, District 8, Ho Chi Minh City of CII. As of March 31, 2024, CII’s capital contribution to NBB was 50 billion VND.

In other developments, on April 24, NBB successfully held its 2024 Annual General Meeting of Shareholders.

In 2024, NBB set a target of 640 billion VND in total revenue, 30 billion VND in pre-tax profit, and 18 billion VND in after-tax profit. The company plans to continue paying no dividends.

Regarding project development, products, and ensuring construction progress for key projects such as the Son Tinh Residential Area Project. At the same time, the company plans to invest in and develop new projects such as NBB II, NBB Garden III, and the De Lagi project; sped up compensation and completion of legal procedures for existing projects for investment or seeking investment partners when necessary…

Notably, NBB’s General Meeting of Shareholders approved the permission for CII to purchase NBB shares from CII Infrastructure Construction JSC (CEE) without having to carry out a public offer procedure. The number of shares expected to be transferred is over 12 million shares, equivalent to 12% of NBB’s total outstanding shares.