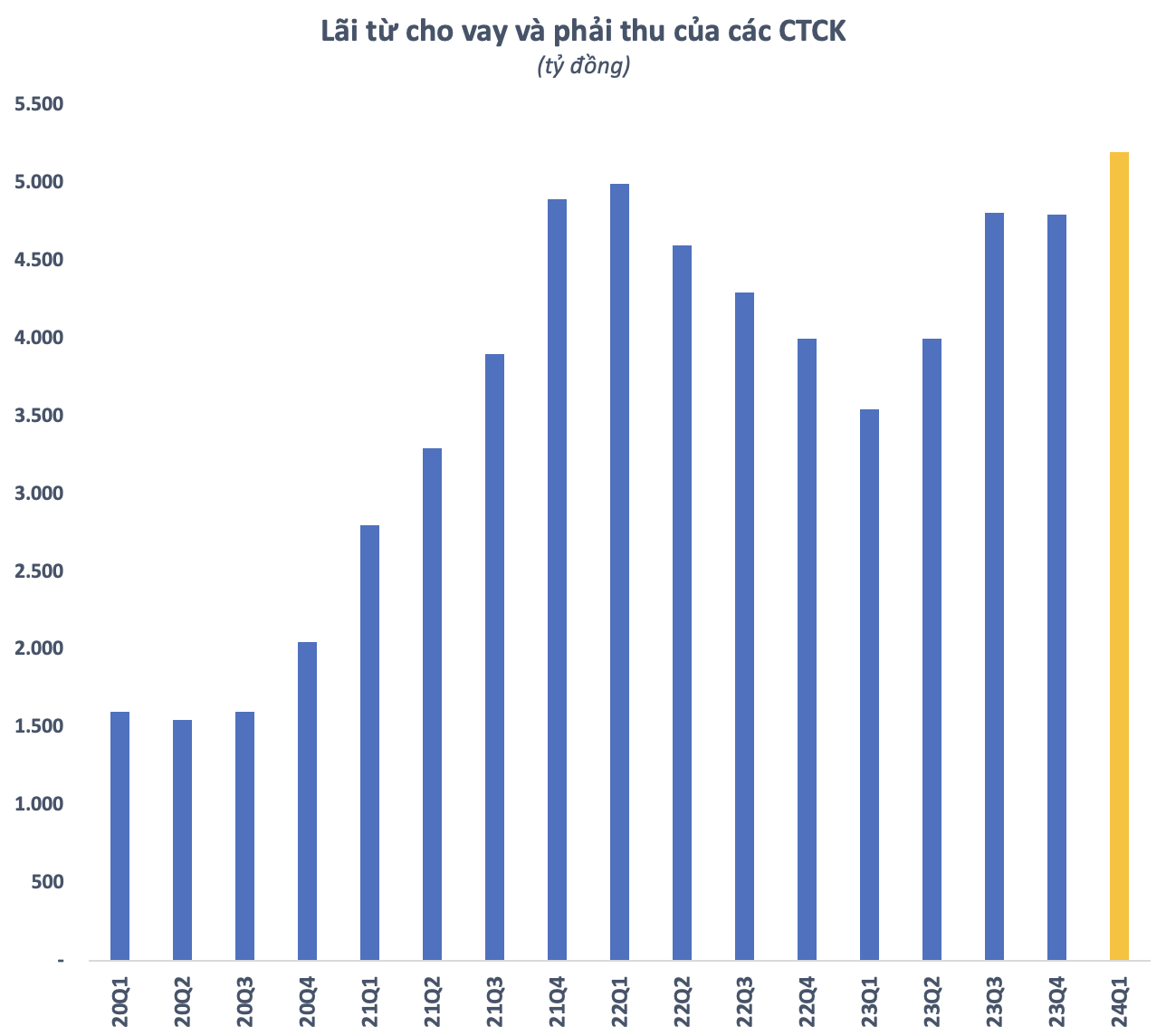

The stock market boomed in the first quarter of the year, and the brokerage operations of the securities companies also operated smoothly, especially lending. According to statistics, the securities companies earned a total of 5,200 billion VND in interest from lending and accrued interest in the first quarter of 2024, an increase of more than 8% compared to the previous quarter and nearly one and a half times the same period in 2023. This is also a record profit in a quarter that the securities group earned from lending activities.

