MWG Announces Q1 2024 Financial Results with Significant Capital Inflow

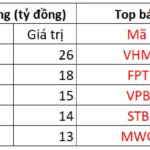

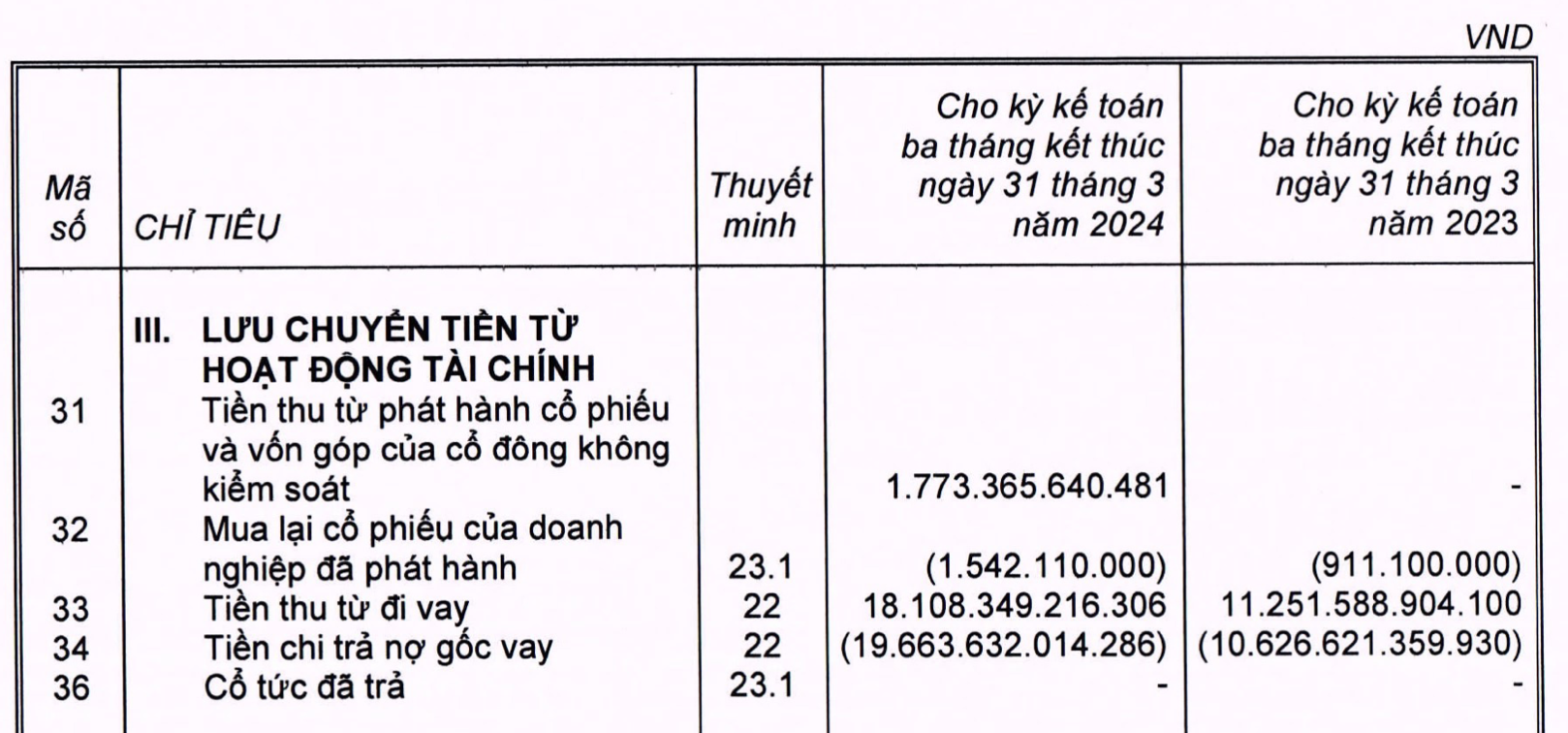

Hanoi, Vietnam – April 29, 2024 – Mobile World Investment Corporation (MWG), Vietnam’s leading consumer electronics retailer, has released its Q1 2024 financial results. In addition to core business performance, MWG’s cash flow from financing activities in Q1 recorded an additional VND 1,773 billion from share issuances and capital contributions from non-controlling shareholders.

Earlier, Bach Hoa Xanh Investment and Technology Joint Stock Company (BHX Investment) – a subsidiary of MWG – announced the completion of a private placement to CDH Investments (through Green Bee 2 Private Limited). The proportion of shares offered was 5% of BHX Investment’s total issued shares.

Speaking at the 2024 Annual General Meeting of Shareholders, MWG’s Chief Investment Officer stated that this is a primary share issuance, with proceeds going directly to the company for working capital financing, store expansion, and long-term growth plans. The investor, upon becoming a shareholder, will not interfere in the company’s operations or decision-making.

Therefore, it is highly likely that the nearly VND 1,800 billion recorded from share issuance and capital contributions from non-controlling shareholders on MWG’s Cash Flow Statement corresponds to the amount received from the sale of 5% of Bach Hoa Xanh shares to CDH Investments.

