Hoang Anh Gia Lai Corporation (HAG) Announces Revised Allocation of Private Placement Proceeds

Hoang Anh Gia Lai Corporation (HAG) has unveiled a revised plan for the utilization of funds raised from its recent private placement offering.

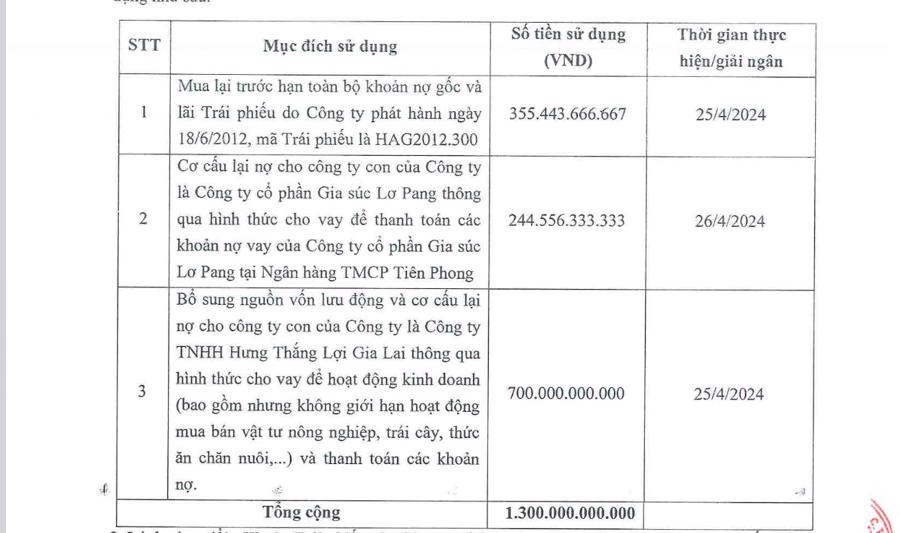

Revised Allocation:

Redemption of HAG2012.300 Bonds: VND 355.44 billion (increased by VND 16.2 billion)

Restructuring of Gia Suc Lo Pang Debt: VND 244.56 billion (decreased by VND 16.2 billion)

Working Capital and Debt Restructuring for Hung Thang Loi Gia Lai: VND 700 billion (unchanged)

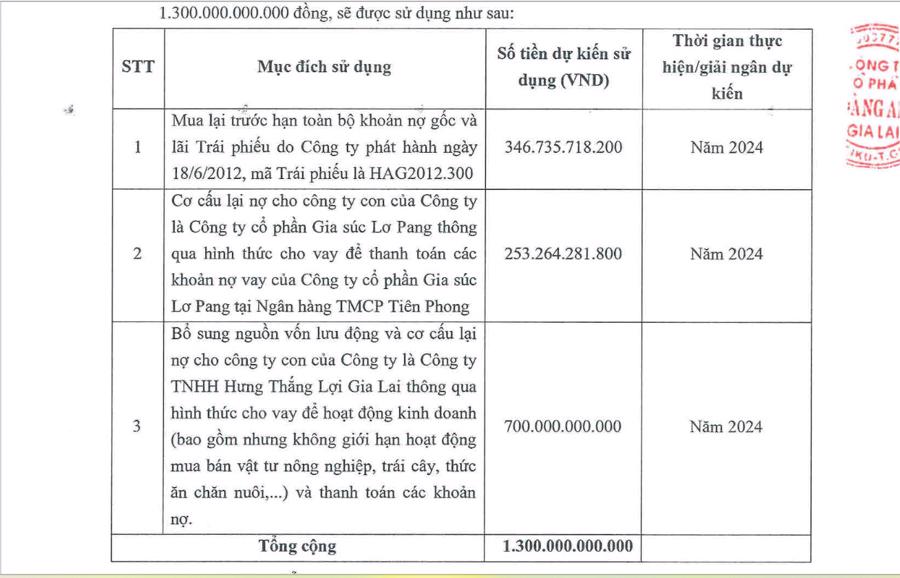

Original Allocation:

Redemption of HAG2012.300 Bonds: VND 346.7 billion

Restructuring of Gia Suc Lo Pang Debt: VND 253.3 billion

Working Capital and Debt Restructuring for Hung Thang Loi Gia Lai: VND 700 billion

The revised allocation was made to reflect the accrual of additional interest on the HAG2012.300 bonds until the date of their anticipated redemption.

Financial Performance:

HAG reported a profit of VND 226 billion in Q1 2024, a decrease of VND 77 billion compared to the same period last year.

Investments and Operations:

Increased banana plantation area to 9,000 hectares

Increased durian plantation area to 2,000 hectares

Continued implementation of financial restructuring measures to reduce bank debt and optimize cash flow

Growth Strategy:

HAG plans to focus on its core businesses of livestock farming and cultivation, with an emphasis on bananas, durians, and pigs. The company’s “Circular Agriculture” model prioritizes sustainable practices and technology to minimize waste and promote environmental protection.

HAG aims to improve its financial performance and reduce accumulated losses through its strategic initiatives and operational efficiency. As of Q1 2024, the company’s accumulated losses stood at VND 1.45 trillion, a reduction of VND 217 billion since the end of 2023.