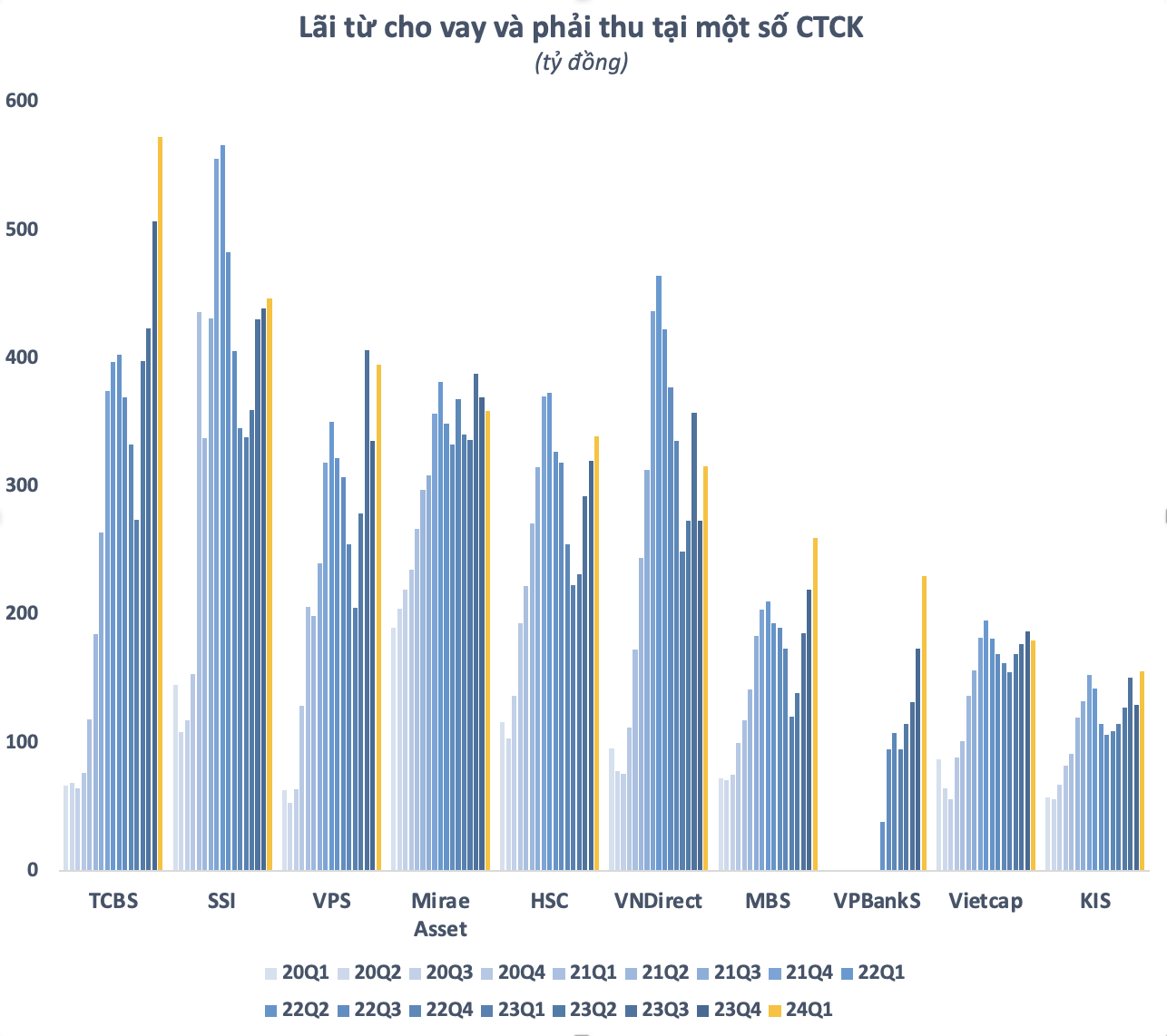

Most of the securities companies recorded an increase in interest and accrued interest from lending in the first quarter of the year compared to the previous quarter and the same period in 2023. The revenue from this source at some securities companies such as TCBS, MBS, and VPBankS even set a record high in the first quarter of 2024. Most notably, TCBS reached nearly 573 billion VND in profit from lending activities, continuing to consolidate its position as the number 1 in the entire industry. This is also the largest interest from lending and accrued interest in a quarter that a securities company has ever achieved.

