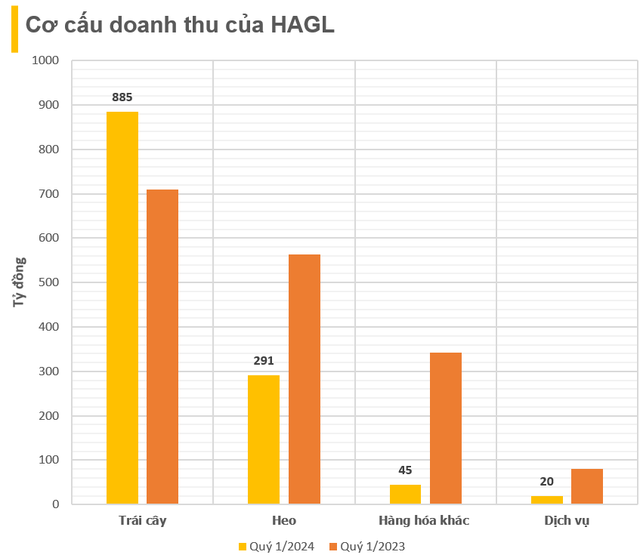

Hoang Anh Gia Lai Group (HAGL, stock code: HAG) has just announced its business results for the first quarter of 2024 with revenue of 1,242 billion VND, a decrease of 26.8% compared to the same period last year. In which, revenue from hog sales decreased by 48.3% to 291.6 billion VND, revenue from sale of goods reached nearly 45 billion VND, down 87%. However, revenue from fruits increased by 24.6% to nearly 885 billion VND.

After deducting the cost of goods sold, HAGL recorded a gross profit increase of more than 10% to 498.2 billion VND. Operating financial income reached 73 billion VND, decreased by nearly 50%. In which, the decline in interest income from loans by 67.6% to 40.3 billion VND was the main reason for the decrease in the company’s financial revenue.

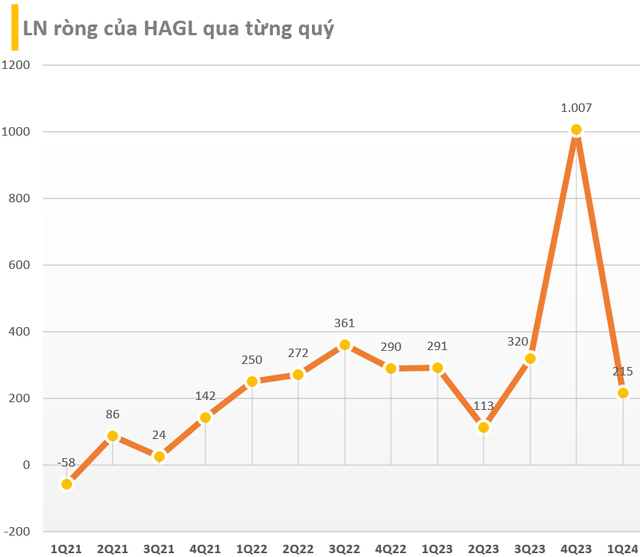

Financial expenses decreased due to lower interest payable. However, selling expenses increased by 95% to 115 billion VND due to a sharp increase in transportation costs. Business management expenses increased slightly compared to the same period. As a result, HAGL’s net profit was 215 billion VND, down 26.1% compared to the first quarter of 2023. EPS decreased from 314 VND to 232 VND.

As of March 31, HAGL still had an accumulated loss of 1,452 billion VND. The charter capital is 9,274 billion VND, so the equity is only 7,032 billion VND. The company’s total financial debt is 7,816 billion VND, of which this enterprise still has a bond debt of 4,528 billion VND at BIDV and ACBS.

The company’s total assets reached 21,170 billion VND, a slight increase compared to the beginning of the year. In which, short-term accounts receivable reached 7,657 billion VND, accounting for more than 1/3 of HAGL’s total assets. Fixed assets reached 5,903 billion VND.