Q1 2024 Business Results of VCI

|

VCI’s Q1 2024 Business Results

Source: VietstockFinance

|

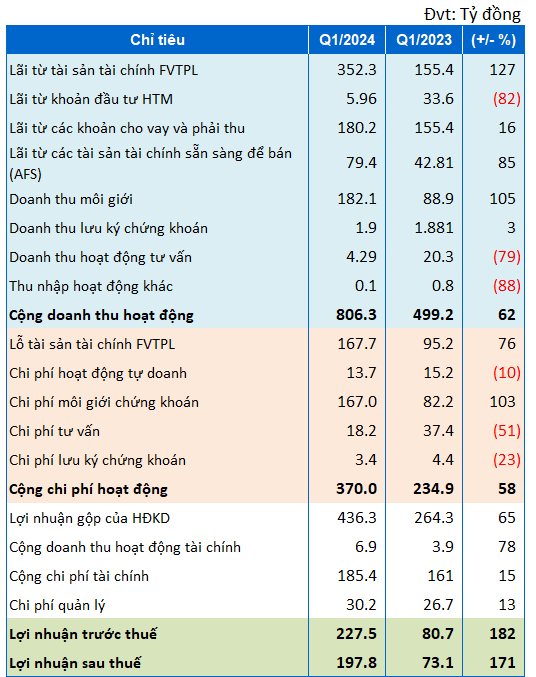

VCI’s Q1 after-tax profit reached nearly 200 billion VND, an increase of 171% compared to the same period last year. This growth was attributed to the main business segments.

VCI’s brokerage and lending activities both increased in Q1. Brokerage revenue doubled compared to the same period last year, reaching 182 billion VND. Interest on loans and receivables increased by 16%, reaching 180 billion VND.

The proprietary trading segment also had good results, with revenue from financial asset gains recognized through fair value profit or loss (FVTPL) increasing by nearly 130%, reaching 352 billion VND. Excluding FVTPL financial asset losses and proprietary trading expenses, VCI’s proprietary trading segment earned 171 billion VND, almost four times higher than the same period last year.

Profit from available-for-sale (AFS) financial assets reached nearly 80 billion VND.

On the cost side, brokerage costs, financial costs, and administrative expenses all increased compared to the same period last year, in line with revenue growth.

Specifically, brokerage costs doubled to 167 billion VND, financial costs increased by 15% to 185 billion VND, and administrative expenses increased by 13% to 30 billion VND.

According to VCI’s explanation, in the first quarter of this year, the stock market performed positively compared to the same period last year. The company realized profits on some investments, so revenue from the sale of FVTPL financial assets from proprietary trading increased, while brokerage revenue also increased.

VCI’s total assets at the end of Q1 were 19.5 trillion VND, an increase of more than 13% compared to the beginning of the year.

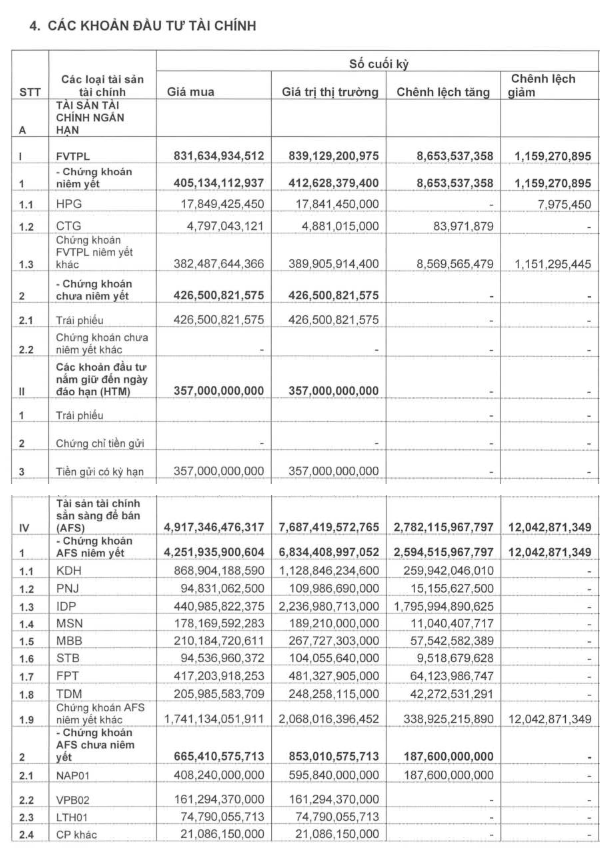

Loans and AFS assets accounted for the largest proportion of the company’s asset structure, at 8.5 trillion VND and 7.7 trillion VND, respectively. Notable stocks in the AFS asset portfolio include KDH, IDP, MBB, FPT, TDM, PNJ, STB…

Compared to the beginning of the year, the value of the company’s FVTPL asset portfolio increased significantly, nearly six times to more than 839 billion VND. The value of FVTPL assets increased as the company increased its investments in listed stocks and unlisted bonds.

|

VCI’s Financial Asset Portfolio as of March 31, 2024

Source: VCI

|

As of that date, the company held more than 1 trillion VND in cash.

The capital structure is relatively balanced, with total debt accounting for approximately 60% of capital sources, at 11.3 trillion VND. The majority is in the form of short-term loans (10.2 trillion VND).

| VCI’s Asset Structure |