|

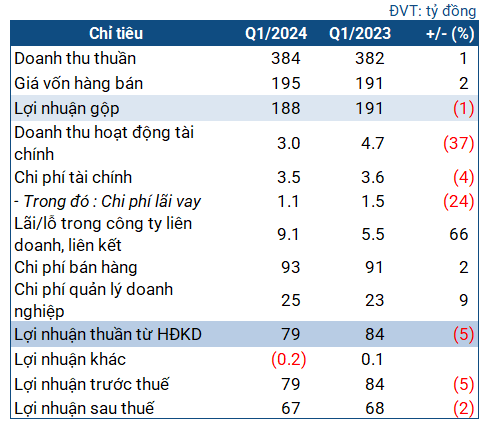

Bidiphar’s Business Situation in Q1 2024

Source: VietstockFinance

|

In Q1, Bidiphar recorded a slight increase in both revenue and cost of goods sold, reaching 384 billion VND and 195 billion VND respectively. After deduction, the company’s gross profit was 188 billion VND, which is the same as the same period last year.

Fluctuations in other indicators did not have much impact on the final result. Bidiphar ended Q1 with after-tax profit of 67 billion VND, which is nearly the same as the previous year.

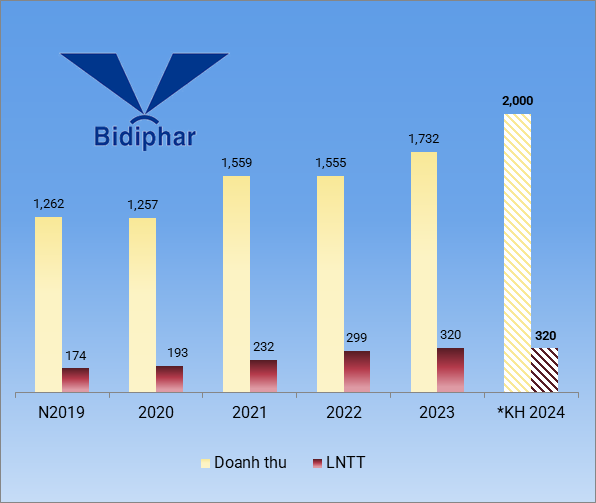

At the 2024 AGM, DBD set a revenue growth target of 15% to 2 trillion VND, but pre-tax profit remained the same as the record level of the previous year at 320 billion VND. Compared to the plan, the company achieved 19% of the revenue target and nearly 25% of the pre-tax profit target for the year.

|

Bidiphar’s Results for Previous Years and 2024 Plan

Source: VietstockFinance

|

In terms of financial status, Bidiphar owns a safe balance sheet at the end of Q1. Total assets reached nearly 2 trillion VND, with nearly 1.3 trillion VND being short-term assets, which is the same as the beginning of the year. The amount of cash and cash equivalents decreased by 14% to nearly 267 billion VND. Inventory slightly decreased to 480 billion VND. Construction in progress costs increased slightly to 166 billion VND, mostly for the high-tech pharmaceutical factory.

Meanwhile, liabilities decreased by 10% to 499 billion VND, with over 365 billion VND being short-term debt (down 13%). The current ratio and quick ratio both exceeded the safe threshold, at 3.6 times and 2.2 times, respectively.

Short-term debt at the end of the period was just over 41 billion VND, which is a loan from BIDV Binh Dinh. In addition, the company also has a long-term loan of 40 billion VND from the Binh Dinh Development Investment Fund.