In the context of the self-trading portfolio fluctuating erratically with the market and the brokerage struggling to break through due to fierce competition, lending is playing an increasingly important role in the operations of the securities companies. Revenue from this segment usually accounts for about 25-40% of operating revenue, and even the largest contributing segment at some securities companies. In terms of profit, interest from lending and accrued interest contributed up to 66% of the total pre-tax profit of securities companies in the first quarter of the year.

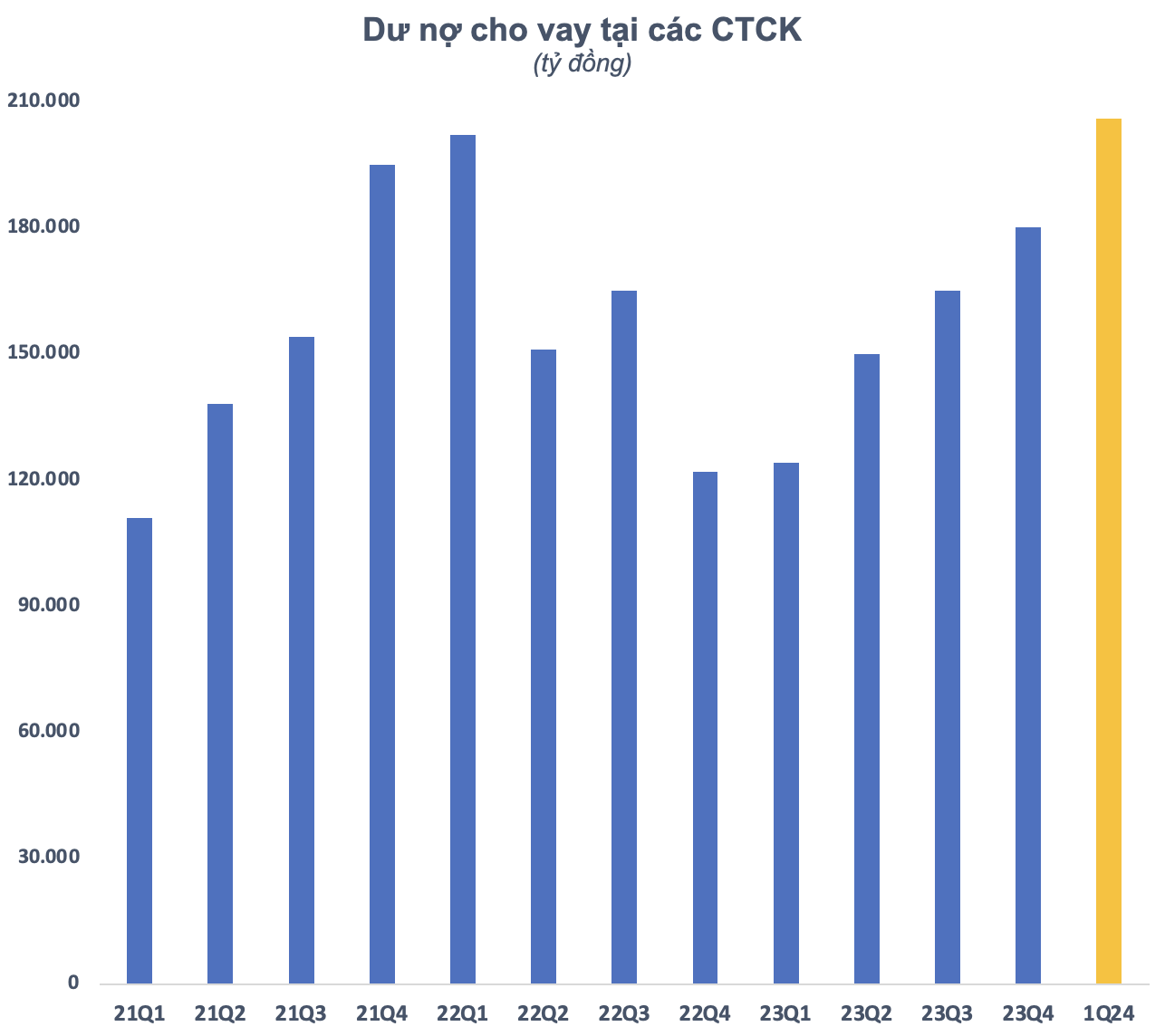

Securities companies have benefited from lending activities thanks to the strong increase in margin leverage demand in the first quarter of the year. According to statistics, outstanding lending balances at securities companies at the end of the first quarter of 2024 are estimated to have increased by 26,000 billion VND compared to the end of 2023, reaching about 206,000 billion VND, the highest ever. In which, the outstanding margin balance is estimated at about 195,000 billion VND, an increase of 23,000 billion VND compared to the end of 2023 and is also a record high in the history of the Vietnamese stock market, surpassing the period of the first quarter of 2022 when the VN-Index reached the peak of 1,500 points.

