Bank Deposits Decline

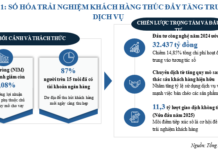

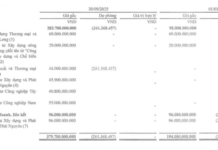

According to the latest data released by the State Bank of Vietnam, bank deposits saw a significant decrease in January. Individuals withdrew a substantial amount of VND 34.643 billion from the banking system, marking the second consecutive month of withdrawals.

The previous month had witnessed withdrawals of VND 61.643 billion. This trend contrasts with 2023, when bank deposits had experienced steady growth until the final month of the year.

Deposits by individuals in banks have been declining.

Savings interest rates have declined considerably since the end of January compared to the same period last year. Not many banks are willing to offer an interest rate of 5% per annum for 12-month deposits. The consistent decline in interest rates since April 2023 has driven savings rates to their lowest point, even below those during the COVID-19 pandemic. Many banks are now offering record-low interest rates.

As of the end of January, individual deposits in the banking system had reached nearly VND 6.5 trillion, a decrease of 0.53% compared to the end of the previous year.

Deposits from economic organizations in the banking system currently stand at over VND 6.67 trillion, a 2.41% decrease from the end of last year, representing a decline of VND 165.189 billion within a month, despite having previously increased steadily.

In total, deposits from both individuals and organizations into the banking system up to the end of January 2023 amounted to nearly VND 13.2 trillion.

Other Investment Channels Attract Funds

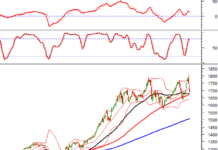

Gold, stocks, and real estate are often considered attractive investment channels for people seeking to preserve or grow their surplus funds. Since the beginning of the year, gold has been the top-performing investment among these options.

Currently, the domestic SJC gold bar price has peaked at over VND 85 million per tael, while plain rings have also risen to VND 76 million per tael. Compared to the beginning of the year, gold bars have increased in value by almost 15%, and rings by over 20%.

Domestic gold prices have surged due to limited supply in the domestic market, increased demand amid falling savings interest rates, and the uptrend in global gold prices.

In a recent interview with PV Tien Phong, Ms. Truong Hoang Diep Huong, an expert from the Institute of Banking Scientific Research, stated that during the first quarter, gold, stocks, and real estate all experienced significant growth.

According to Ms. Huong, people are investing their surplus funds in financial assets instead of bank deposits, due to the comparative advantage of investment returns over interest rates.

At a recent seminar, Dr. Vu Dinh Anh, a financial expert, noted that in the past, real estate was typically used only for residential purposes, which did not generate cash flow. Currently, a popular investment option is to rent out real estate, especially to foreigners at high rates, and then rent a different property for oneself.

The concept of cash flow housing requires ownership, non-use, and exploitation through rental, creating a source of income.

“The current real estate market shows that many people have withdrawn their savings from banks and invested in real estate, waiting for prices to rise and then selling, a process known as short-term speculation, while others hold on to investments for a longer period. Regardless of whether it’s investing or speculating, liquidity should be a primary concern,” said Mr. Anh.

The second type of real estate investment involves owning property and renting it out. This segment, which focuses on renting and subletting, is not concerned with liquidity but rather with generating a continuous and substantial cash flow.

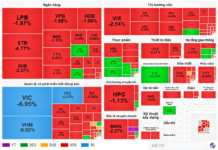

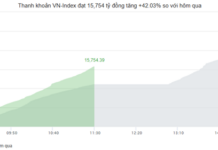

Stocks are another investment channel that has gained attention in the context of low interest rates. Investing in stocks can provide investors with higher returns than savings deposits.

The number of newly opened accounts has increased steadily in the first three months of this year, reflecting the strong performance of the market and indicating investor interest in this investment channel. In March alone, over 160,000 new accounts were opened.