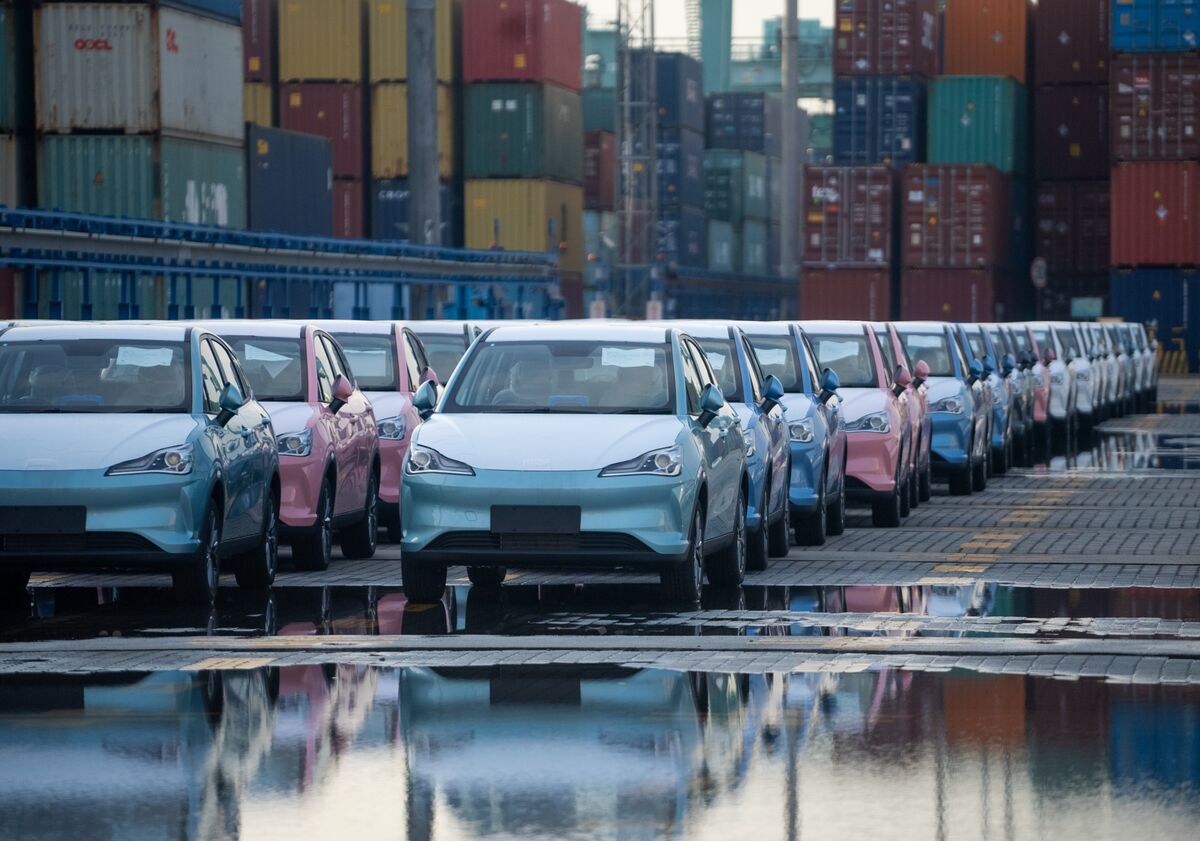

CHINESE CARS OVERFLOW EUROPEAN PORTS

Recently, pictures taken at several European ports have drawn attention. These photos depict hundreds, even thousands, of cars parked bumper-to-bumper, stretching from one area to another.

A representative from the Antwerp-Bruges Port (in Belgium, one of the largest car import ports in Europe) stated that “Car distributors are increasingly using import yards at the port as a storage facility. Instead of keeping cars in their own warehouses, they are now simply leaving them at the port.”

The representative also said that “all the major car import ports” are facing congestion due to this issue but did not specify the origin of the imported vehicles.

Antwerp-Bruges Port in Belgium.

However, the Financial Times quoted an industry expert who claimed that Chinese cars were the primary cause of the port congestion. Experts believe that Chinese manufacturers are unable to sell their vehicles in Europe as quickly as anticipated.

A supply chain manager in the automotive industry stated, “Car manufacturers are using ports as parking lots.”

Experts also told the Financial Times that numerous electric vehicles from Chinese brands have been sitting at ports for up to 18 months. Port authorities are even demanding that importers provide proof of plans to transport these vehicles.

One logistics expert suggested that the cars will remain there until a distributor or customer agrees to purchase them.

Another European port.

WHAT’S HAPPENING WITH CHINESE CARS?

In reality, the accumulation of Chinese cars in European ports was somewhat predictable.

Despite being the world’s largest car market for many years, China’s domestic consumption has lagged behind the production capacity of its automakers. With supply outstripping demand, Chinese manufacturers have sought to export cars to other markets.

Major Chinese automakers like BYD, Great Wall, Chery, and SAIC all have plans to increase sales in Europe. If they can sell more cars there, their factories in China can operate at higher capacities, reducing production costs and keeping car prices low.

Inside a BYD factory.

The trend is evident in China’s auto export figures. In 2023, the country’s car exports surged by 58% compared to 2022, more than doubling.

In the first two months of this year alone, the largest export markets for pure electric vehicles (EVs), plug-in hybrid electric vehicles (PHEVs), and hydrogen fuel cell vehicles were European countries such as Belgium, the United Kingdom, Germany, and the Netherlands.

Belgium, the United Kingdom, Germany, and the Netherlands are popular destinations for Chinese cars.

Once the cars arrive in Europe, manufacturers face another challenge: finding trucks to transport them further. The Financial Times notes that Chinese automakers are new to the market and may face difficulty securing priority from trucking companies.

Tesla faced similar issues when it initially imported cars into Europe, struggling to find available trucks. While Tesla was able to resolve the problem, new entrants will need to overcome this hurdle.

“Any new player is going to have problems, if you are not big enough, and you don’t constantly have volume, then you won’t be the biggest customer [for transport companies],” a logistics expert stated.

Tesla electric vehicles were also stuck at the Antwerp-Bruges Port due to a lack of available trucks.

Shipping cars from China to other markets, not just Europe, presents challenges for Chinese manufacturers.

As Chinese automakers focus on increasing exports, it also strains the availability of specialized car carrier ships, typically known as Roll On – Roll Off (RORO) vessels.

According to published data, the total distance traveled by these RORO ships has increased by 17% compared to last year, due in part to the need for Chinese automakers to transport vehicles farther distances.

Longer ship voyages mean longer wait times for vessels, creating greater gaps in delivery schedules. As a result, some automakers have opted to build their own ships to gain more control over vehicle exports.

BYD’s first RORO vessel, named Explorer No.1.

BYD, the world’s largest electric vehicle manufacturer, is a prime example. According to its latest plans, BYD will add eight more car carriers to its fleet within the next two years, all dedicated to vehicle exports. BYD currently operates one vessel, which departed from Shenzhen, China, in January.

“BYD will roll out [an additional] seven car-carrier vessels over the next two years to solve the problem of [vehicle] shortage [in certain markets],” said Wang Chuanfu, BYD Chairman.

The decision stems from rising charter fees, making ship purchases a more cost-effective solution that will preserve BYD’s price competitiveness against rivals.