Thus, the valuation of Bach Hoa Xanh based on the offering price to CDH Investments is approximately VND 35,500 billion (~USD 1.4 billion).

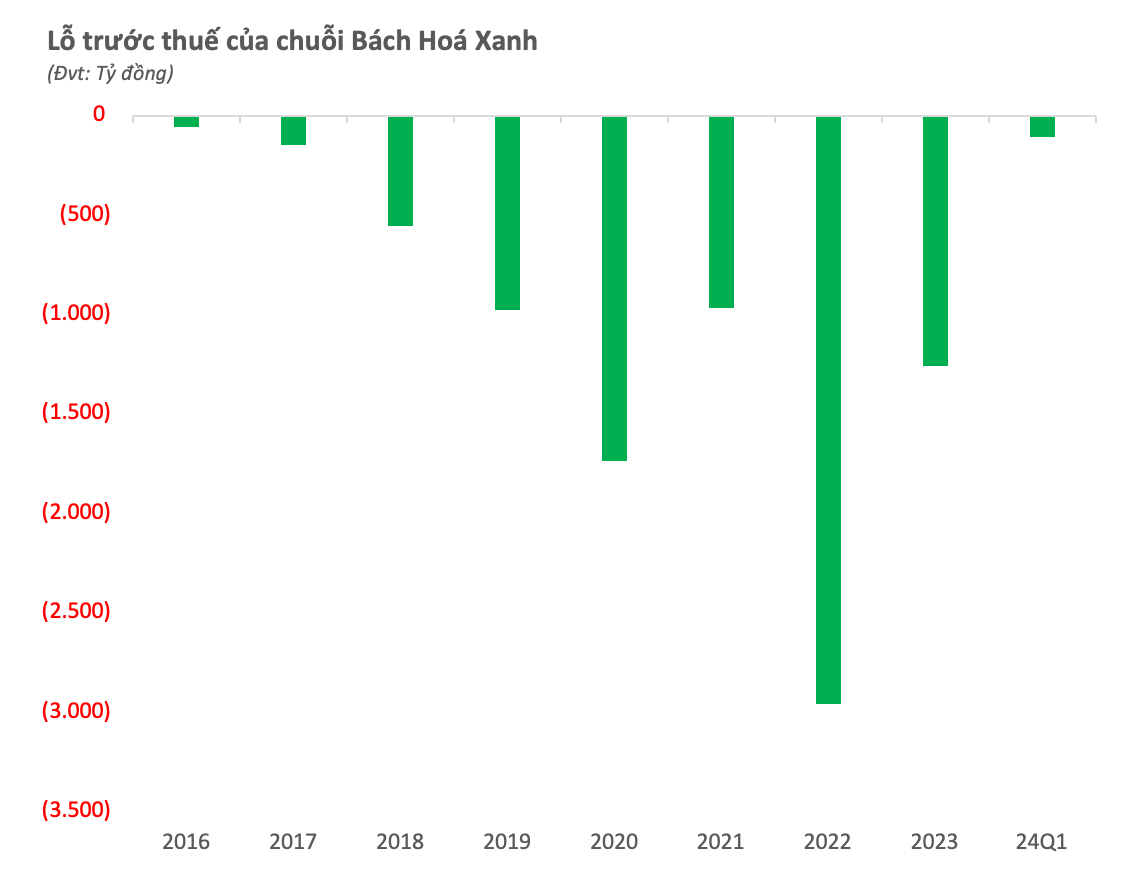

Bach Hoa Xanh’s growth has been a key topic of interest for shareholders. The milestone of reaching break-even point at the end of 2023 is seen as a driving force for the supermarket chain’s strong growth. MWG has expressed high expectations for Bach Hoa Xanh, with CEO Nguyen Duc Tai stating that the supermarket chain will be a major growth driver for MWG over the next five years.

At the 2024 Annual General Meeting of Shareholders, Chairman of the Board of Directors Nguyen Duc Tai said that Bach Hoa Xanh has no plans to raise additional capital due to lack of need. “If there was a need, we would have already sold 10%. Bach Hoa Xanh will not open another round of fundraising. Bach Hoa Xanh has entered a phase where it is no longer making losses, and the parent company no longer has to provide funds for its operations. Therefore, there is no reason to raise additional capital,” Tai said.

The Chairman of MWG also stated that from now on, Bach Hoa Xanh will grow to a sufficiently large scale and be listed on the stock exchange, as promised to the investor who recently acquired 5% and as expected by other shareholders. “When the scale is large enough and profit figures in the trillions emerge, that’s when Bach Hoa Xanh will be ready to enter the stock market,” Tai emphasized.

Earlier, responding to a shareholder’s question about the supermarket chain’s future profit projections, Pham Van Trong, CEO of Bach Hoa Xanh, confidently stated that he personally believes that a “four-digit” profit (trillions in profit) is achievable within the next 1-2 years.

In terms of profitability, the supermarket chain is indeed significantly reducing its losses. According to Q1 financial statements, Bach Hoa Xanh’s after-tax loss was VND 105 billion, only about a third of the VND 300 billion loss recorded in Q4 of last year.