KienlongBank Q1 2024 Business Results

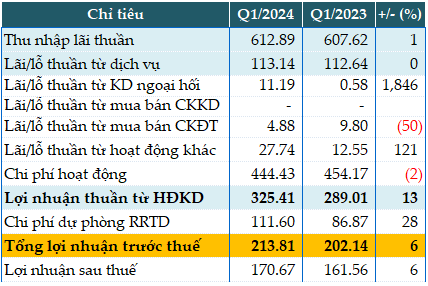

In the first quarter, the bank’s core activities were roughly in line with the same period last year, with net interest income reaching almost VND613 billion. Service activities also remained unchanged, generating over VND113 billion in profit.

Foreign exchange trading was KienlongBank’s fastest-growing activity, with a profit of over VND11 billion, compared to VND575 million in the same period last year.

Other activities were the next growth area, with profit of nearly VND28 billion, 2.1 times higher than the same period due to increased recovery of bad debts previously covered by risk provisions.

Despite a 2% reduction in operating expenses compared to the same period, KienlongBank increased its credit risk provision expenses by 28%, allocating nearly VND112 billion to strengthen resources, increase buffers, cover bad debts, and mitigate bad debt ratios below regulatory limits. This will reduce provisioning pressure in the coming years and lessen the impact of bad debts in the future. As a result, the bank’s pre-tax profit rose by 6% to nearly VND214 billion.

Compared to the pre-tax profit target of VND800 billion set for 2024, KienlongBank has achieved nearly 27% of the goal after the first quarter.

KienlongBank’s Q1 2024 Business Results (in billion VND)

Source: VietstockFinance |

KienlongBank’s total assets increased slightly by 1% to nearly VND87.581 billion as of the end of Q1. While loans to customers rose by 3% (VND53.972 billion), customer deposits decreased by 1% (to VND56.239 billion).

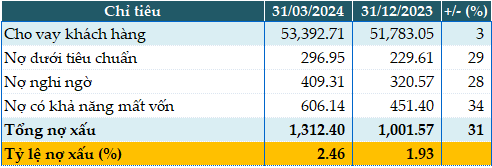

Total bad debts as of March 31, 2024, amounted to VND1.312 billion, an increase of 31% compared to the beginning of the year. All three bad debt categories increased. As a result, the ratio of bad debts to outstanding loans rose from 1.93% at the beginning of the year to 2.46%.

KienlongBank’s Loan Quality as of March 31, 2024 (in billion VND)

Source: VietstockFinance |

By Hàn Đông