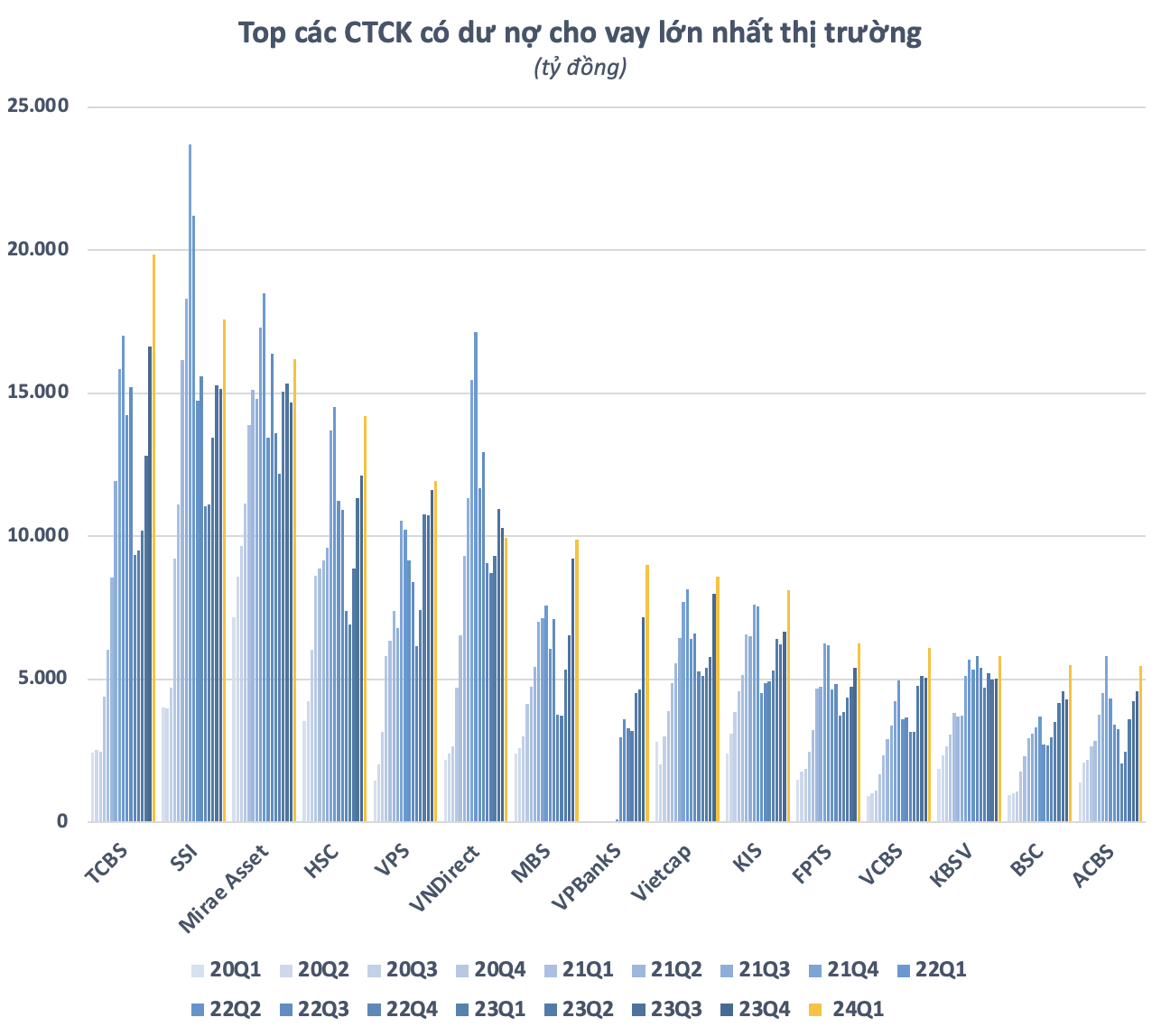

In general, most securities companies have recorded an increase in outstanding lending balance in the first quarter of 2024. In the top, only VNDirect had an outstanding balance decrease compared to the end of last year, but the decrease was not large. In contrast, many securities companies have outstanding balances increasing by thousands of billions such as TCBS, SSI, Mirae Asset, HSC, VPBankS, KIS, VCBS, BSC, etc. It can be seen that the strong increase in outstanding balance is mainly concentrated in the group of securities companies that have banks behind them.

The trend of “banking” securities companies is predicted to develop increasingly when enterprises find it difficult to access capital from bank credit and bond channels. Meanwhile, the procedures for pledging and mortgaging assets as stocks to borrow from the securities companies are much simpler and more flexible. This brings benefits to all 3 parties: (1) enterprises can solve urgent capital needs; (2) securities companies quickly increase their lending scale, bringing in large revenue; (3) banks solve part of the problem of excess capital when credit growth is limited.

According to Mr. Bui Van Huy – Director of DSC Securities, Ho Chi Minh City Branch, the ratio of margin to capitalization of the Vietnamese stock market is currently very high compared to other markets, but the difference is that the outstanding lending balance in the market for a long time has also been considered a channel to partially replace the banking channel, in order to serve large shareholders to borrow capital through stock pledging instead of just a leverage tool for stock investors.

Therefore, the growth of outstanding lending balance in the group of individual investors accounts for only a part, the rest will come from institutions and big players in the market. Experts believe that the current context does not show significant risks impacting the group of investors above and it is necessary to monitor foreign and domestic factors.

Many preferential interest rate packages are launched

