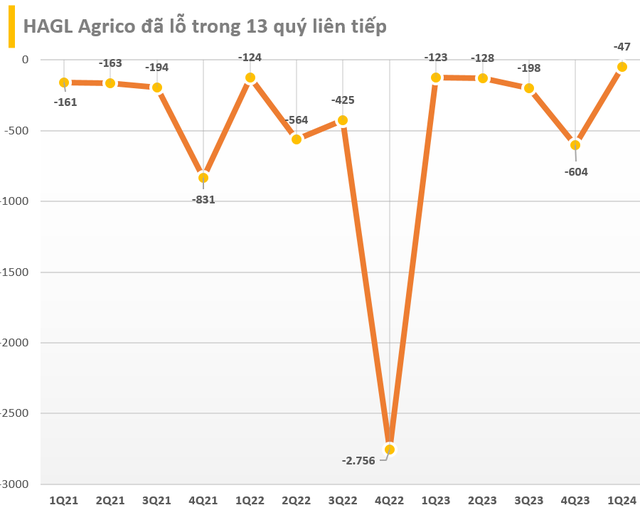

Hoang Anh Gia Lai International Agriculture JSC. (stock code: HNG) has just announced its Q1 2024 business results, which saw net revenue decrease by 26% to 93.5 billion VND. Operating below cost, plus expenses, caused the company to post a 47 billion VND loss after tax, although it was a reduction compared to the 112 billion VND loss reported in the same period of 2023. This is also the 13th consecutive quarter of company losses, although the losses have now reduced to double digits.

According to HAGL Agrico’s management, the fruit segment only achieved revenue of 41.4 billion VND in Q1 2024; a yield of 3,529 tons, down 46% compared to the same period. The reason for this is that during this period, the company focused on developing and exploiting only 918 hectares of the banana plantation area effectively, compared to 2,049 hectares in the same period.

The remaining area has ceased production to concentrate resources on investing in new infrastructure and facilities; emphasizing synchronous planning, investment to meet business production needs.

In the rubber segment, revenue for the quarter was 26 billion VND, with a yield of 825 tons. HAGL Agrico explained that the rubber tapping cycle ends in January each year, so rubber is only harvested in January. Additionally, the high cost of goods sold, mainly depreciation costs, led to insufficient revenue to cover costs.

As of the end of Q1 2024, HAGL Agrico had accumulated losses of 8,149 billion VND, reducing its equity to just 2,487 billion VND. Total financial debt at the end of the period exceeded 8,800 billion, including 2,543 billion in long-term debt. HAGL Agrico owes 6,040 billion VND to CTCP Nông nghiệp Trường Hải (a member of Thaco) and 1,120 billion VND to HAGL. The remaining debt is from banks.

The company’s total assets are valued at 14,247 billion VND. However, the company has only over 6 billion VND in cash, compared to 76 billion VND at the beginning of the year. HAGL Agrico’s assets are primarily comprised of incomplete construction costs (4,670 billion VND), mainly for the development of fruit and rubber plantations, cattle farming projects, and more.