May Viet Tien’s 2024 Annual General Meeting of Shareholders was held on April 27, 2024 – Photo: Huy Khai

|

Business plan eases amid various challenges

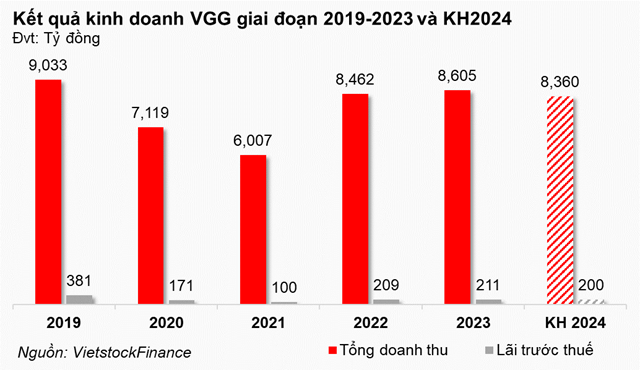

In 2023, demand for textiles declined in major export markets such as the US, the EU, Japan, South Korea, and the domestic market. May Viet Tien, similar to other companies in the industry, had to cope with scarce raw materials, small and fragmented orders, difficult techniques, reduced unit prices, increased input costs, labor costs, and labor turnover. However, the Company still ended the year with total revenue and pre-tax profit increasing by 7% and 6%, respectively, compared to 2022, and fulfilling the yearly plan.

According to the Company, the Vietnamese textile and garment industry has seen positive signals since the first quarter of 2024. Nonetheless, challenges are expected to continue in 2024 as more major textile and garment import markets impose new mandatory regulations related to human rights and environmental audits in the supply chain, eco-design regulations, recycled products, and textile waste treatment. In addition to factors such as war and global inflation leading to rising costs, the income of workers and the business results of enterprises are significantly impacted.

In 2024, May Viet Tien plans for the parent company to achieve total revenue of VND 8,360 billion and pre-tax profit of VND 200 billion, down 3% and 5% compared to the implementation in 2023, respectively. Another planned target is an increase of 4% in the average income per employee, to VND 12 million per person per month.

Business model transformation is needed

For the export market, the Company will continue to thoroughly review and evaluate the market, customers, and products in 2023 to develop solutions for the 2024 plan; continue to focus on the two major customers, Nike and Uniqlo; and seek additional export customers.

In the domestic market, the Company will develop an operating plan to implement a new business model in 2024, with the goal of stabilizing the domestic market and quickly releasing inventory; review and evaluate the store system, suspending the operations of inefficient stores and relocating them to different locations; continue to apply RFID technology to manage sales and inventory; develop new products under the TT_up brand; and restructure online sales.

According to the sharing of General Director Bui Van Tien at the meeting, inventory management is critical, and May Viet Tien had to spend a significant amount of time focusing on inventory management in 2023.

Mr. Le Tien Truong, Chairman of the Board of Directors of the Vietnam Textile and Garment Group (UPCoM: VGT) – the entity that owns 30.4% of May Viet Tien’s capital, also attended the meeting and shared about Viet Tien’s upcoming orientations: “The model of mass production, large scale, cheap raw material prices, and high productivity has reached its limit and is no longer suitable. The leading brands and principals are positioning this type of product in the Bangladesh processing market, not in Vietnam, which reduces May Viet Tien’s efficiency. The way forward is to quickly transform the production and business model, adapting flexibly to each stage.”

“The transition process will be from direct production to supply chain management,” Mr. Truong emphasized.

Investment plan of VND 50 billion and dividend payment at a rate of 20% for 2024

May Viet Tien plans to invest a total of VND 50 billion in 2024, of which VND 28.6 billion will be invested in the construction of offices, stores, and warehouses at 458 Minh Khai, Hanoi; and the remaining VND 21.4 billion will be allocated for investment in automated technology, specialized machinery, digital transformation and management, repairs, upgrades to the working environment, and maintenance of infrastructure. In general, the investment expenditure has increased by nearly VND 42 billion compared to the actual expenditure in 2023, mainly for the purchase of machinery and equipment for internal circulation.

Regarding the progress of the project in Hanoi, General Director Bui Van Tien said that the project has been delayed, with eight months passing but the bidding process has not yet been approved. Also expressing his views on the project, Chairman of the Board of Directors Vu Duc Giang set the goal of completing the project in 2024.

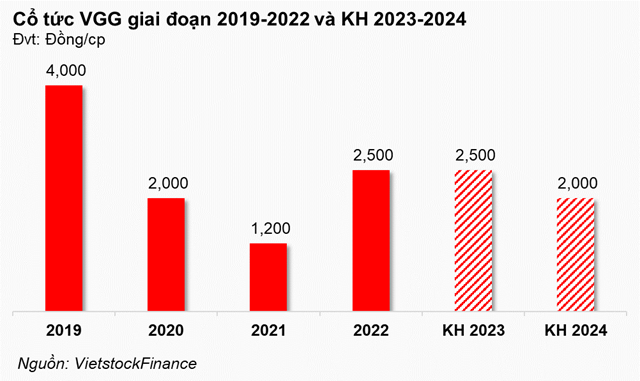

In terms of profit distribution, May Viet Tien plans to distribute a cash dividend for 2023 at a rate of 25% (VND 2,500 per share), higher than the rate of 20% approved at the 2023 Annual General Meeting of Shareholders. For 2024, the Company plans to distribute a dividend at a rate of 20%.