According to the consolidated financial report for Q1/2024, as of March 31, 2024, Nam Long Investment Corporation had total capital of over VND 28,821.5 billion, nearly VND 220 billion higher than at the end of 2023.

Of which, Nam Long Group’s liabilities increased slightly by 2.4% to over VND 15,440 billion, including short-term debt of over VND 10,156 billion, up 2.7% compared to the beginning of the year; long-term debt increased by 1.9% to nearly VND 5,284 billion.

Nam Long Group lost VND 65 billion after tax in the first quarter of the year.

Nam Long Group’s borrowing and financial leasing in Q1/2024 amounted to over VND 6,214 billion, accounting for 40.2% of the company’s liabilities. Of which, Nam Long Group’s long-term borrowing and financial leasing increased by nearly 2.9% to nearly VND 3,812 billion, while short-term borrowing and financial leasing remained almost unchanged at nearly VND 2,403 billion.

Nam Long Group’s largest creditor is Phương Đông Commercial Joint Stock Bank (OCB) with nearly VND 754 billion of short-term debt and nearly VND 904 billion of long-term debt. In addition, OCB also holds a bond of Nam Long Group worth VND 500 billion.

After OCB is Sumitomo Mitsui Bank with a long-term loan of nearly VND 776 billion; Standard Chartered (Vietnam) Limited Liability Bank over VND 423 billion (short and long-term); Ngoại Thương Joint Stock Commercial Bank – Ho Chi Minh City Branch over VND 72 billion; United Overseas Bank (Vietnam) Limited Liability Company over VND 7 billion. In addition, Nam Long Group also borrowed over VND 169 billion from 3 other individuals.

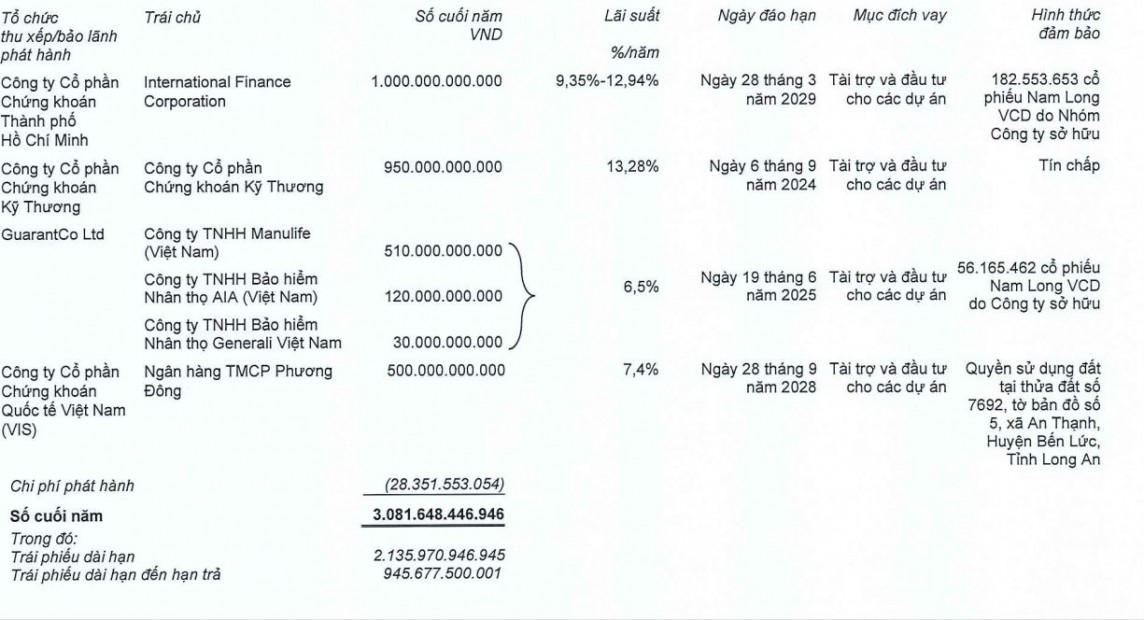

At the same time, Nam Long Group also raised significant capital from bonds to increase financial leverage. As of March 31, 2024, Nam Long Group holds a debt of nearly VND 3,082 billion, accounting for 49.6% of total borrowings.

Although there were no significant fluctuations in borrowings in the first quarter of 2024, Nam Long Group currently has more than VND 1,283 billion of long-term debt due. This includes VND 337.2 billion of long-term loans due and VND 945.6 billion of bonds.

This bond debt corresponds to the value of the NLGB2124001, NLGB2124002 series of bonds issued by Nam Long Group on September 6, 2021, and due to mature on September 6, 2024.

On September 6, 2024, Nam Long Group will mature two bonds worth approximately VND 950 billion.

In addition to long-term debt due, Nam Long must also repay nearly VND 1,120 billion of short-term loans between June and November 2024.

In terms of business, in Q1/2024, Nam Long Group achieved revenue of VND 204.6 billion, down 13% year-on-year. After deducting the cost of goods sold, gross profit was VND 86.5 billion, a decrease of 46%.

In the period, financial revenue was over VND 25 billion, a decrease of VND 20 billion compared to Q1/2023. Financial expenses were VND 50.5 billion, down 34%. In addition, profit from associated companies decreased by 69% to only VND 24 billion.

Gross profit was not enough to cover expenses, causing Nam Long Group to lose VND 58.7 billion from operating activities. As a result, the company reported a net loss of VND 65 billion, and the after-tax profit of the parent company’s shareholders was negative VND 77 billion.

Explaining the reasons for the loss, Nam Long Group said that in Q1/2024, revenue from apartment sales decreased and the profit received from the joint venture company Mizuki decreased compared to the same period in 2023.

In 2024, Nam Long Group’s shareholders approved a business plan with net revenue of VND 6,657 billion and after-tax profit of VND 821 billion, after-tax profit of the parent company’s shareholders was VND 506 billion.

Nam Long Group said that the company’s revenue will come from the handover of key projects (Akari Can Tho, Ehome S Can Tho, EhomeS MR1, Izumi, Southgate); providing project management and sales services for joint ventures; sale of commercial assets in the projects.

At the end of Q1/2024, Nam Long Group’s total assets reached VND 28,821.5 billion, a slight increase of 0.8% after the first three months of the year. Of which, cash and cash equivalents decreased slightly by 2.6% to VND 2,473 billion, short-term financial investments decreased by 33.2% to VND 701.5 billion…

It is worth noting that Nam Long Group’s inventory as of March 31, 2024 reached nearly VND 18,118 billion, up 4% (up VND 702.3 billion) compared to the beginning of the year, accounting for 62.8% of total assets. In particular, it is mainly concentrated in unfinished real estate properties such as Izumi project (VND 8,565 billion), Waterpoint phase 1 project (VND 3,768.6 billion), Hoang Nam – Akari project (VND 1,910.3 billion), Waterpoint phase 2 project (VND 1,700.6 billion),…

Izumi project and Waterpoint project have been mortgaged by Nam Long Group to secure some of its loans.