Financial Performance of CTF

Quarterly Net Income Trend

| CTF’s Quarterly Net Income from 2017 to Present |

Q1 2024 Performance

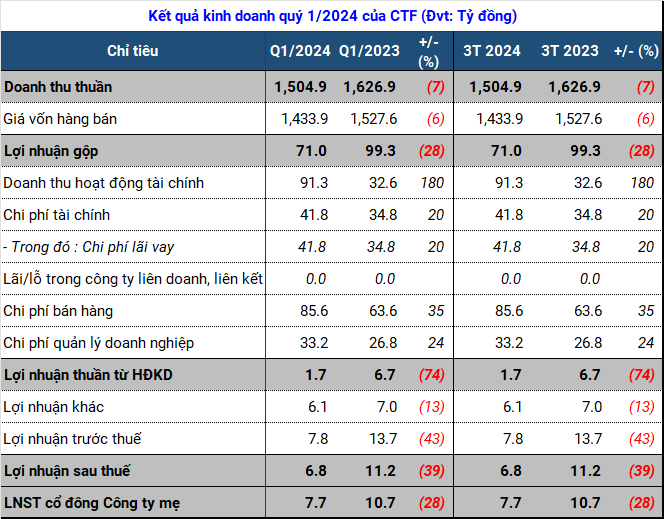

City Auto Corporation (HOSE: CTF) recorded revenue of VND 1.5 trillion in the first quarter of 2024, a 7% decrease compared to the same period last year. However, the high cost of goods sold pressured the gross profit, narrowing it by 28% to VND 71 billion.

CTF’s gross profit margin in Q1 was a mere 4.72%, one of the company’s lowest levels in recent years. The company attributed this to the significant decline in the Vietnamese automobile market and the impact of the global economic downturn.

The setbacks in the past three months were not solely due to external factors. Various expenses, including interest, sales, and administrative costs, surged notably. Most significantly, sales expenses increased by 35% to VND 85 billion, primarily driven by higher personnel costs.

Similarly, management personnel expenses led to a 24% increase in CTF’s administrative costs, reaching VND 33 billion. The company spent VND 42 billion on interest and bond payments, a 20% increase.

Total expenses exceeded the company’s gross profit. However, revenue from investment income provided CTF with an additional VND 60 billion, compared to no such revenue in the same period last year.

Other Highlights

Source: VietstockFinance

|

– By the end of Q1 2024, CTF’s total investment in other entities decreased from VND 205 billion to VND 154 billion. Notably, the company divested VND 11 billion, VND 7 billion, and VND 32 billion from New City Rent A Car, Easy Car, and Dasonmotors, respectively.

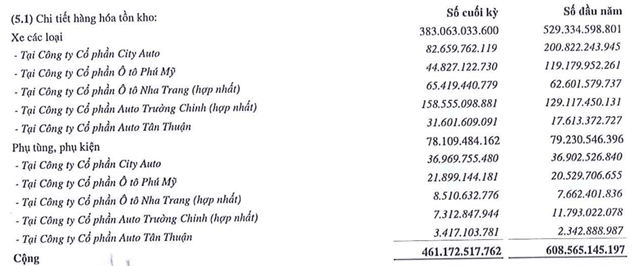

– Despite market challenges, the company’s inventory was reduced by 24% to VND 461 billion, primarily due to a significant decrease in the number of vehicles held by CTF and its subsidiary, Phu My Automobile.

CTF’s Inventory Details as of Q1 2024. Source: CTF

|

– In 2024 and beyond, CTF plans to continue expanding its Ford and Hyundai showrooms. In Q2, the company expects to complete and open two showrooms in Tien Giang and Di An, covering 3,000 sqm and 4,000 sqm, respectively.

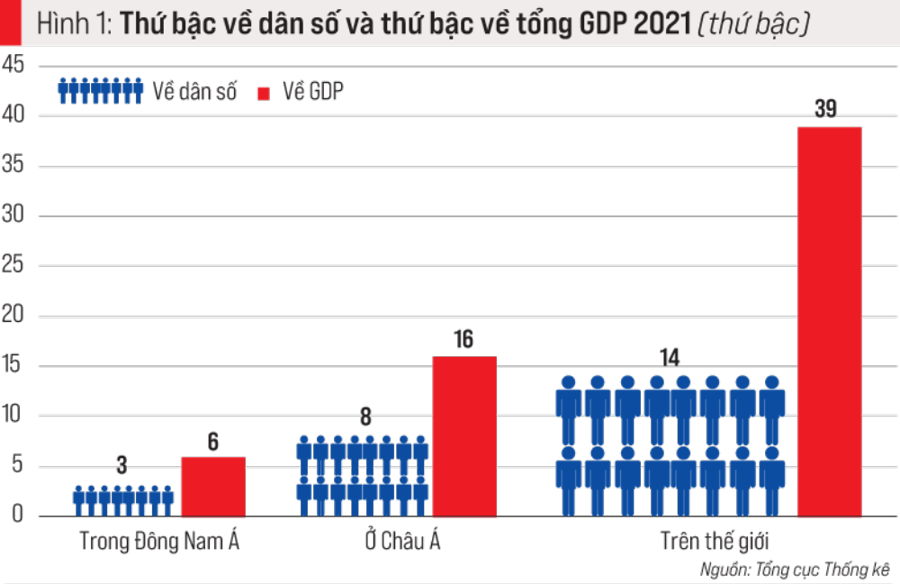

– CTF acknowledges that the end of the 50% excise tax reduction for domestically produced vehicles in early 2024 will impact car sales. However, the company remains optimistic about the long-term potential of the Vietnamese automobile market, citing its growing population, increasing incomes, and high demand for vehicles.

– Industry experts predict a 10% growth in the Vietnamese automobile market in 2024 (to approximately 428,000 units sold), supported by economic recovery and manufacturer incentives.

– SSI Research anticipates a 9% increase in auto sales in 2024, despite potential headwinds in the first half of the year due to low consumer demand and buyers waiting for new models. The report highlights economic recovery, new vehicle launches, easing chip shortages, and attractive loan rates as growth drivers.

– S&P Global Mobility estimates a 2.8% rise in global light vehicle sales in 2024 to approximately 88.3 million units.

Author: Tu Kinh