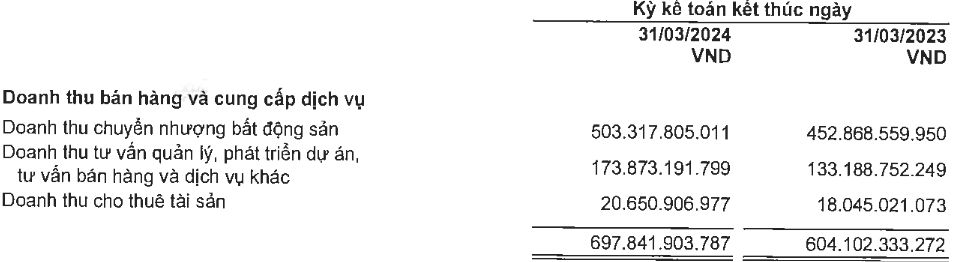

In the first quarter, NVL recorded net revenue of over VND 397 billion ($17.2 million), up by 15% compared to the same period last year. Revenue from real estate transfer, business management consulting, and property leasing all increased.

|

NVL Q1-2024 Revenue Structure

Source: NVL

|

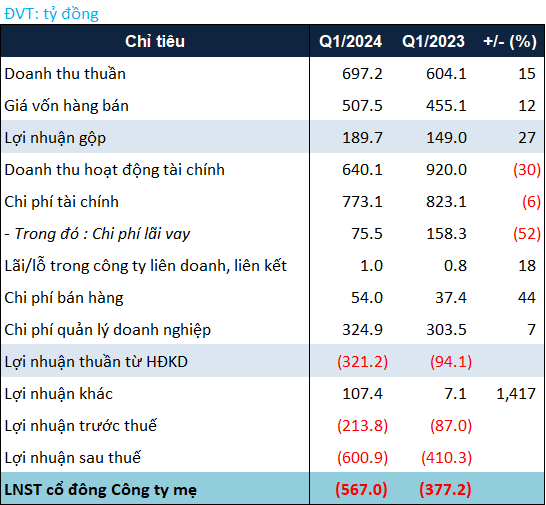

However, NVL‘s financial revenue decreased by 30% to VND 640 billion ($27.8 million), due to a decline in revenue from investment cooperation contracts to just over VND 456 billion ($19.8 million). Interest expenses fell by 52%, while financial expenses decreased by only 6% due to higher exchange rate losses.

A highlight for NVL during the period was other income, which reached over VND 107 billion ($4.6 million), compared to just over VND 7 billion ($300,000) in the same period last year. This was due to the Company receiving nearly VND 331 billion ($14.3 million) from contract violation penalties, while NVL also paid nearly VND 207 billion ($8.9 million) in contract violation compensation.

After deducting expenses, NVL reported a net loss of VND 567 billion ($24.5 million) in the first quarter of the year, the Company’s largest quarterly loss ever.

|

NVL Q1/2024 Business Results

Source: VietstockFinance

|

As of December 31, 2024, NVL‘s total assets were nearly VND 236.5 trillion ($10.2 billion), a slight decrease of 2% compared to the beginning of the year. Cash on hand decreased by 8% to nearly VND 3.2 trillion ($139 million).

On the other side of the balance sheet, NVL‘s liabilities also decreased by 2%, to nearly VND 191.8 trillion ($8.3 billion). However, total borrowings remained largely unchanged, at over VND 58.2 trillion ($2.5 billion), with outstanding bond debt of over VND 38.5 trillion ($1.7 billion). Notably, other long-term payables from project development cooperation decreased by nearly 10%, to over VND 58.8 trillion ($2.5 billion).