CBBank Announces Latest Savings Interest Rates

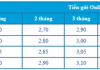

Construction Bank for Investment and Development of Vietnam (CBBank) has recently released its new savings interest rate schedule, with significant increases across certain tenors. Notably, savings interest rates for 6- to 36-month tenors have risen by 0.5 percentage points.

The revised interest rates stand as follows: 4.5%/annum for 6-month deposits; 4.45%/annum for 9-month deposits; 4.65%/annum for 12-month deposits; and 4.9%/annum for 18- to 36-month deposits.

For other tenors, CBBank has maintained its existing interest rates. Accordingly, 1-month deposits continue to earn 3.1%/annum, while 3-month deposits earn 3.3%/annum.

These new interest rates will come into effect from April 24th.

CBBank’s Latest Savings Interest Rates.

BVBank Unveils New Savings Interest Rates

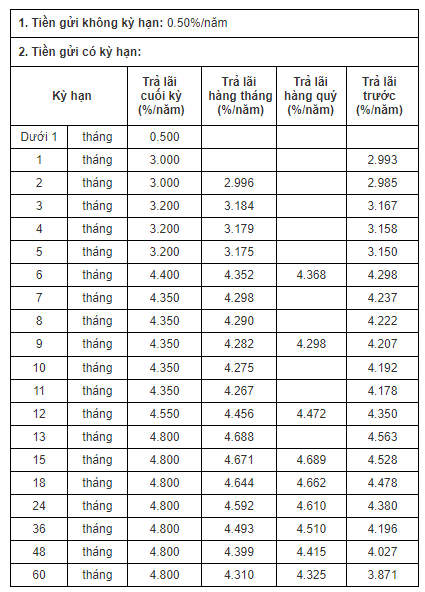

On April 24th, Vietnam Joint Stock Commercial Bank for Foreign Trade (BVBank) also adjusted its savings interest rates for 3-, 6-, and 12-month tenors, increasing them by 0.05 percentage points.

Specifically, online savings interest rates for 3-month deposits have been raised to 3.1%/annum. 6-month deposits now earn 4.1%/annum, while 12-month deposits have seen an increase to 4.7%/annum.

BVBank has kept interest rates unchanged for other tenors. The lowest rate of 2.85%/annum remains applicable to 1-month deposits. The bank offers its highest interest rate of 5.35%/annum for 24-month deposits.

BVBank’s Latest Savings Interest Rates.

PVcomBank Releases New Savings Interest Rates

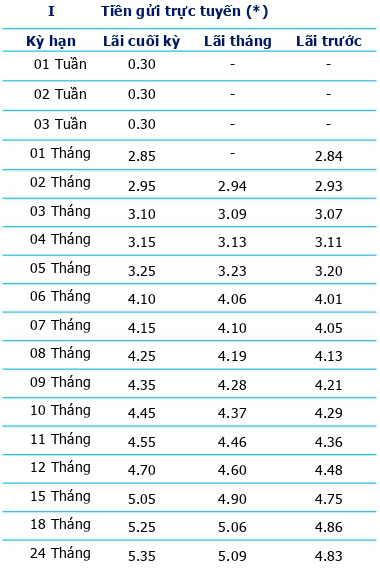

Joint Stock Commercial Bank for Investment and Development of Vietnam (PVcomBank) officially adjusted its online savings interest rates for certain tenors on April 23rd.

Accordingly, interest rates for 1- to 3-month deposits have increased by 0.3 percentage points to 3.15%/annum. Deposits with 18- to 36-month tenors earn 0.2 percentage points more, now standing at 5.3%/annum. PVcomBank has maintained interest rates for all other tenors.

PVcomBank’s Latest Savings Interest Rates

OceanBank Announces Significant Savings Interest Rate Increases

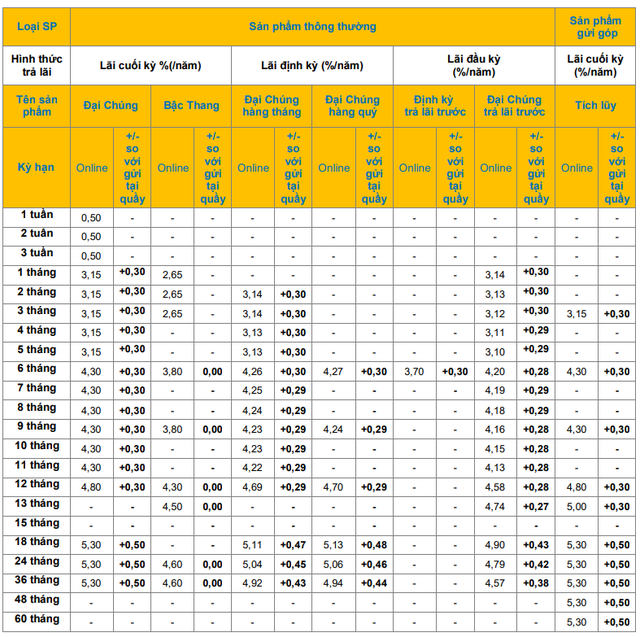

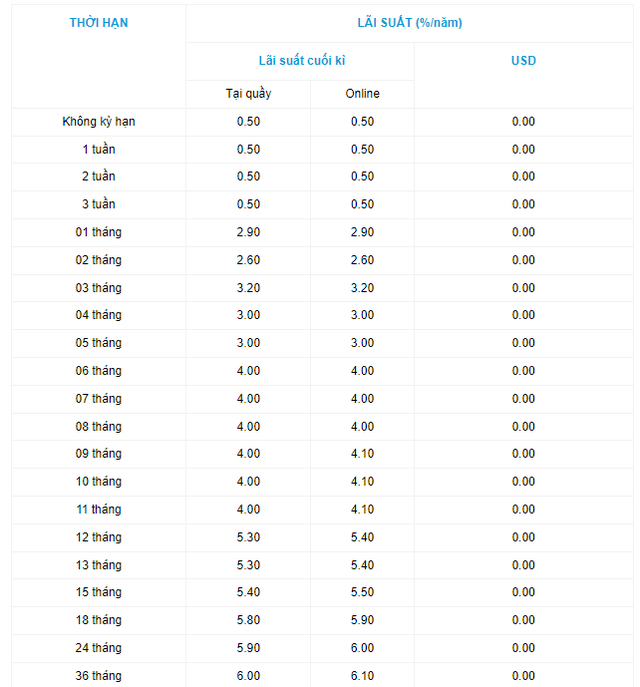

On the first day of the week (April 22nd), OceanBank announced substantial increases in its savings interest rates across all tenors, with the highest hike reaching 0.9 percentage points.

According to OceanBank’s latest online savings interest rate schedule, 1-month deposits have seen a 0.3 percentage point increase to 2.9%/annum. 3-month deposits earn 0.1 percentage points more at 3.2%/annum.

6- to 7-month deposits have increased by 0.1 percentage points to 4%/annum, while 8- to 11-month deposits now earn 0.2 percentage points more, standing at 4%/annum.

12- to 13-month deposits have received a 0.5 percentage point increase to 5.4%/annum. Interest rates for 15-month deposits have risen by 0.6 percentage points to 5.5%/annum. 18-month deposits earn 0.7 percentage points more, now at 5.9%/annum.

24-month deposits have witnessed an 0.8 percentage point increase, bringing their current rate to 6%/annum. The most significant increase was applied to 36-month deposits, which now earn 6.1%/annum, reflecting a 0.9 percentage point rise.

OceanBank’s Latest Savings Interest Rates.