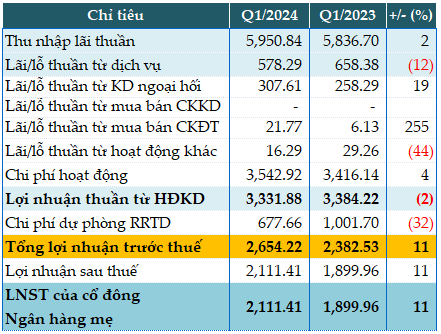

In the quarter, Sacombank gained nearly VND 5,951 billion in net interest income, slightly up by 2% YoY.

The following figures account for a large proportion of the main income: service revenue of over VND 578 billion (-12%) and foreign exchange trading revenue of nearly VND 308 billion (+19%).

The bank’s operating expenses slightly up by 4% to nearly VND 3,543 billion. In addition, the bank reduced credit risk provisioning expenses by 32% to almost VND 678 billion. As a result, Sacombank’s pre-tax profit was over VND 2,654 billion, up 11% YoY.

Thus, after the first quarter, Sacombank has achieved 25% of the pre-tax profit target of VND 10,600 billion set for the whole year of 2024.

|

Business results of Q1/2024 of STB. Unit: Billion VND

Source: VietstockFinance

|

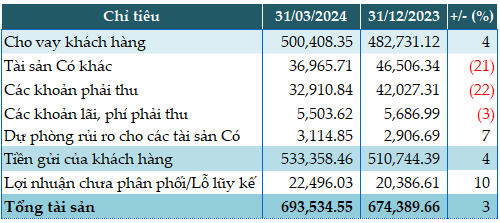

The bank’s total assets as of the end of the first quarter were VND 693,535 billion, an increase of 3% compared to the beginning of the year. Of which, cash increased by 12% (VND 8,487 billion), deposits at other commercial banks increased by 13% (VND 56,766 billion), loans to customers increased by 4% to VND 500,408 billion…

Regarding capital sources, customer deposits also increased by 4% compared to the beginning of the year, to VND 533,358 billion. Deposits from other commercial banks increased by 7% to VND 36,896 billion, issuance of financial papers increased by 10% to VND 31,828 billion…

|

Some financial indicators of STB as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

|

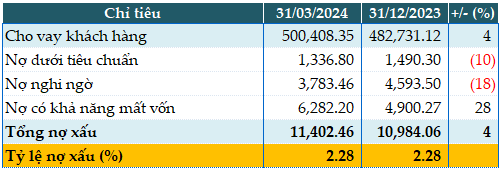

As of March 31, 2024, Sacombank’s total bad debts were recorded at over VND 11,402 billion, a slight increase of 4% compared to the beginning of the year. The bank recorded a clear improvement in the sub-standard debt group and doubtful debt. As a result, the ratio of bad debt to loans remained at 2.28%, the same as at the beginning of the year.

|

Loan quality of STB as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

|