The Ministry of Construction stated in its first-quarter 2024 report that although the corporate bond market has shown some positive changes, it still faces several challenges and difficulties.

According to the consolidated figures, the issuance volume in the first quarter of 2024 decreased by 36% year-on-year, while the pressure to repay bonds due in 2024 remains high. Specifically in 2024, it is estimated that about 279,219 billion VND worth of bonds will mature, with real estate bonds accounting for the largest share at 115,663 billion VND, or 41.4%.

During the quarter, there were 14 private placements worth 13,060 billion VND and two public offerings worth 2,650 billion VND.

According to data reported for the months in the first quarter of 2024 by the Vietnam Bond Market Association (VBMA), compiled from the HNX and SSC, the details are as follows:

In January, there were two private placements of corporate bonds worth 1,650 billion VND and one public offering worth 2,000 billion VND. Compared to December 2023, the issuance value dropped significantly from an average of about 43,000 billion VND, a decrease of 91%. Enterprises repurchased 7,394 billion VND, down 31.1% year-on-year. Seven enterprises announced delays in principal and interest payments during the month, with a total value of approximately 8,432 billion VND (including interest and remaining principal of the bonds), and five bond codes received extensions for interest and principal payments.

In February 2024, there were three private placements of corporate bonds worth 1,165 billion VND; the issuance value in February remained very low compared to the 2023 average. Enterprises repurchased 2,056 billion VND worth of bonds ahead of maturity, down 68% year-on-year. Seven enterprises announced delays in principal and interest payments during the month, with a total value of approximately 6,213 billion VND (including interest and remaining principal of the bonds), and 24 bond codes received extensions for interest and principal payments or early redemption.

In March 2024, there were seven private placements of corporate bonds worth 8,745 billion VND. Enterprises repurchased 8,031 billion VND worth of bonds ahead of maturity, down 72% year-on-year. Seven enterprises announced delays in principal and interest payments during the month, with a total value of approximately 4,851 billion VND (including interest and remaining principal of the bonds), and 27 bond codes received extensions for interest and principal payments or early redemption.

The Ministry of Construction stated that the Government and the Prime Minister have recently directed relevant ministries, sectors, and localities, particularly the Ministry of Finance, the Ministry of Construction, and the State Bank of Vietnam, to actively take decisive measures to enhance access to credit capital, ensuring efficiency, safety, soundness, and sustainability in order to promote the development of the corporate bond market, including the real estate sector.

Accordingly, the corporate bond market has gradually stabilized and shown positive changes in recent times.

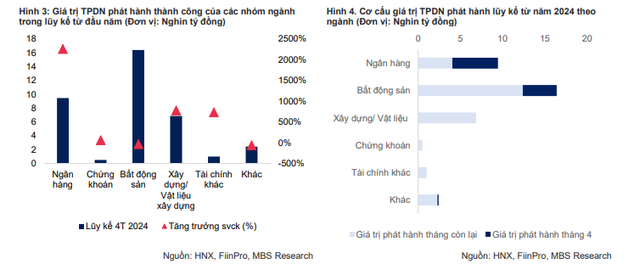

MB Securities Company (MBS) also released a market report in April (up to April 24), showing that since the beginning of the year, the total value of corporate bonds (TPDN) issued reached over 36,600 billion VND, an increase of 14% year-on-year. The average weighted interest rate of TPDN in the first four months of the year is estimated to be about 9.9%, higher than the average of 8.3% in 2023.

Since the beginning of the year, real estate has been the industry group with the highest issuance value at about 16,400 billion VND, (a decrease of 32% year-on-year), accounting for a 45% share, with an average weighted interest rate of 12.3%/year and an average term of 2.5 years.

The enterprises with the largest issuance value include: Vinhomes JSC (6,000 billion VND), Vingroup Corporation – JSC (6,000 billion VND), Hai Dang Real Estate Investment and Development Co., Ltd. (2,500 billion VND).

In April, the value of bonds repurchased ahead of maturity was estimated at over 7,600 billion VND, a decrease of 48% compared to the previous month. Since the beginning of the year, approximately over 28,800 billion VND worth of TPDN has been repurchased ahead of maturity, a decrease of 43% year-on-year.

The pressure to repay bonds will increase significantly in the second quarter, with the banking and real estate sectors continuing to account for a large share.

MBS experts estimate that the largest total TPDN value due will fall in the second quarter of this year, at around 72,000 billion VND (excluding repurchases). Of this, the banking and real estate sectors will account for 32% and 27%, respectively. Notably, the repayment pressure remains high for real estate enterprises as the market has not fully recovered, and the difficulties and legal and project implementation obstacles have not been resolved; enterprises need time to rebalance their operating cash flow while their debt repayment capacity remains weak.

No information on bond defaults was recorded in April. Currently, the total value of TPDN in default on payment obligations is estimated at approximately 193,600 billion VND, accounting for nearly 19% of the outstanding TPDN in the entire market, with the real estate sector continuing to account for the largest share at approximately 70% of the defaulted value.