In line with Article 169, Clause 2 of the 2019 Labor Code, and Article 4 of Decree 135/2020 issued by the Government, the retirement age for employees in normal working conditions will be progressively adjusted until it reaches 62 for male employees in 2028 and 60 for female employees in 2035.

As of 2021, the retirement age for employees in normal working conditions is 60 years and 3 months for male employees and 55 years and 4 months for female employees. Subsequently, it will increase by 3 months each year for male employees and 4 months for female employees.

According to this regulation, in 2024, the retirement age for male employees will be 61 years, while the retirement age for female employees will be 56 years and 4 months. Employees who meet the social insurance contribution period as prescribed by the law on social insurance are entitled to receive a pension upon reaching the retirement age.

Employees with reduced working capacity; working in particularly arduous, toxic, and hazardous occupations; or working in areas with especially difficult socio-economic conditions may retire at a lower age but not more than 5 years earlier than the above-mentioned regulations at the time of retirement, unless otherwise specified by law.

Employees with high professional and technical qualifications and in certain special cases may retire at an older age but not more than 5 years later than the regulations specified above at the time of retirement, unless otherwise specified by law.

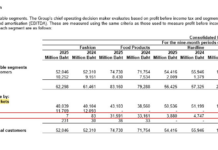

Retirement age increase roadmap for employees in normal working conditions

Pension and social insurance allowance increase

Resolution No. 104/2023 of the National Assembly resolves to implement a comprehensive reform of the wage policy from July 1st, in accordance with Resolution No. 27 of the 7th session of the Central Executive Committee, 12th tenure. At the same time, it adjusts pensions, social insurance allowances, monthly allowances, preferential allowances for the meritorious, and a number of social security policies currently linked to the base salary.

According to the proposal of the Ministry of Labor, Invalids, and Social Affairs, pensions and social insurance allowances will increase by 15% from July 1st.

The Ministry of Labor, Invalids, and Social Affairs believes that if the salary of civil servants and public employees increases by 23.5%, then pensions should increase by at least 15%. When the wage reform is implemented, retired employees before 1995 will have their benefits settled at the highest level, ensuring that they are not disadvantaged. For the meritorious, after the wage reform, they will receive a higher-than-average salary.

The Vietnam Social Security suggests adjusting the pension increase by 8% from July 1st, to reduce the disparity between those receiving pensions before the wage reform and those receiving pensions from July 1st onwards.

According to the Vietnam Social Security, with the proposed method of calculating the average salary subject to social insurance for calculating pensions and lump-sum benefits, the average 5-year pension level of employees will increase by approximately 1.5% (excluding inflation), while the pension of those retiring after July 1st will only increase by approximately 0.13% compared to those retiring in June 2024.

In practice, the pension adjustments in 2004 and 2005 were only around 10%, and considering the inflation factor in the pension adjustment and economic growth in 2023 (as stipulated in Article 57 of the Social Insurance Law 2014), the Vietnam Social Security proposes a pension adjustment of approximately 8% from July 1st.

Regarding pension increases, according to the Ministry of Labor, Invalids, and Social Affairs, they will be divided into 3 groups of beneficiaries.

Specifically, Group 1 includes regular retirees, whose pension increase will be calculated reasonably between the region where they worked and their retirement location, and will be balanced among those with the same position before and after July 1st.

Group 2 includes retirees before July 1st, for whom the State needs to apply a compensation level to reduce the salary difference between retirees before and after the wage policy reform.

Group 3 includes retirees before 1995, for whom it is proposed that the Politburo and competent authorities apply special policies to further increase their pensions.