PVOIL’s Business Performance in Q1 2024

|

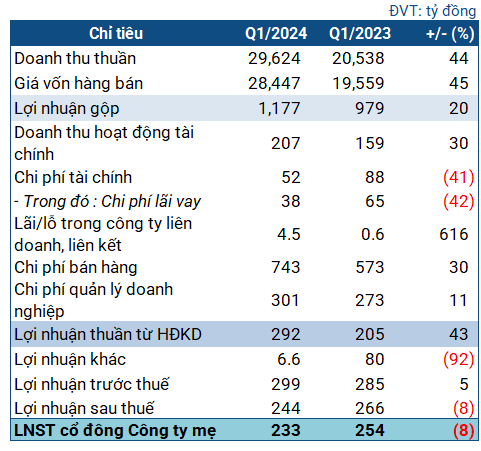

PVOIL’s Business Indicators in Q1 2024

Source: VietstockFinance

|

In Q1, PVOIL’s revenue surged by 44% to nearly VND 30 trillion. After deducting the cost of goods sold, gross profit increased by 20% to almost VND 1.2 trillion.

Financial revenue jumped by 30% to VND 207 billion, driven by foreign exchange gains. Meanwhile, financial expenses dropped by 41% to VND 52 billion. Both sales expenses and administrative expenses increased; however, the company still recorded a net profit of VND 292 billion, a 43% increase. Nevertheless, other income decreased by 92% to VND 6.6 billion.

PVOIL’s pre-tax profit rose by 5% to VND 299 billion. However, after deducting taxes, net profit reached VND 233 billion, 8% lower year-over-year. This was primarily due to a refund of nearly VND 25 billion in deferred income tax expense in the same period last year (Q1 2024 only received a refund of VND 3.2 billion).

Despite the slight decline in profit, PVOIL’s Q1 performance can still be considered strong. Compared to the plan approved by the 2024 Annual General Meeting of Shareholders, PVOIL achieved 36% of its revenue target and 41% of its after-tax profit target.

In terms of financial status, PVOIL maintained a solid balance sheet at the end of Q1. Total assets reached nearly VND 36.7 trillion, a 6% decrease compared to the beginning of the year. Of this, current assets accounted for almost VND 31 trillion, an 8% reduction. Cash and cash equivalents totaled nearly VND 15 trillion, slightly lower than at the start of the year. Inventories increased by 23% to over VND 5.1 trillion.

On the funding side, short-term debt was close to VND 24.7 trillion, a 9% decrease, representing almost all of the company’s liabilities. Short-term borrowings increased slightly to over VND 7 trillion. The quick ratio was 1.3 times, indicating the company’s financial stability.