Lowest Net Profit HAH Since Q1 2021

| Net profit HAH Lowest in 13 Quarters |

Net profit hit 13-quarter low

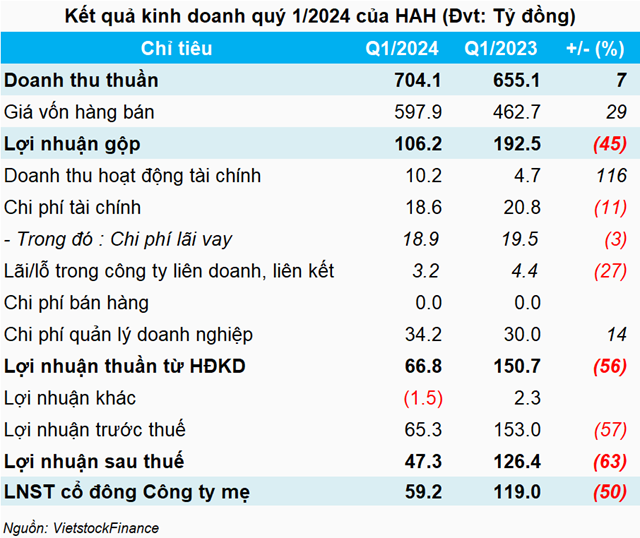

HAH released its Q1 2024 financial statements, showing net revenue of over VND 704 billion, up 7% year-over-year. However, by the end, HAH only reported a net profit of VND 59 billion, down by half.

According to HAH, the poor performance in Q1 was mainly attributable to a decline in its shipping business. Specifically, shipping volume increased due to newly opened shipping routes, but freight and ship charter rates decreased, leading to a steep drop in the profit from ship exploitation. In addition, the operations of its subsidiaries and associates were also impacted, further reducing profits.

New VND 500 billion bond issuance

At the end of Q1, HAH had total assets of nearly VND 5,780 billion, up 8% from the start of the year. Fixed assets accounted for 54% of the total, or over VND 3,096 billion, consisting primarily of transportation and transmission equipment.

Another significant item was short-term accounts receivable, which totalled nearly VND 987 billion and made up 17% of the total. A notable portion of this was the advance payment of nearly VND 435 billion to Huanghai Shipbuilding Co., Ltd for three 1,800 TEU container ship construction contracts. In late 2023, HAH took delivery of the Haian Alfa, with the remaining two vessels expected to be delivered in the first half of 2024.

Cash and cash equivalents surged by 2.6 times over the beginning of the year, to VND 632 billion. This was mainly due to a sharp increase in non-term bank deposits.

In terms of financial resources, HAH reported over VND 2,516 billion in liabilities, up 15% from the start of the year, primarily driven by the recognition of convertible bonds.

Specifically, HAH began to recognize the value of the convertible bonds that it successfully issued in February of this year. The bonds have an issuance value of VND 500 billion. After deducting issuance costs of over VND 10 billion and a small portion of VND 346 million allocated for issuance expenses, the bond value as of March 31, 2024, was nearly VND 490 billion.

These bonds were issued by HAH on February 2, 2024, with a 5-year term expiring on February 2, 2029, and a fixed interest rate of 6% per annum, paid every six months. The entire lot of bonds was purchased by four investors: SSI Fund Management Company (SSIAM), Vietnam Growth Investment Fund L.P (VGIF), Daiwa-SSIAM Vietnam Growth Fund III L.P (DSVGF), and Japan South East Asia Finance Fund III L.P (JSEAFF).

Source: HAH’s Q1 2024 financial statements

|

SSIAM and foreign funds participate in HAH’s VND 500 billion bond issuance

Borrowings also reached a high of over VND 1,270 billion, but had decreased by 8% compared to the beginning of the year. A majority of this was a long-term loan from Vietcombank Hai Phong branch for VND 712 billion, used to invest in Kalmar forklifts, purchase the Hai An West ship, and fund container ship projects such as Marine Bia (Hai An City), A Kibo (Hai An Rose), Max King (Hai An East), build the HCY-265 container ship (Hai An Alfa), and develop the Pantos-Hai An Logistics Project.