Chinese brands have been gradually penetrating the Thai market for the past five years. However, the progress and scale of their presence have accelerated significantly in the past year or so. The culmination of this presence was evident at the recent Bangkok International Motor Show 2024 in March.

At the event, half of the top-selling car brands were Chinese, and their booths were lavishly designed and spacious.

When it comes to the Thai electric vehicle market, Chinese brands such as BYD dominate the charts, with BYD dominating the segment while MG and Haval have sold more than Honda in the combustion engine SUV segment. Beyond the headline numbers, however, the “ground reality” of Chinese cars in Thailand is starting to become apparent.

Chinese cars, with their new technology, designs, and affordable price tags, have easily attracted new buyers, but whether they can retain customers in the long run depends on service and quality, factors that have not been tested much. Photo: Wapcar

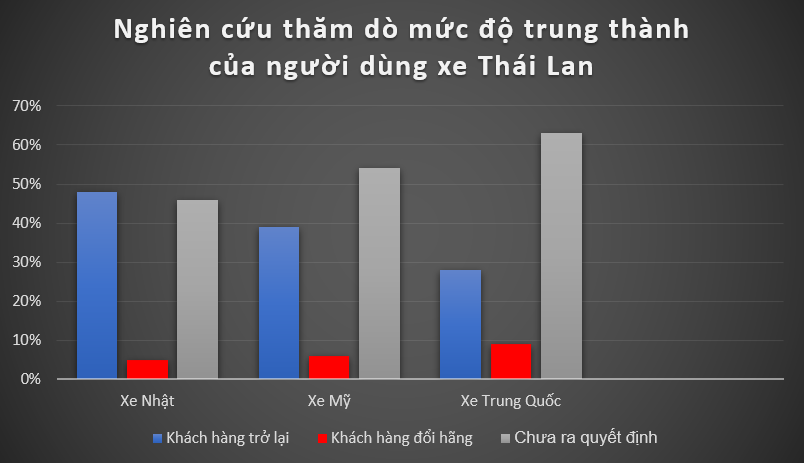

Differential Asia, a Singapore-based automotive consulting firm, has just released data it collected on customer experience in Thailand over the past 12 months. The study focused on the loyalty index of Thai consumers towards automotive brands present in the country.

The results show that Japanese car brands retain their customers the best, with 48% of users certain to return when buying a new car. Of the remaining 52%, 5% would switch brands, and 46% were undecided (the numbers add up to more than 100% due to rounding). American car brands came in second with a 39% retention rate, 54% undecided, and 6% churn.

Chinese car brands, on the other hand, only managed to retain 28% of their first-time buyers, with 63% undecided and 9% switching brands.

Repeat purchase rates for Chinese cars are the lowest, while the number of customers who have decided to switch brands is the highest. Data: Differential Asia, photo: Quang Phong