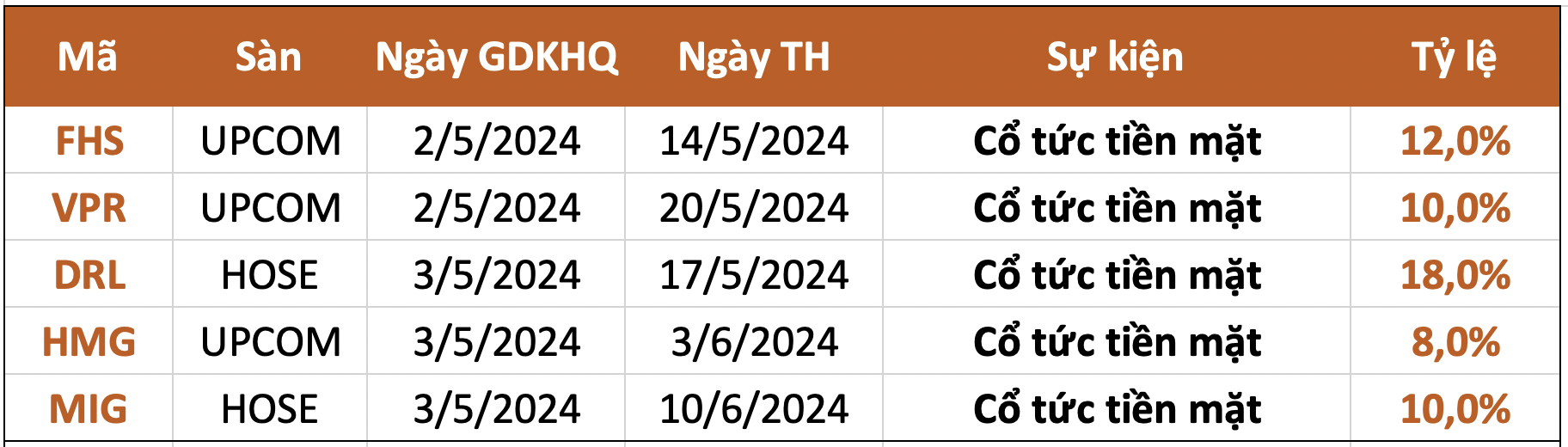

According to statistics, 10 enterprises announced their dividend right exercise in the week following the holidays. Therein, with 5 enterprises paying dividend in cash, 18% being the highest and 8% being the lowest.

Ho Chi Minh City Book Distribution JSC. (Fahasa, code FHS) announced closing the list of shareholders entitled to receive the 2023 second-phase cash dividend. The last registration date is 02/05/2024. With the 12% implementation ratio (1 share receives 1.200 VND) and approximately 12.8 million shares traded, Fahasa expects to spend around 15.3 billion VND to complete this payment phase. The expected payout date is 14/05/2024.

Hydropower – Electricity Corporation 3 (code DRL) has just announced closing the list of shareholders entitled to receive the remaining 2023 cash dividend at a rate of 18% (1.800 VND/share). Ex-dividend date is 03/05. Payment date is expected to be 06/05. Previously, DRL had made 2 advanced dividend payments in 2023, totaling 40% (VND4,000/share).

DRL’s 2024 annual general meeting of shareholders on April 10th also approved the 2024 dividend plan at a rate of 40%, with a remuneration plan for members of the BOD and Supervisory Board of more than 1.5 billion VND.

The Military Insurance Corporation (MIC, code MIG – HOSE floor) announced that May 3rd will be the ex-dividend date for shareholders to receive the 2023 cash dividend at a rate of 10%, equivalent to 1.000 VND/share. With the Company’s after-tax profit in 2023 being 280 billion VND, after deducting reserves, the remaining profit is 249 billion VND, along with the remaining profit from previous years, MIC will spend approximately more than 172 billion VND to pay dividends.

In addition, MIC will proceed to implement the capital increase plan that was presented at the 2023 general meeting, with an expected additional share issuance volume of 28 million shares, to increase capital from 1,726 billion VND to 2,014 billion VND.

At the same time, the Company will issue over 2.8 million shares under the employee stock option plan (ESOP). These shares will be subject to transfer restrictions for 5 years and the restriction gradually lifted over the years.