The land segment has shown positive signs of recovery. Land prices have stopped decreasing, and the number of investors seeking products has gradually increased. In Hanoi and Ho Chi Minh City, demand for land is showing signs of increase.

The real estate market report for the first quarter of 2024 by Batdongsan.com.vn indicates that the land market has begun to “thaw”. Specifically, the level of interest in land in the last two quarters of 2023 was only 44%, but in the first quarter of 2024, it increased to 48%.

In Hanoi, demand for land has increased sharply in some suburban districts such as Dong Anh, Long Bien, and Hoai Duc, which is 1.7-2 times higher than the same period last year. In the South, the level of interest in land has stopped declining. Compared to the first quarter of 2023, the demand for land at the beginning of 2024 increased by 13-25% in District 12, Thu Duc City, and Hoc Mon District.

At the same time, customers’ efforts to find land are becoming increasingly evident. More and more people are looking for land. According to experts, there are currently three groups in the market targeting land acquisition. Two of these groups are classified as “sharks” with strong financial resources, and the other group is made up of small and medium-sized investors.

Sharing about this issue, Mr. Tran Khanh Quang, who has many years of experience in real estate investment, said that the first group of “shark” investors are individual investors with large capital who buy land plots in bulk or even buy failed land subdivision and sales projects. The evidence is that there have been land subdivision and sale projects in the market where the investors have “drowned” in financial debt and reduced prices by 50-60%. This group prioritizes land near the center of Ho Chi Minh City because they calculate that liquidity will be better there.

Secondly, the “sharks” are large real estate companies. This group actively seeks to buy land funds to develop new projects, especially when the amended laws are passed, creating conditions for the development of large urban areas.

These “sharks” will focus on buying large amounts of land in bulk or acquiring projects where investors are facing financial distress and are forced to reduce their selling prices. Currently, land projects priced at or below 1 billion VND in neighboring provinces have begun to trade again.

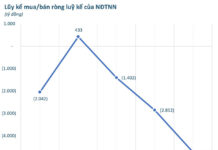

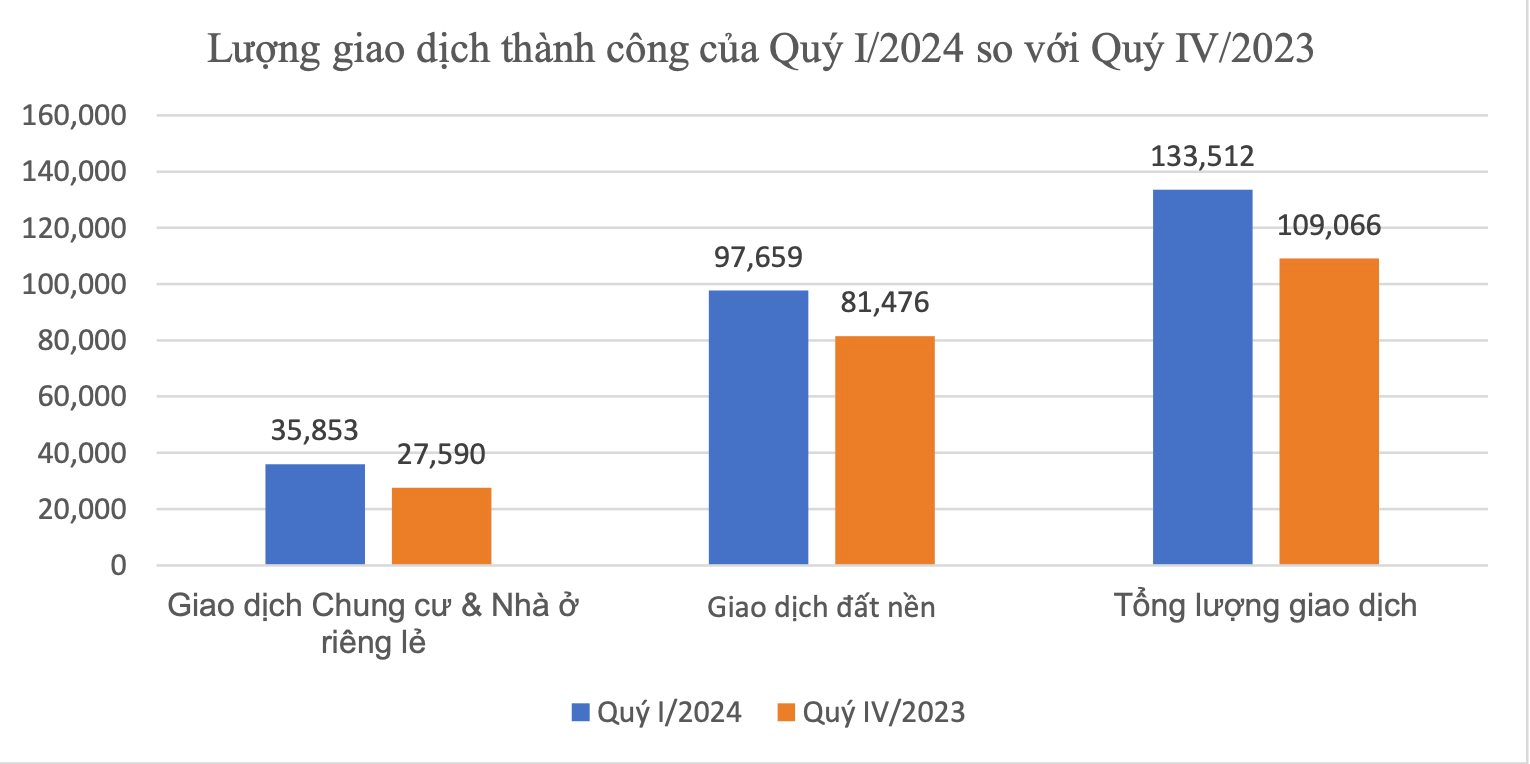

Land transactions are showing signs of increasing. Source: Ministry of Construction

The real estate market at the beginning of 2024 is witnessing many domestic enterprises with strong financial potential continuing the race to acquire clean land funds. At the same time, foreign enterprises are taking advantage of the situation to hunt for projects facing financial difficulties. The investment appetite of enterprises at this time is for projects with clean land funds, good quality, real value, legal ownership, complete compensation and clearance, and development potential.

According to the analysis of experts, the recovery of the land market is driven by three factors. First, the cyclical nature of the land market, after Tet, the demand for land usually increases. Secondly, land prices have adjusted in some areas, leading investors to consider participating.

Specifically, many provinces in the South such as Ba Ria – Vung Tau, Long An, Lam Dong, and Dong Nai have witnessed a decrease in the current selling price of land from 12% to 19% compared to the beginning of 2023. Thirdly, the wave of anticipation of changes in three new laws, including the Land Law, the Housing Law, and the Real Estate Business Law, which will soon take effect.

However, the overall recovery of the market depends on many factors such as income, cash flow of people, and confidence in the market. Therefore, experts advise investors to consider using financial leverage with a high ratio at this stage. This is because the macroeconomy still faces many challenges, and policies and solutions from the government also need time to implement and take effect.