SHB to Diversify Portfolio, Transfer Stakes in Laos, Consider Foreign Investment

On April 25, Saigon – Hanoi Bank (SHB) held its 2024 Annual General Meeting of Shareholders at the Melia Hotel on Ly Thuong Kiet Street, Hoan Kiem District, Hanoi.

At the meeting, the bank’s management announced that SHB and an investor have signed an agreement to transfer all stake in SHB Laos. The necessary procedures are being processed to obtain approval from the governments and central banks of both countries to finalize the deal.

Regarding the capital transfer in SHB Laos, Chairman Do Quang Hien stated that SHB has signed a basic agreement with a Laotian partner. He emphasized that SHB prioritizes the interests of its shareholders in this transaction. “We are proud to have negotiated a favorable deal with a higher valuation than the market average. Our investors can rest assured that during negotiations, our partners described us as meticulous, but they appreciated it,” said Mr. Hien.

SHB is one of the first two Vietnamese joint-stock commercial banks licensed to establish a wholly-owned limited liability bank in Laos. Currently, SHB Laos has a charter capital of 1,158 billion dong and its head office is in Vientiane. It has two branches in key locations in Laos, namely Champasack and Savannakhet. In 12 years of operation, SHB Laos has maintained safe and effective business practices, contributing to Laos’ socio-economic development and fostering friendly neighborly relations between the two countries.

SHB’s decision to divest from its subsidiary in Laos was approved by shareholders at the 2021 Annual General Meeting of Shareholders. Bank management believes that transferring stakes in the Laotian subsidiary will generate a significant capital surplus for both shareholders and the bank. It will also enhance SHB’s reputation and image in domestic and international financial markets.

In addition to the complete transfer of shares in SHB Laos, SHB’s management also announced that the bank is selecting a suitable partner to transfer shares and transform the operations model of SHB Cambodia.

Another issue of interest to shareholders is the transfer of shares to foreign investors. At last year’s AGM, SHB’s Chairman mentioned that there would be mid-term “suitors” in 2023 or early 2024. However, negotiations are still ongoing.

Regarding this matter, the SHB Chairman said that the bank is gradually transferring shares in its finance company to a foreign partner and transferring shares in SHB Laos and SHB Cambodia. All transfers are made to benefit shareholders, investors, and SHB. The management sets requirements that satisfy both parties, but prioritizes the interests of shareholders and investors. “If we transferred shares with less favorable terms, it would be much faster,” he added.

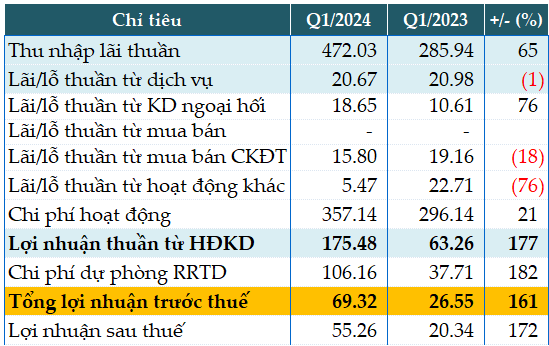

In 2023, SHB reported positive results. Pre-tax profit reached 9,239 billion dong. As of December 31, 2023, total assets amounted to 630,501 billion dong, an increase of 16%. The charter capital was 36,194 billion dong.

For 2024, SHB aims to achieve pre-tax profit of 11,286 billion dong, a 22.2% increase compared to 2023. Total assets are projected to grow by 11.2% to 701,000 billion dong; of which, the total outstanding credit balance will increase by 14% to 518,555 billion dong. Simultaneously, the non-performing loan ratio is expected to be controlled below 3%.

Regarding profit distribution, SHB recorded post-tax profit of 7,321 billion dong in 2023. After allocating to funds, the remaining profit was 5,929 billion dong. The bank plans to distribute dividends to shareholders at a rate of 16% of charter capital in two components: 5% in cash and the remaining 11% in shares.

Upon completion of the share dividend distribution, SHB’s charter capital will increase to nearly 40,658 billion dong. The entire additional capital will be primarily used for corporate lending, including loans for working capital, fixed asset financing, and production and business loans. The expected disbursement period is the third or fourth quarter of 2024 or upon completion of the issuance plan.

In its 2024 business plan, SHB intends to continue paying dividends to shareholders at a rate of 18%, to be distributed in 2025.