Growth Amidst Adversities

In Q1 2024, the dairy industry continued its downward trend observed since mid-2023, with a 2.8% decline year-over-year, as per AC Nielsen. This decline was reflected across multiple other FMCG categories.

Similar trends were reported by the General Statistics Office of Vietnam, with total retail sales and consumer service revenue growing by only 8.2% in Q1 2024, significantly lower than the average annual growth rate of 11.5% witnessed during the pre-COVID period (2015-2019).

These figures indicate that consumer sentiment and disposable income are being impacted by the dynamic global economic landscape and severe climatic conditions. Despite the challenging macroeconomic and industry environment, Vinamilk sustained positive business performance, achieving revenue of VND 14,112 billion in Q1 2024, a 1.4% increase compared to the same period last year.

Region-wise, domestic net revenue amounted to VND 11,497 billion, on par with the previous year, while international markets recorded an impressive 7.7% growth, reaching VND 2,615 billion. Notably, net export revenue was VND 1,297 billion, maintaining a high level compared to Q4 2023 and reflecting a 5.9% increase year-over-year.

Traditional export markets continued to contribute significantly to these positive results. Additionally, Vinamilk remains committed to its strategy of penetrating high-potential export markets, such as those in Africa and South America.

Net revenue from international subsidiaries reached VND 1,319 billion in Q1 2024, representing a 9.6% growth year-over-year. Amidst inflationary pressures, Angkormilk and Driftwood both recorded solid revenue growth due to enhanced brand recognition and increased value delivery to consumers.

Double-Digit Profit Growth in Q2

The consolidated gross profit margin stood at 41.9% in Q1 2024, recovering by 311 basis points and 123 basis points compared to the same period and full year 2023, respectively. This was driven by revenue growth coupled with favorable input costs.

Selling and administrative expenses in Q1 2024 accounted for 24.7% of net revenue, slightly higher than the 24.5% reported in 2023. This increase ensures adequate funding for business development initiatives while preserving the improvements made in gross profit margin.

Consequently, consolidated profit after tax for the first three months of the year reached VND 2,207 billion, a 15.8% increase year-over-year. This performance marks the second consecutive quarter of double-digit growth in this metric, driven by improved gross profit margin and effective management of operating expenses.

The consolidated net profit margin for Q1 2024 amounted to 15.6%, expanding by 195 basis points compared to the same period last year and 71 basis points compared to the full year 2023. Correspondingly, earnings per share (EPS) reached VND 944, an 18.5% increase year-over-year.

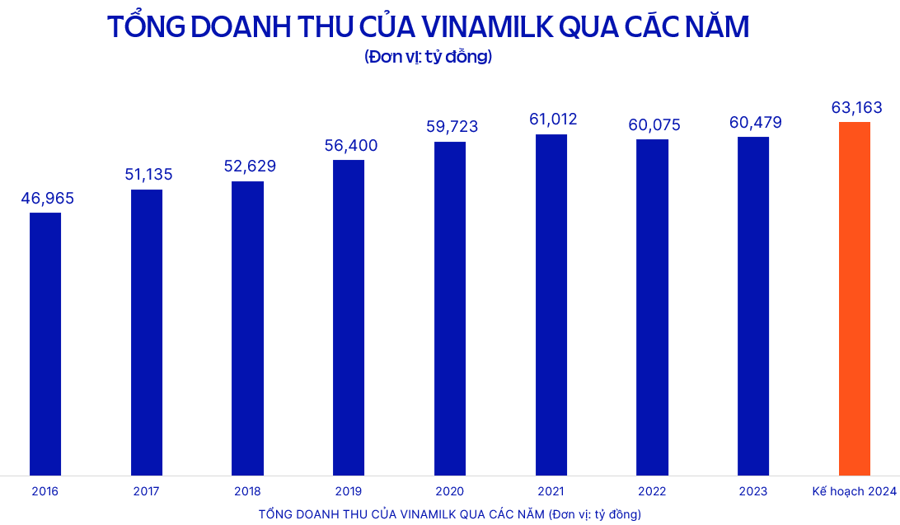

Despite the promising start to the year, Vinamilk maintains a cautious approach in its annual plan approved at the 2024 AGM, setting a revenue target of VND 63,163 billion, a 4.4% increase compared to 2023, and a profit after tax target of VND 9,376 billion, a 4% increase. As of Q1, the company has achieved approximately 22.4% and 23.5% of its annual revenue and profit targets, respectively.

As of March 31, 2024, the consolidated cash balance remained at a high level, supported by the company’s stable profitability and robust operating cash flow, ensuring the financial health of the organization. Additionally, the debt-to-asset ratio stood at 13.2%, minimizing leverage risks and allowing for efficient allocation of financial resources towards business investments and value creation for the parent company’s shareholders.

During Q1 2024, Vinamilk declared an interim dividend for 2023, with a dividend per share of VND 900, payable on April 26, 2024.

ESG (Environmental, Social, Governance) Highlights

The British Standards Institution (BSI) awarded Vinamilk’s Vietnam Beverage Plant with carbon neutrality certification in accordance with the international standard PAS 2060:2014. With this recognition, Vinamilk now has three entities, including two plants and one farm, certified under this standard.

This achievement is a testament to the company’s dual focus on implementing emissions reduction projects in livestock production and maintaining and expanding its green funds to absorb and reduce its carbon footprint as part of its journey towards Net Zero by 2050.

In Q1 2024, Vinamilk received the Vietnam High-Quality Goods Award for the 28th consecutive year. Vinamilk is one of the few businesses to have consistently maintained this prestigious recognition since the program’s inception in 1996.

This year’s survey indicated that aside from product quality, consumers highly value sustainability attributes in their brand and product choices.

Ms. Vu Kim Hanh, Chairwoman of the Vietnam High-Quality Goods Business Association, stated, “In the transition towards sustainable development, Vinamilk’s leadership is crucial to inspire and motivate other businesses to embark on the path of responsible entrepreneurship.”

Vinamilk recently published its 2023 Annual Report, which contains detailed information on its business operations at https://www.vinamilk.com.vn/bao-cao-thuong-nien/bao-cao/2023/index.html

The company has also released its 2023 Sustainability Report, providing comprehensive insights into its environmental, social, and governance performance at https://www.vinamilk.com.vn/static/uploads/download_file/1713846759-0dccf725b4bd5f04faacb9f9a6b763a8e37e401a0bd18013b995a0454e8f068d.pdf