As the market opened, domestic stocks underwent an adjustment period due to the onset of unfavorable news. Overnight, the Dow Jones fell 375 points following the GDP report. The recently released figures from April 25 indicate that the U.S. economy saw a slowdown in the first three months of 2024. Market attention is now focused on the Federal Reserve’s (FED) March inflation figures to be released this evening, which will be a basis for forecasting interest rate cut prospects.

Domestically, the market was also disappointed by news that the KRX system’s implementation had been delayed. The State Securities Commission has declined to approve the KRX system’s launch on May 2nd, citing several reasons. The State Securities Commission mentioned that there are no official documents from members regarding their readiness to connect to the KRX information technology system or their ability to provide securities services to investors after the connection is established.

The stock group reacted most negatively to this change. Previously, they had reached “price ceilings” with each new development and plan for KRX’s implementation. Although the market recovered afterward, the stock sector remained immersed in red. Over 20 stocks experienced price declines.

However, the impact of the stock group on the main index was relatively small, given the low liquidity and its low proportion of capitalization.

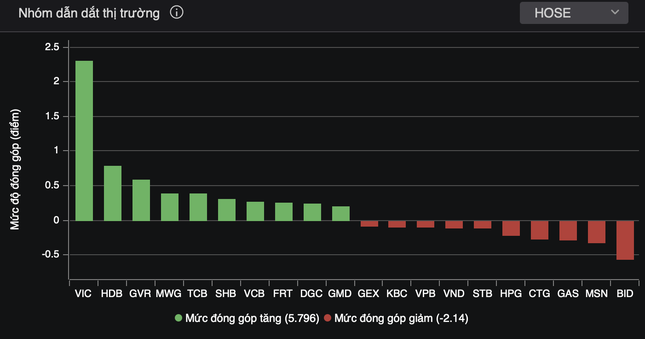

VIC’s uptrend significantly contributed to the VN-Index’s rise.

VIC’s uptrend significantly contributed to the VN-Index’s rise. The Vingroup stock increased by 5.8%, continuing its upward momentum after the company’s shareholders’ meeting, where Mr. Pham Nhat Vuong’s comments on cash flow and Vinfast were particularly noteworthy.

The VN30 group, despite its bifurcated state , had leading stocks like HDB, SHB, GVR, MWG, PLX, and TCB, which provided considerable support to the VN-Index. Conversely, the performance of stocks like BID, MSN, GAS, CTG, and HPG was not overly negative. No single stock caused the VN-Index to lose more than 1 point.

Ahead of the 5-day holiday , market liquidity remained subdued. The HoSE’s order-matching value was over VND14,000 billion.

Closing the trading session, the VN-Index gained 4.55 points (0.38%) to 1,209.52 points. The HNX-Index decreased by 0.75 points (0.33%) to 226.82 points. The UPCoM-Index rose by 0.43 points (0.49%) to 88.76 points. Foreign investors engaged in net buying, amounting to VND217 billion, focusing on MWG, PVS, VCB, MSN, and KDH.

With the trading session’s end, the market enters a 5-day holiday from April 30th to May 1st . The Vietnam Stock Exchange (VNX), Ho Chi Minh City Stock Exchange (HoSE), Hanoi Stock Exchange (HNX), and Vietnam Securities Depository (VSDC) will observe a 5-day holiday. Consequently, trading on the stock exchange will cease during the holiday period.

On the following Saturday (May 4th), the stock exchanges and VSDC will suspend trading, clearing, and settlement activities.