On April 29th’s survey, gold businesses continue to maintain the previous day’s gold price for both buying and selling transactions, with no adjustment from most gold shops. Currently, the price of SJC gold remains high, hovering around VND 85.5 million when sold. The price of plain gold rings is also fluctuating at VND 76.5 million/tael.

Specifically, Vietinbank Gold listed the price of SJC gold at VND 83-85.52 million/tael. This is also the business that keeps the highest price of SJC gold in the market. Meanwhile, the price of plain gold rings at this business is currently listed at VND 73.7-75.4 million/tael.

Saigon Jewelry also keeps the price of SJC gold unchanged at VND 83-85.2 million/tael. The price of plain gold rings is currently listed at VND 73.8-75.5 million/tael.

Similarly, PNJ listed the price of SJC gold at VND 83 -85.2 million/tael. The price of gold rings is VND 73.8-75.5 million/tael.

Meanwhile, DOJI adjusted the price of SJC gold to VND 82.6-84.8 million/tael. The price of gold rings is currently at VND 74.8-76.5 million/tael.

As for Bao Tin Minh Chau, the price of SJC gold has been adjusted down to VND 82.63-84.75 million/tael, a decrease of VND 350,000-500,000 per tael compared to the previous day. The price of gold rings remains at VND 74.58-76.18 million/tael.

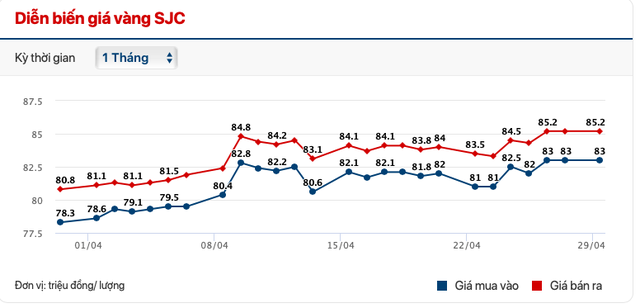

Fluctuations of SJC gold price in the past month. Chart: Cafef

Compared to January 1st, 2024, in just 4 months, the price of each gold bar has increased by more than VND 11 million, equivalent to nearly 15%, while the price of gold rings has increased by more than VND 13 million, equivalent to 22.3%. Meanwhile, the highest interest rate for 4-month savings is only over 3%/year.

According to a recent announcement by the General Statistics Office, as of April 25th, the average price of world gold was USD 2,322.36/ounce, an increase of 8.54% compared to March 2024 due to escalating geopolitical tensions in the Middle East, prompting investors to seek gold as a safe haven. Domestically, the gold price index for April 2024 increased by 6.95% compared to the previous month. This figure increased by 17.01% compared to December 2023; an increase of 28.62% compared to the same period last year. On average, the domestic gold price index increased by 20.75% in the first 4 months of 2024. The report noted that domestic gold prices have fluctuated in line with world gold prices.

In the global market, according to Vietnam time, the current gold price is around USD 2,331/ounce. Converted to VND, the world gold price is equivalent to VND 71.6 million/tael; thus, the difference between the domestic and world SJC gold price is around VND 13 million/tael.

According to experts, the low savings interest rates are driving people to look for alternative ways to preserve their money. While the real estate market is recovering, the bond investment channel is stagnant, and the continuous increase in gold prices has made it an attractive investment channel.

According to experts’ analysis, if investors trade gold in the short term, the risk of loss is significant due to the high difference between the buying and selling prices of gold. For example, if someone bought plain gold rings on April 10th, they would have lost nearly VND 5 million per tael by now. Meanwhile, if they bought SJC gold, they would have lost more than VND 2 million per tael.

According to Assoc. Prof. Dr. Dinh Trong Thinh, an economic expert, the difference between the buying and selling prices of gold, which is up to VND 2.5 million, is too high. This poses a significant risk of loss for gold investors. Mr. Thinh said that in the past, the difference between the buying and selling prices of gold was only VND 400,000 to 500,000/tael. However, gold businesses are widening the buying and selling difference to protect themselves amid strong price fluctuations.