Interest rate is one of the factors that strongly boosted the margin balance in the last quarter. From the beginning of 2024, many securities companies have launched programs to reduce margin lending rates to stimulate leverage demand from investors. Typically, DNSE Securities lends margin at an interest rate of 5.99% applied to some stock codes; Yuanta has many interest rate packages at 8-9%; Mirae Asset also offers a margin loan interest rate package as low as 7.99%…

SSI is also implementing a program to reduce margin interest rates from 7.99% for customers from March 4 to June 30. Accordingly, customers with an outstanding balance increase of more than 3 billion VND compared to the outstanding balance at the end of January 31 will enjoy a margin loan interest rate reduction of 1% compared to the current interest rate. For outstanding balances increasing by more than 10 billion VND, there will be a 2% reduction compared to the interest rate, while the current lending interest rate of SSI is 13.5% per year.

In general, if there are no preferential programs, the margin interest rate level at many securities companies is still quite high, ranging from 13-15% for loans with a term of one year, such as VNDirect (13.8%), VPS (14%), SHS (14.5%),… However, with the deposit interest rate and lending interest rate of commercial banks forecast to continue to remain at a low level, margin lending interest rates are expected to tend to decrease in the coming time.

Along with preferential margin interest rate programs, many securities companies also implement a “zero fee” policy to encourage investors to trade. The race to waive fees and reduce margin interest rates among the securities companies aims to attract more investors to open accounts and increase transactions in order to compete for market share. The biggest beneficiaries of this trend are of course the investors.

According to SSI Research’s strategy report, this analysis department believes that record low interest rates will be the main growth driver to attract new cash flow from investors, especially for individuals. In the context that other investment channels are quite limited, this capital flow can return to the stock market in 2024.