A Rhodium Group analysis has found that the European Union (EU) will likely need to impose tariffs as high as 55% to blunt the flood of cheap electric vehicles (EVs) from China.

The analysis comes as the EU opens an anti-subsidy investigation into electric vehicle imports from China. Rhodium Group, which had previously estimated the EU would impose tariffs of 15-30% on Chinese EVs, said this would not be enough to contain the threat from China. “Even at the high-end of this range, several Chinese producers could still earn a substantial profit margin by exporting to Europe given their significant cost advantage,” the report said.

Chinese companies such as BYD, which overtook Tesla to become the world’s largest seller of electric vehicles last year, can afford to sell their cars at a much higher margin in regions like the EU than at home, despite a 10% tariff.

Electric vehicles from Chinese companies are expected to account for 11% of the EU market in 2024 and could reach 20% by 2027. Photo for illustration. Photo: China Daily

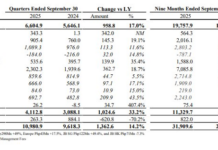

This is because Chinese electric vehicle makers are engaged in a fierce price war at home. According to Rhodium Group, BYD’s Seal U, which sells for around €20,500 in China and €42,000 in the EU, is estimated to make a profit of €1,300 per vehicle at home, compared with €14,300 in Europe. Even after a 30% tariff, a company like BYD would still make a higher profit selling in the EU, the report said.

“Substantially higher tariffs in the region of 45% or even 55% may be necessary to make exports to Europe commercially unattractive,” for manufacturers like BYD, Rhodium Group said.

Last year, the European Commission opened an investigation into Chinese electric vehicles and subsidy policies, with officials saying a wave of cheap EVs was threatening the bloc’s manufacturers.

Government incentives in the early 2010s led to a surge in start-ups and helped build up domestic battery manufacturing capacity, paving the way for China to produce affordable and globally competitive electric vehicles, experts say.

Chinese electric vehicle manufacturers have faced strong headwinds in the United States, making the European market even more important for companies such as BYD as they seek to expand globally.

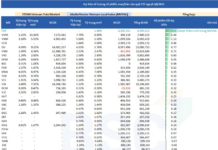

Electric vehicles from Chinese companies are expected to account for 11% of the EU market in 2024 and could reach 20% by 2027, according to analysis by the European Federation for Transport and Environment.

That number is expected to exceed 25% this year, even accounting for “made-in-China” vehicles produced by non-Chinese companies.

To counter the policy risks, electric vehicle makers are seeking to shift production to Europe. BYD plans to build a factory in Hungary.