Cash flow has yet to show signs of returning despite the end of the five-day holiday. The index struggled throughout the session, but in the last 30 minutes, it suddenly surged 6.84 points to close at its highest point of the day, 1,216 points. The market breadth improved towards the end of the session, with 268 stocks gaining points over 194 declining stocks.

Of note was the remarkable recovery of the real estate group, which had declined sharply throughout the morning due to disappointing business results with a series of businesses reporting record losses in Q1. However, in the afternoon, the group rebounded 0.46%. Notably, VHM rose 0.86%; VRE rose 1.34%, and NLG also rose 3.56%.

Despite this, the Information Technology sector was the strongest performer, rising 3.05%, with FPT rising 3.33%; CTR rose 2.82%. Seafood rose 1.66%; Banks also rose 0.17%; Retail rose 1.54% with MWG rising 1.28%; PNJ and FRT rose 1.16% and 1.86%, respectively. Another notable gainer today was the Electricity group, which rose 1.34% due to record power consumption during the recent holidays. GEX rose 2.7%; POW rose 5.71%; NT2 rose 4.67%…

The top stocks driving the market today were FPT, which gained 1.27 points; VCB, which gained 0.95 points; SAB, which gained 0.69 points; POW and REE, which gained 0.34 points and 0.26 points, respectively.

Cash flow has not shown any signs of returning; liquidity on the three exchanges today was nearly 16,000 billion dong, of which foreign investors sold a net 906.8 billion dong, with a net sell order of 333.8 billion dong.

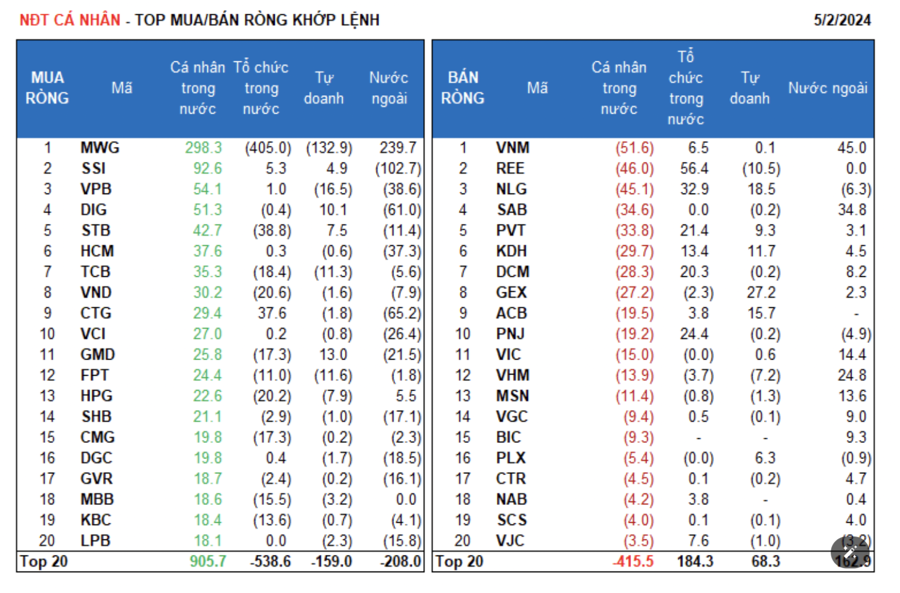

Foreigners’ main net buy orders were in the Retail, Food, and Beverage sectors. The top net bought stocks by foreign investors included MWG, VNM, SAB, VHM, VIC, MSN, BIC, VGC, DCM, and HPG.

On the net sell side, foreign investors focused on the Financial Services sector. The top net sell orders by foreign investors included SSI, CTG, DIG, VRE, VPB, VCI, HDB, GMD, and DGC.

Domestic individual investors bought a net 929.9 billion dong, including a net buy order of 753.1 billion dong. In terms of matched orders, they bought net in 9 out of 18 sectors, mainly in the Retail sector. Leading net buy orders from domestic individual investors were MWG, SSI, VPB, DIG, STB, HCM, TCB, VND, CTG, and VCI.

On the net sell side, they sold net in 9 out of 18 sectors, primarily in the Food and Beverage and Industrial Goods and Services sectors. The top net sellers include VNM, REE, NLG, SAB, PVT, KDH, GEX, ACB, and PNJ.

Proprietary traders were net buyers of 88.9 billion dong, while selling a net 35.6 billion dong in matched orders. In matched orders, proprietary traders bought net in 5 out of 18 sectors. The strongest net buy was in Real Estate and Industrial Goods and Services. The top net buy orders from proprietary traders today were VRE, GEX, NLG, HDB, ACB, GMD, KDH, DIG, PVT, and E1VFVN30. The top net sell was in the Retail sector. The top net sold stocks included MWG, VPB, FPT, TCB, REE, HPG, VHM, HT1, MBB, and LPB.

Domestic institutional investors sold a net 151.5 billion dong, with a net sell order of 383.6 billion dong.

In terms of matched orders, domestic institutions sold net in 9 out of 18 sectors, with the largest value in the Retail sector. Leading net sellers included MWG, STB, VND, HPG, TCB, CMG, GMD, MBB, KBC, and FPT. The largest net buy value was in the Industrial Goods and Services sector. The top net buys included REE, CTG, NLG, PNJ, PVT, DCM, KDH, TCH, PVD, and VJC.

Negotiated transactions today reached 1,952.1 billion dong, up 15.7% compared to the last trading session of April 2024 and contributing 12.2% to the total transaction value.

Today, there was a notable negotiated transaction in BWE shares, where a foreign institution sold 12 million units (equivalent to 469.8 billion dong) to a domestic individual and institution. Moreover, there was another large negotiated transaction between foreign institutions in FPT shares, with over 3.4 million shares (equivalent to 450.6 billion dong) being transferred.

The proportion of cash flow allocation increased in Real Estate, Retail, Construction, Software, Plastic, Rubber & Fiber, Electricity Production & Distribution, and Aviation, while decreasing in Banking, Securities, Food, Steel, Agriculture & Fisheries, Warehousing, Logistics and Maintenance, and Oil & Gas Equipment and Services.

In terms of matched orders, the proportion of transaction value increased again in the large-cap VN30 and small-cap VNSML groups, while decreasing in the mid-cap VNMID group.