Foreign Trade: Persistent Trade Surplus

In international trade, exports and imports are matters of significant concern. They not only determine economic standing and influence political positioning but also impact domestic aggregate demand, economic growth, and the balance of trade, a pivotal macroeconomic variable affecting the overall balance, foreign exchange reserves, foreign exchange market, and inflation.

EIGHT CONSECUTIVE YEARS OF TRADE SURPLUS

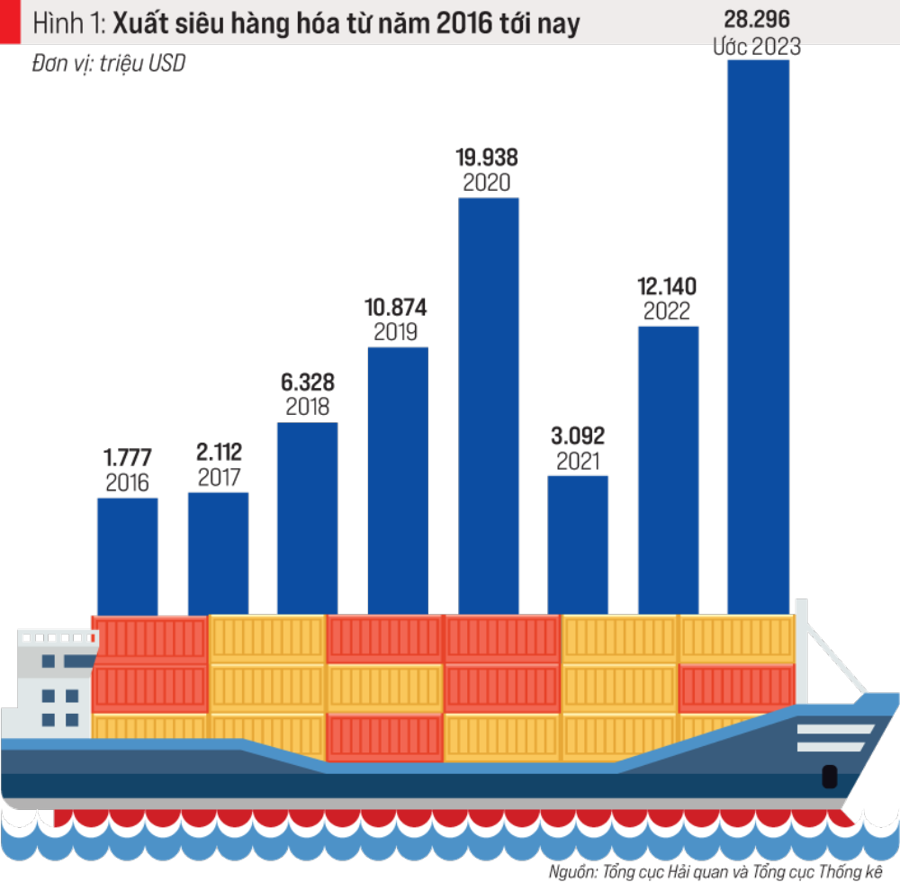

The trade surplus in commodities from 2016 onwards is depicted in Figure 1.

The trade surplus in commodities in 2023 marks the eighth consecutive year of surplus. This is the longest period of trade surplus in recent years. In the past, trade deficits were prevalent, with surpluses being infrequent and typically lasting only 2-3 years, and the surplus amounts were meager.

Not only has the trade surplus persisted, but the magnitude of the surplus in 2023 is the highest ever recorded, surpassing the record set in 2020 and more than doubling the surplus of the previous year. This unprecedented level has surprised both policymakers and experts.

Over time, the trade surplus has continued consistently across months, with some months showing a surplus of over USD 2-3 billion, notably in March, when it reached over USD 4.8 billion, the highest monthly surplus ever recorded.

The trade surplus is entirely attributable to the foreign-invested sector. The domestic economic sector continues to experience a substantial trade deficit (USD 21,735 million). Of the 88 primary markets, Vietnam maintains a trade surplus in 53, including 19 with a surplus exceeding USD 1 billion (Figure 2).

Fifteen markets have a surplus exceeding USD 2 billion; eight exceed USD 3 billion; five exceed USD 4 billion; four exceed USD 5 billion; and the United States leads by a wide margin. The majority of these markets are developed economies, indicating that Vietnam’s export prices are competitive due to low labor costs.

These markets are significant recipients of foreign direct investment in Vietnam and are part of the “club” of Vietnamese localities with high export volumes. They are also covered by bilateral or multilateral free trade agreements (FTAs) of the latest generation.

The trade surplus is driven by exports exceeding imports (USD 354.7 billion versus USD 326.4 billion). Of the 45 primary exported commodities, 36 have a value exceeding USD 1 billion, including seven exceeding USD 10 billion (Figure 3).

These are all commodities where Vietnam has a competitive advantage due to its abundant labor force, low prices, and the use of technology from the foreign-invested sector.

In terms of location (source of goods), 39 out of 63 provinces and cities have export revenue exceeding USD 1 billion, including 10 exceeding USD 10 billion (Figure 4).

These are all areas with significant foreign direct investment, numerous industrial zones, and many industrial enterprises.

Among the 88 primary markets where Vietnam exports, 32 have a trade surplus exceeding USD 1 billion, including 14 exceeding USD 5 billion, and notably, five exceeding USD 10 billion: the United States: USD 97,020 million; China: USD 61,208 million; South Korea: USD 23,499 million; Japan: USD 23,315 million; and the Netherlands: USD 10,242 million. These markets have substantial foreign direct investment in Vietnam and are part of comprehensive, strategic partnerships, strategic partnerships, and comprehensive partnerships, as well as free trade agreements (FTAs).

Imports declined more than exports (a decrease of 9.2% compared to 4.6%). This occurred not because import prices increased, but rather because they decreased compared to the previous year (despite the increase in VND/USD exchange rate), leading to reduced demand for production and exports. Subsequently, production and exports in the following cycle will be affected. Imports by the foreign-invested sector declined more sharply than those by the domestic economic sector (-10.3% compared to -9.2%). Of the 53 commodity items, 41 experienced a decline, including several with significant reductions (over USD 1 billion), such as chemical products, plastics, textile and footwear raw materials, iron and steel products, base metals, telephones and components, automobiles, and automotive parts.

A significant trade surplus also presents challenges. Firstly, the trade surplus occurs while total exports decline (not due to increased exports), yet imports decline more than exports. A substantial decline in exports will impact production and exports in the subsequent cycle.

Secondly, the trade surplus is solely attributed to the foreign-invested sector, while the domestic economic sector continues to experience a substantial trade deficit.

Aside from the markets where Vietnam has a significant trade surplus, it also imports from several markets with substantial trade deficits exceeding USD 1 billion, including China and South Korea.

EXPECTATIONS FOR A NINTH CONSECUTIVE YEAR OF TRADE SURPLUS AND SOLUTIONS

These expectations stem from several factors. The uninterrupted trade surplus over the past eight years may continue in 2024. 2024 is a year of acceleration, with a higher growth target than in 2023; with a higher growth target when the two largest components of domestic aggregate demand (asset accumulation and final consumption) remain weak, the trade surplus will support growth in terms of GDP utilization…

The article was published in the special issue of Economy 2023-2024: Vietnam & The World, released on March 6, 2024. We invite you to read it here:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam