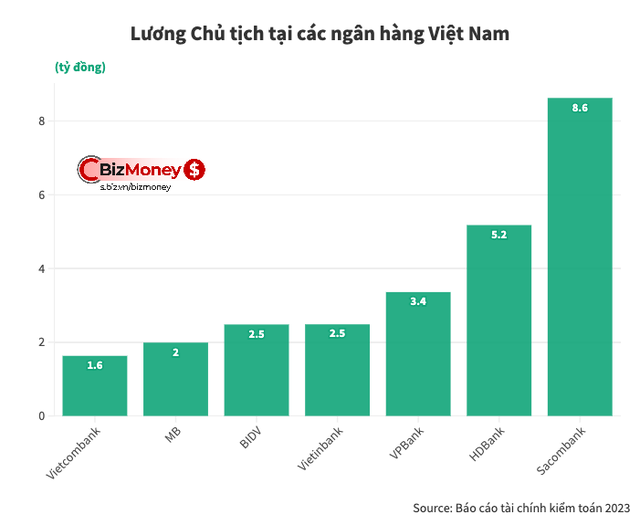

In particular, according to the 2023 consolidated audit report with the remuneration of 10 leaders of the largest commercial banks in Vietnam by total assets, four leaders had an income increase of 1-283%, one person remained the same, while the rest decreased or had no information.

In the Big 4 bank group, Mr. Phan Duc Tu – Chairman of BIDV, the bank with the largest total assets in Vietnam this year, received a remuneration of more than VND 2.48 billion. Compared to the level of VND 2.3 billion in 2022, this year the income of the head of this bank increased by 6.4%.

Similarly, the remuneration of the Chairman of another bank in the Big 4, VietinBank, also increased slightly from VND 2.46 billion to VND 2.48 billion. Accordingly, Mr. Tran Binh Minh’s remuneration in 2023 increased by nearly 1%, but still much lower than the growth rate of this bank’s profit.

In contrast to the above two leaders, Mr. Pham Quang Dung – Former Chairman of Vietcombank had an income decrease of more than 2.4% compared to 2022, from VND 1.67 billion to VND 1.63 billion, although 2023 was still a year of “prosperity” for the bank. However, from January 1, 2024, Mr. Dung was appointed by the Prime Minister to the position of Deputy Governor of the State Bank of Vietnam.

Meanwhile, in the group of private joint-stock commercial banks with top total assets, the remuneration of the Chairmen of the banks also had a strong differentiation, from VND 1.8 billion to VND 8.6 billion.

The highest salary in this group is Mr. Duong Cong Minh – Chairman of Sacombank. Last year, the captain of Sacombank received more than VND 8.6 billion. This amount is 3-4 times higher than his counterparts at state-owned banks, and it is enough for the leader of this bank to buy the latest Lexus car.

In 2023, under the leadership of Mr. Duong Cong Minh, Sacombank achieved pre-tax profit of more than VND 9,500 billion, an increase of 51% compared to the plan set at the beginning of the year. In addition, last year was also the time when the bank completed the provision of 100% of the bad debt reserve not yet recovered from VAMC – one of the important goals of the Sacombank Restructuring Project.

Next, Mr. Kim Byongho, Chairman of HDBank, an independent member, had an income of more than VND 5.1 billion. The remuneration of this foreign Chairman has improved significantly compared to 2022, increasing by more than 280%. However, also in the list of the bank’s Board of Directors, female billionaire Nguyen Thi Phuong Thao’s remuneration was “only” at VND 1.85 billion, a slight decrease compared to 2022.

At MB, last year, Chairman Luu Trung Thai took the “hot seat” from April 2023. Although he has not been the Chairman of the bank for a full year, this leader received a remuneration of more than VND 1.98 billion, equivalent to more than VND 220 million per month.

Unlike the captains of banks with an increase or decrease in the previous year, the remuneration of VPBank Chairman Ngo Tri Dung remained unchanged. In the difficult business environment in 2023, Mr. Ngo Tri Dung received a remuneration of VND 3.36 billion, equivalent to VND 280 million per month from the bank.

Also in 2023, two other Vice Chairmen of VPBank, Mr. Lo Bang Giang and Mr. Bui Hai Quan, also received a remuneration of VND 3.12 billion, unchanged compared to the previous year. According to the month, the income of these two leaders is about VND 260 million/month.

Another bank in the private group with large total assets, SHB, did not disclose the details of the salary and bonuses of the members of the Board of Directors (BOD). However, last year, 10 members of the bank’s BOD received a remuneration of more than VND 14 billion, nearly VND 1.4 billion higher than in 2022. If divided equally, each member received an income of more than VND 1.4 billion. However, the actual amount received by the bank’s leaders will vary depending on their position, role, and contributions.