According to a resolution from the General Meeting of Shareholders (GMS), the Board of Directors of Masan Consumer has been authorized to develop a plan to distribute all of its retained earnings after tax as of December 31, 2023. Masan Consumer’s retained earnings after tax as of December 31, 2023, amounted to over VND 16,124 billion.

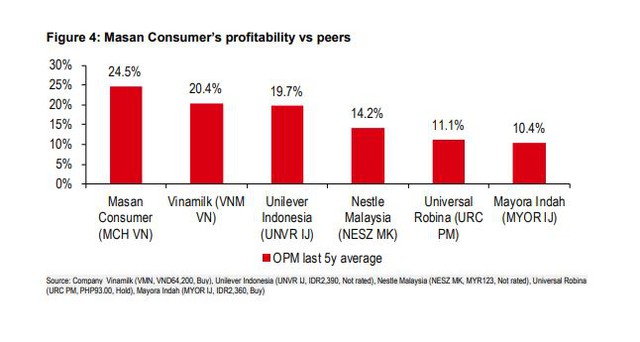

Highest profit margin in the region

Masan Consumer’s (MCH) average profit margin over the past 5 years has reached 24.5%, the highest among consumer companies in the region, according to HSBC.

HSBC’s assessment, which was released on April 18, comes as Masan Consumer Corporation (Masan Consumer – MCH) is considering listing its shares on the Ho Chi Minh City Stock Exchange (HoSE)…

In its report, the bank assesses that MCH has the highest average profit margin compared to FMCG companies in the region over the past 5 years, reaching 24.5%. This is followed by Vinamilk with 20.4%, Unilever Indonesia with 19.7%, and Nestle Malaysia with 14.2%.

MCH shares have been traded on the UPCoM market since 2017. HSBC believes that the transfer to the HoSE trading floor could enhance the liquidity of these shares.

|

HSBC believes that these plans may have been driven by MCH’s recent recovery, with its market capitalization of USD 4 billion now higher than that of Masan (the owner of Masan Consumer) at USD 3.8 billion. MCH’s 2023 earnings before interest, taxes, depreciation, and amortization (EBITDA) were 9% higher than the EBITDA of Masan’s FMCG segment. MCH has a compound annual growth rate (CAGR) of 15.4%. Earnings per share (EPS) reached 10.7%.

Positive contribution to Masan

MCH is a company that manufactures a wide range of food and beverage products, including spices, noodles, chili sauce, instant coffee, beer, etc. In 2023, MCH recorded net revenue of VND 29,066 billion and EBITDA profit of VND 7,431 billion. On a like-for-like (LFL) basis, MCH’s revenue increased by 9% in 2023 and by 5.4% year-on-year, while still maintaining a healthy inventory level.

Shoppers at WinMart supermarket

According to Masan’s Q1 2024 financial report, Masan Consumer Holdings (MCH) further accelerated the growth momentum seen in 2023 with continued positive business results during the first quarter of this year. MCH’s revenue and gross profit margin recorded growth of 7.4% and 45.9%, respectively. Its EBITDA margin also rose by 25.3%. Furthermore, according to the report, MCH currently maintains a high level of inventory across distribution channels. This is a clear sign of a positive recovery in the consumer market, as leading consumer companies like MCH have been increasing their inventory to healthy levels.

In addition to serving domestic consumers, Masan Consumer is also targeting a market of 8 billion people with its “Go Global” strategy, which will open up many opportunities in the medium and long term.

This year, the company plans to achieve net revenue of VND 31,500 – 34,500 billion and post-tax profit of VND 7,300 – 7,500 billion.