On the evening of March 19, an Eximbank representative stated that they had a working session with Mr. P.H.A’s lawyer, the credit card holder in Quang Ninh, who had a debt of over 8.8 billion VND ($384,000) after nearly 11 years.

Although there is no information about the content of the meeting, it is known that both sides agreed to cooperate to settle the case, ensuring the rights and benefits of both parties as soon as possible.

In recent days, the report has attracted the attention of many banks and credit card holders. A “wave” of checking credit card debts and payment balances has appeared not only for Eximbank cardholders, but also for customers of many other commercial banks.

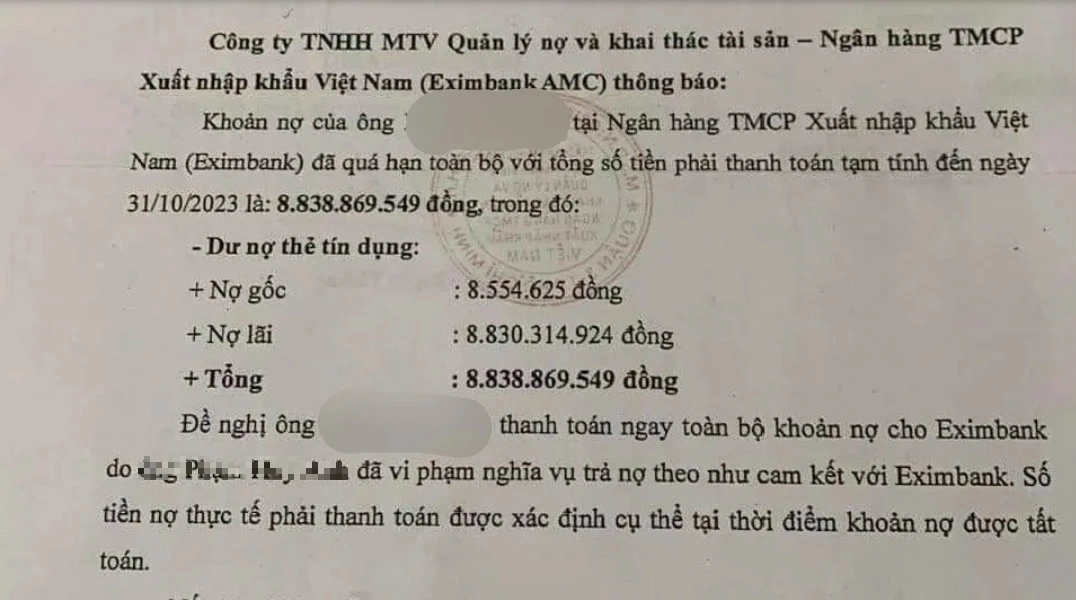

Eximbank’s announcement sent to customers

|

Prior to this, as reported by Bao Người Lao Động, Mr. P.H.A opened a MasterCard credit card at Eximbank’s Quang Ninh branch on March 23, 2013, with a credit limit of 10 million VND ($434). This card then had two payment transactions totaling over 8.5 million VND ($369). However, since September 14, 2013, the above-mentioned card debt became bad debt.

Recently, the Asset Management Company of Eximbank (Eximbank AMC) sent a notice to Mr. P.H.A, demanding payment of the principal and estimated interest up to October 31, 2023, which amounts to over 8.8 billion VND ($383,000) after nearly 11 years.

According to Eximbank, this is a long-overdue debt that has lasted nearly 11 years. Eximbank has repeatedly notified and worked directly with the customer, but the customer has not yet come up with a debt settlement plan.

Eximbank requests the customer to immediately settle the entire credit card debt with the bank. If not, legal measures will be taken, including legal action and other legally permissible debt recovery measures according to regulations.

Meanwhile, Mr. P.H.A said that around March 2013, he asked an employee named Giang, who worked at Eximbank’s branch in Quang Ninh, to make a credit card for him. However, in reality, he did not receive this credit card. It was only more than 4 years later (in 2017) when he needed to borrow money that he was shocked to learn that he had a bad debt at Eximbank.

Since then, the customer and the bank have worked together multiple times, but the case has not been thoroughly resolved until Eximbank AMC’s announcement of a debt note of over 8.8 billion VND ($383,000) stirred public opinion.

On the regulatory side, it is known that the State Bank of Vietnam’s branch in Quang Ninh has requested Eximbank’s headquarters in Ho Chi Minh City and Eximbank’s Quang Ninh branch to verify and report on any relevant information related to this case.

Thái Phương