POW’s Business Indicators in the First Quarter of 2024

|

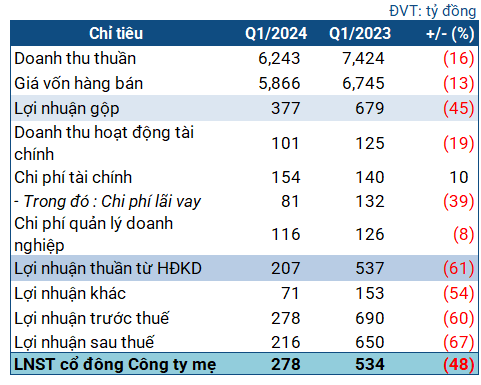

POW’s Business Indicators for Q1 2024

Source: VietstockFinance

|

Specifically, POW’s net revenue recorded a 16% decrease compared to the same period last year, reaching over 6.2 trillion VND. After deducting the cost of goods sold, the business had a gross profit of 377 billion VND, which is 45% lower than the corresponding period.

Financial revenue fell by 19% to 101 billion VND due to a decrease in interest on deposits. Meanwhile, financial expenses increased by 10% to 154 billion VND due to exchange rate differences. Despite a reduction in other expenses, POW’s total net profit reached only 278 billion VND, which is 48% lower than the same period last year.

POW explained that the decline in the performance of several hydropower plants due to unfavorable hydrological conditions and low water levels was the primary cause of this decrease. For instance, Hua Na Hydropower (HOSE: HNA) reported a 48% decrease in revenue, and Dakdrinh Hydropower saw a 46% revenue loss. Notably, a thermal power plant, Nhon Trach 2 (HOSE: NT2), even suffered a substantial loss of 158 billion VND due to reduced electricity production.

| POW’s Business Situation in Recent Quarters |

NT2 Unexpectedly Records Heavy Losses in the First Quarter

Regarding its financial position, POW’s balance sheet shows some concerns. At the end of the first quarter, the business’s total assets increased slightly compared to the beginning of the year, reaching 72.5 trillion VND. Current assets decreased slightly to over 28 trillion VND. The company holds over 9.1 trillion VND in cash and cash equivalents, a 16% decrease from the beginning of the year. Construction in progress increased by 26% to over 11.4 trillion VND, mostly related to the Nhon Trach 3 and 4 Power Plant projects.

On the liabilities side, short-term debt increased by 7% to nearly 28.6 trillion VND. The current and quick ratios are close to 1 and 0.92, respectively, indicating some risk in the company’s ability to repay its debts.

Short-term borrowings declined slightly to 5.3 trillion VND, while long-term borrowings increased by 16% to nearly 8.3 trillion VND, all of which are bank loans.