Vinapharm Targets Revenue of VND 5,955 Billion and Pre-tax Profit of VND 475.9 Billion in 2024

Hanoi, April 23, 2024 – Vietnam National Pharmaceutical Corporation (Vinapharm, stock code: DVN, UPCoM) held its 2024 Annual General Meeting of Shareholders nearly a year after the transfer of the ownership representation of the state capital in Vinapharm from the Ministry of Health to the State Capital Investment Corporation (SCIC).

PLAN FOR VND 476 BILLION IN PRE-TAX PROFIT

According to the business performance report presented by Ms. Han Thi Khanh Vinh, Member of the Board of Directors and General Director of Vinapharm, the total revenue in Vinapharm’s consolidated financial statements in 2023 reached VND 307.5 billion, exceeding the target set for 2023 by 111.1% and up by 75.6% compared to the actual figure in 2022. The pre-tax profit in the consolidated financial statements in 2023 reached VND 222.8 billion, equivalent to 105.2% of the target and a surge of 707.8% year-on-year.

The total revenue in Vinapharm’s consolidated financial statements in 2023 reached VND 5,868.2 billion, representing 103.5% of the actual figure in 2022 and 99.2% of the set target. Pre-tax profit reached VND 425 billion, a 222.2% increase compared to 2022, and 127.1% of the target. The consolidated pre-tax profit increased significantly year-on-year and exceeded the target due to an increase of VND 195.2 billion in the consolidated pre-tax profit of Vinapharm, equivalent to a 707.8% increase year-on-year.

Ms. Han Thi Khanh Vinh, Member of Board of Directors and General Director, presenting the Business Performance Report for 2023 and Plan for 2024

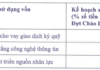

Based on the expected strong recovery of the global pharmaceutical industry and trends in the pharmaceutical sector in 2024, the General Meeting of Shareholders approved the consolidated business plan for 2024 with a projected revenue of VND 290.4 billion and pre-tax profit of VND 223.5 billion. Vinapharm’s consolidated business plan for 2024 targets revenue of VND 5,955.2 billion and pre-tax profit of VND 475.9 billion, equivalent to 101.5% and 112.0% of the actual figures in 2023, respectively.

APPROVAL OF RESTRUCTURING PLAN

The General Meeting of Shareholders approved Vinapharm’s Restructuring Plan, which includes major orientations such as:

– Deploying the development of a modern and professional distribution system to enhance the distribution capacity of the corporation and its subsidiaries.

– Increasing the charter capital of subsidiaries and the ownership ratio in member companies with good growth rates, high dividend rates, and sustainable development orientations.

– Seeking investment opportunities in pharmaceutical companies outside the current list of member companies to optimize the use of capital and seize favorable investment opportunities in the market.

– Receiving the transfer of branded/valuable products from multinational corporations for processing and manufacturing in Vietnam.

– Finding domestic and foreign partners to implement the construction of a pharmaceutical/biopharmaceutical production plant in Vietnam.

Presidium of the General Meeting

With a view to enhancing Vinapharm’s operational efficiency and empowering the Board of Directors in its governance role, the General Meeting of Shareholders approved the change in Vinapharm’s management and operational model to a structure comprising the Shareholders’ General Meeting, Board of Directors, and General Director. At least 20% of the members of the Board of Directors must be independent members, and an Audit Committee will be established under the Board of Directors.

This model is stipulated in the Law on Enterprises and is in line with best practices in corporate governance in developed countries around the world. The change in management and operational structure with an Audit Committee under the Board of Directors not only meets legal requirements but also establishes an advanced governance system in accordance with international practices, reducing overlapping in the governance structure of Vinapharm.

In conjunction with the change in management and operational structure, the General Meeting of Shareholders unanimously agreed on the number of Board of Directors members, including independent members, for the remaining term of 2021-2026, which is 05 members. Accordingly, the General Meeting of Shareholders elected Mr. Do Manh Cuong as an independent member of the Board of Directors for the term 2021-2026.

Vinapharm’s Board of Directors for the 2021-2026 term

DISCUSSION: CONSIDERING THE TIMING OF SHARE LISTING

What is Vinapharm’s strategic orientation to become a leading player in the pharmaceutical manufacturing and distribution sector in Vietnam?

Ms. Han Thi Khanh Vinh: Implementing Decision No. 376/QD-TTg dated March 17, 2021, of the Prime Minister approving the development program for domestic pharmaceutical and medicinal herb production until 2030, with a vision to 2045, and Resolution No. 36-NQ/TW dated January 30, 2023, of the Politburo on developing and applying biotechnology for sustainable development in the country in the new situation, Vinapharm will continue to leverage its potential and position as the only pharmaceutical corporation with a controlling stake owned by the State-owned Enterprise and will implement a number of business strategies that align with the current situation and development trends of the pharmaceutical sector in Vietnam and globally, with the goal of Vinapharm achieving stable, sustainable, efficient growth, benefiting shareholders, and contributing to the healthcare of the people.

Vinapharm is one of the largest pharmaceutical companies in Vietnam, while many companies such as Trapharco and Duoc Hau Giang are listed