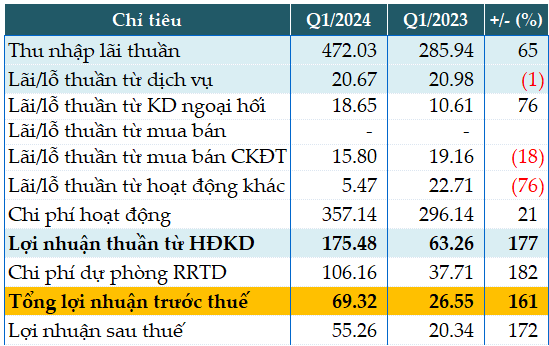

In the first quarter of this year, BVBank’s main revenue grew by 65% year-on-year, reaching VND 472 billion. Service revenue slightly decreased by 1% to VND 21 billion due to the impact of bancassurance.

Remarkably, foreign exchange business revenue reached nearly VND 19 billion, up by 76%, due to exchange rate fluctuations and a 1.5-fold increase in foreign currency trading volume compared to the same period last year.

On the contrary, profit from trading investment securities and other operating activities decreased by 18% and 76% to VND 16 billion and over VND 5 billion, respectively.

Operating expenses surged by 21% to VND 357 billion as the bank increased its investment in network expansion, rebranding, and continued its digital transformation efforts.

Despite setting aside over VND 106 billion for risk provisions, nearly three times higher than the same period last year, BVBank still recorded a pre-tax profit of more than VND 69 billion, 2.6 times higher than the same period last year.

Compared to the pre-tax profit target of VND 200 billion set for the full year, BVBank has achieved 35% after the first quarter.

|

BVBank’s Q1/2024 business results. Unit: Billion VND

Source: VietstockFinance

|

As of the end of the first quarter, the bank’s total assets narrowed by 4% compared to the beginning of the year, to VND 83,956 billion. Credit growth was negative by 1%, with customer loans outstanding at VND 57,095 billion. Meanwhile, customer deposits increased by 4% to VND 59,662 billion.

BVBank’s bad debts as of March 31, 2024, stood at VND 2,231 billion, up by 17% compared to the beginning of the year. The bad debt ratio increased from 3.31% at the beginning of the year to 3.91%.

|

BVBank’s loan quality as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

|