Meeting Update

The 2024 annual general meeting of shareholders (AGM) of VPBank was held on the morning of April 29 in Hanoi. Photo: The Manh

|

According to the voting record, as of 9 a.m. on April 29, the 2024 annual general meeting of shareholders (AGM) of VPBank was attended by 180 shareholders, representing more than 6.52 billion shares, equivalent to 81.93% of the total number of shares entitled to vote. The meeting was eligible to proceed.

5 Key Growth Directions for 2024

Mr. Nguyen Duc Vinh – Member of the Board of Directors and General Director of VPBank said that the 2022-2026 growth target remains unchanged. If any areas were delayed in previous years, the coming years, especially the 2024-2025 period, will be the time for the Management Board to step up efforts, overcome these delays, and regain growth. VPBank will focus on five key growth directions for 2024.

Firstly, the focus will be on growing quality. While in the past five years, VPBank‘s strategy was to expand its scale, it is now necessary to focus on simultaneously acquiring customers who generate higher profits.

In the coming period, VPBank will pay close attention to asset quality issues. While the impact from 2023 has not yet subsided, and the difficulties in the real estate sector have not eased, VPBank still sees opportunities. The government’s support for the market and the potential for supply and demand to recover. However, the bank has been very cautious in its growth in the first quarter of 2024, and the average growth rate has not yet been high. The Management Board of VPBank still believes that the second half of 2024 will be the time when demand in the market gradually recovers, and while the recovery may be strong in 2025, we remain optimistic and are preparing for that growth.

Secondly, all customer segments will be addressed, with the focus on growth in the strategic segments of individual customers and SMEs at a rate of 25-30%. At the same time, we will seek opportunities for development in the FDI segment, which is assessed as having great potential. We expect to more than double the number of customers and quadruple the scale of mobilization and lending. The goal is to make the FDI segment a future pillar of VPBank, aligning with other segments, and creating great opportunities in the market.

In the past, due to capital constraints, we were unable to access many large segments. But now, with a large capital base and the support of SMBC, we believe that VPBank has the strength and resources to develop in a balanced way.

Thirdly, VPBank recognizes the trend from the government and the world toward green credit (ESG), which is in line with the goal of achieving sustainable development. We will focus on supporting the transition to clean energy, combating climate change, protecting the environment, and supporting the vulnerable in society. Therefore, VPBank is not just a bank that serves the wealthy and high-income earners to minimize risk. While this remains a focus, we also have a high sense of social responsibility.

VPBank is providing services to the most disadvantaged people, as well as small and medium-sized enterprises, especially micro businesses that do not have access to credit. This is the responsibility and social commitment of the bank, which is both about economic development and promoting business while also contributing to society.

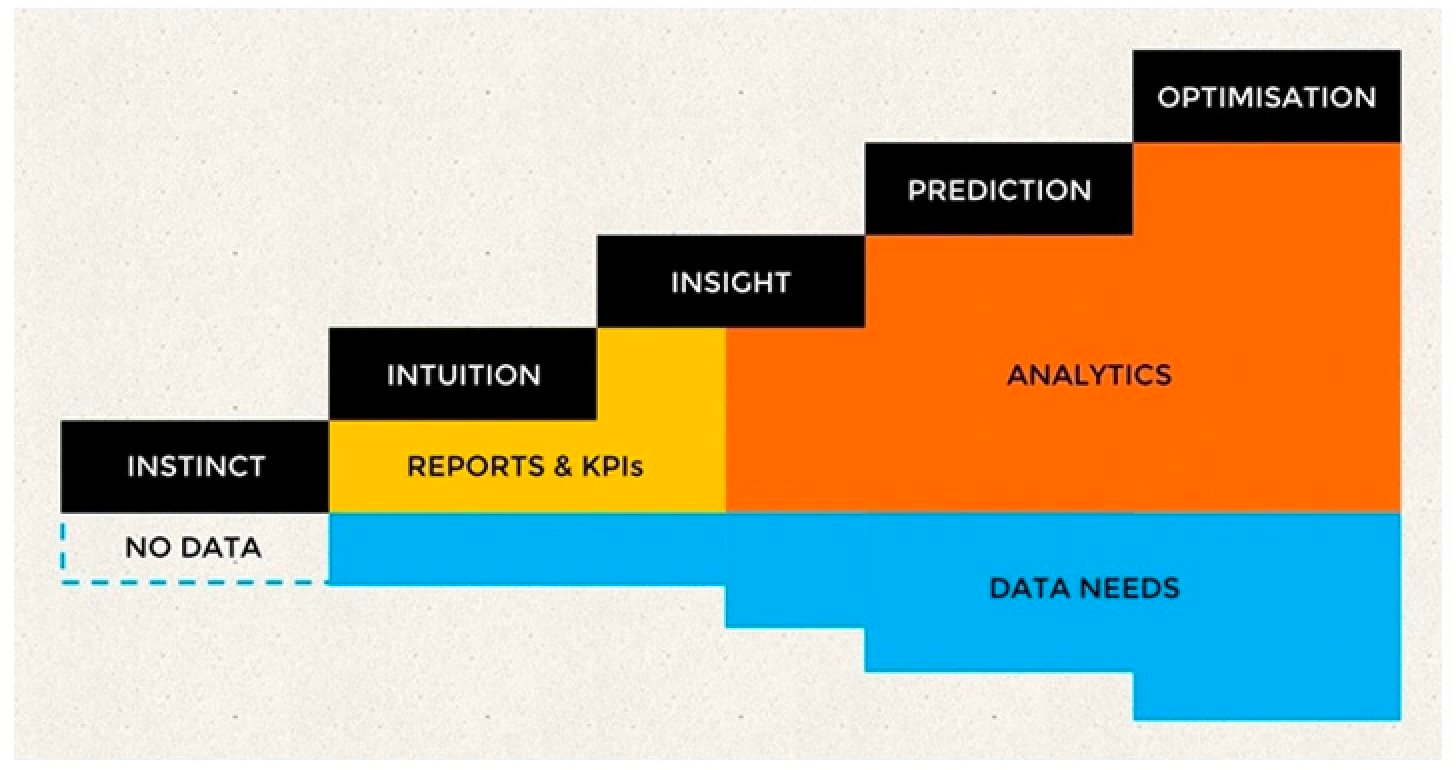

Fourthly, VPBank is building and strengthening our technology and digitalization platform, particularly by developing a data infrastructure. The first step is to establish a data research and development unit. The Management Board has been directly involved in the development of initiatives to support the application of these innovations. We are not just paying lip service, but are committed to bringing the results of practical applications of technology, data, and AI to support the bank’s modernization and digitalization to bring real value to the community.

Fifthly, we recognize that the ecosystem is not just about the scale of the corporation, but about the connections between the different parts. In this regard, VPBank is interested in the ecosystem that supports investors, consumers, and real estate transactions. Pilot programs and key initiatives have received significant investment from the Management Board.

With the five directions mentioned above, and under the condition that VPBank optimizes its performance, we aim to achieve a growth of approximately 30% in total assets. We expect to maintain a high growth rate in mobilization of 25-30%, and the growth rate of lending will remain at the highest level in the market.

VPBank is also carrying out a comprehensive restructuring of FE Credit. After 10 years of bringing great value to the bank, FE Credit entered a difficult period due to COVID-19, with more than 60% of customers being affected. Many workers were unable to make their payments, leading to a high increase in the bad debt ratio. Therefore, VPBank has implemented various measures to reduce the growth rate and ensure the quality of its assets. This is also an opportunity for the Management Board to review the business