Prior to the event, DIG informed shareholders about the giveaway program for those attending the conference. Nevertheless, as of 3:15 PM, the number of shareholders attending the conference had not yet reached the required quorum to commence proceedings. According to the schedule, the DIG conference was scheduled to begin at 1:30 PM.

The 2024 annual DIG shareholders’ meeting was held on the afternoon of April 26 in Vung Tau. Photo: Thu Minh

|

Plan for pre-tax profit of over VND 1,000 billion

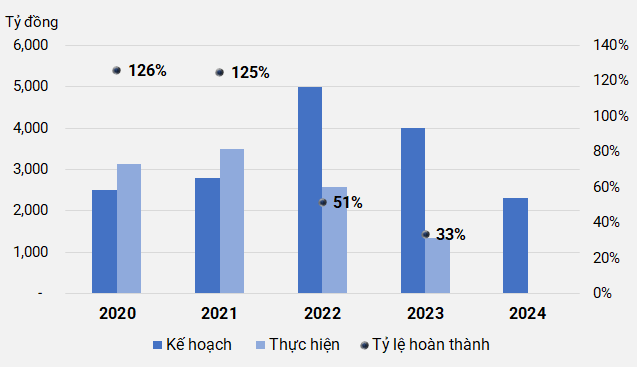

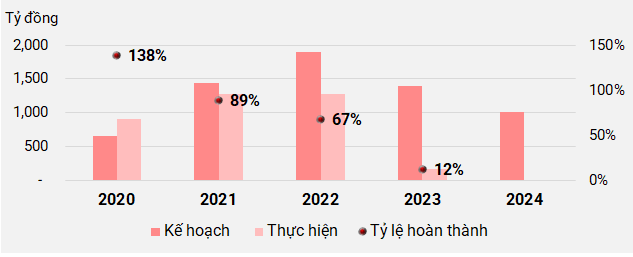

Since the COVID-19 pandemic, DIG has set very high business targets, but the actual results have been very low. In 2024, the company continues to set revenue and profit targets that are somewhat more modest than in previous years, but are still many times higher than the actual results in 2023.

Specifically, DIG has set a target for revenue and other consolidated income of VND 2,300 billion, an increase of 72% compared to the previous year; consolidated pre-tax profit of VND 1,010 billion, six times higher than in 2023. Dividends from 8% – 15% and charter capital of VND 10,000 billion.

|

Results of DIG‘s revenue plan in recent years

Author’s compilation

|

|

Results of DIG‘s pre-tax profit plan in recent years

Author’s compilation

|

In 2024, DIG will focus on completing the preparation procedures for the Long Tan – Dong Nai urban tourism project; seeking approval for the adjustment of the master plan for the Chi Linh central area; completing the adjustment of the progress of the Bac Vung Tau new urban area and the Dai Phuoc ecological tourism urban area; adjusting the master plan for the Hiep Phuoc residential area; completing the adjustment of the 1/500 detailed plan for the Nam Vinh Yen new urban area project; and completing the legal procedures for the Lam Ha Center Point housing project… The total investment plan for 2024 is more than VND 7.2 trillion, including VND 6.4 trillion for project investment and VND 811 billion for financial investment.

At the conference, DIG presented a plan to issue 410 million shares to increase capital to more than VND 10.2 trillion, including the offering of 200 million shares to existing shareholders, 150 million shares as private placement, 30 million ESOP shares, more than 15.2 million shares to pay dividends for 2023, and more than 15.2 million shares to increase share capital from equity.

Of which, 200 million shares will be offered to existing shareholders at a price of VND 15,000 per share (32.794% of the outstanding shares) in 2024, and the shares will be subject to a one-year transfer restriction. Proceeds are expected to total VND 3,000 billion, which will be used to pay off VND 900 billion worth of bonds, provide VND 1,135 billion in capital for the Cap Saint Jacques project, and inject VND 965 billion into the Vi Thanh residential area.

The 150 million shares of private placement are expected to be issued at a price of not less than VND 20,000 per share and will also be subject to a one-year transfer restriction. Proceeds are expected to total VND 3,000 billion, of which VND 1,000 billion will be used to provide capital for the Lam Ha Centre Point housing project in Ha Nam province, and VND 2,000 billion for the Nam Vinh Yen new urban area project in Vinh Phuc province. The expected implementation period for the issuance is 2024-2025.

30 million ESOP shares will also be issued at a price of VND 15,000 per share in 2024 and will be subject to a one-year transfer restriction. Proceeds are expected to total VND 450 billion, which will be used to supplement DIG‘s working capital.

Nearly 15.2 million shares of dividend payments and 15.2 shares of bonuses will also be distributed in 2024. The source of funds for the issuance will be taken from undistributed profits after tax, capital surplus, and the development investment fund as of December 31, 2023.

To be continued…

Online