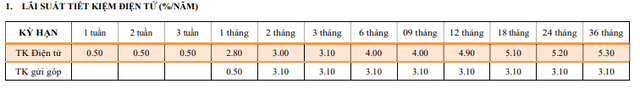

As of today, April 26, Tiên Phong Bank (TPBank) officially adjusted its interest rates on savings. Accordingly, this bank increased by an average of 0.1-0.3 percentage points at some applicable terms with online savings deposits.

Specifically, the interest rate on 1-month savings increased by 0.3 percentage points to 2.8%/year.

The interest rate on 3-month savings increased by 0.3 percentage points to 3.1%/year.

The interest rate on 6-month savings increased by 0.2 percentage points to 4.0%/year.

The interest rate on 12-month savings increased by 0.2 percentage points to 4.9%/year.

The interest rate on 18-month savings increased by 0.1 percentage points to 5.1%/year.

The interest rate on 36-month savings increased by 0.1 percentage points to 5.3%/year.

Latest interest rate on savings at TPBank.

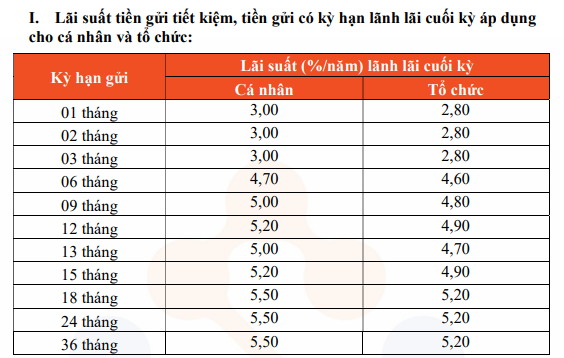

Earlier, on April 25, KienlongBank also increased interest rates on savings with an increase of 0.1-0.3 percentage points for deposit terms from 6-13 months.

Accordingly, the interest rate on 6-month savings increased by 0.3 percentage points to 4.7%/year.

The interest rate on 9-month and 12-month savings increased by 0.2 percentage points, to 5%/year and 5.2%/year, respectively.

However, this bank adjusted the interest rate on 13-month savings down to 5%/year, a decrease of 0.1 percentage points.

This bank kept the interest rate on savings for the remaining terms unchanged. The term of 1-3 months has an interest rate of 3%/year, the term of 15-36 months is listed at 5.5%/year. This is also the highest mobilization interest rate at this bank at the present time.

Latest online savings interest rates at KienLong Bank.

Since the beginning of April, more than 10 banks have adjusted their interest rates upwards, including: TPBank, HDBank, MSB, Eximbank, NCB, VPBank, KienLongBank, VietinBank, Bac A Bank, GPBank, OceanBank, BVBank, PVComBank, CBBank…

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)