The VN-Index continued to climb for the third consecutive session this morning, buoyed by the strength of blue-chip stocks. The VN30-Index rose 0.7%, the strongest performer among the capitalization group indices, while accounting for over 45.3% of the total matched value on the HoSE floor. The five most actively traded stocks on the market were all in this basket.

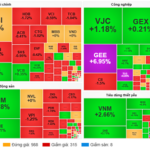

In addition, all 10 stocks leading the VN-Index were in the VN30 group. The leaders were TCB up 2.67%, HPG up 2.29%, VCB up 0.65%, MSN up 2.94%, BID up 1.02%, VRE up 2.42%… The uptrend is dominating the blue-chip group, with 19 stocks rising and 9 falling.

However, the VN-Index closed the session up only 0.58%, rather modestly, as there was still no good consensus on the pillar stocks: VHM was down 0.49%, VIC down 0.23%, FPT down 0.63%. In addition, VCB, CTG, GAS, VPB were still weak.

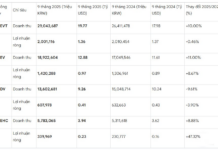

Overall liquidity on the two exchanges this morning has not improved, with only nearly VND6,290 billion successfully matched, down 20% compared to yesterday morning. The HoSE floor also decreased by 20%, reaching VND5,823 billion, the lowest in 3 sessions. The market liquidity leaders are also some blue-chips such as TCB, with VND318.8 billion matched, MSN with VND298 billion matched, HPG with VND276.7 billion matched, MWG with VND253.5 billion matched, and FPT with VND157.2 billion matched.

One of the reasons for the weak liquidity could be that investors are waiting for the restructuring of the domestic ETF fund this afternoon. Typically, trading slows down in the few sessions before restructuring but explodes in the ATC session due to matching orders.

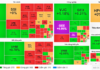

Although liquidity is very cautious, that does not mean the developments are unfavorable. Rather, the market is gradually moving up in a cautious sentiment. The development of the HoSE floor breadth indicates that there are still some light sell-offs. The VN-Index peaked at 9:20 am, up nearly 9.4 points, then pulled back. The second peak at 10:45 am was up about 8.6 points, and the morning session closed up 7.08 points, equivalent to +0.58%. Thus, the index reflects the fact that blue-chips are holding their momentum and anchoring higher, while the breadth is narrowing slightly under weak selling pressure. The VN-Index currently has 265 stocks up/158 stocks down, while at the second peak, the index had 269 stocks up/121 stocks down.

The extent of the price decline in stocks is also not too wide; on the HoSE floor, only about 35% of the stocks with trading transactions dropped by more than 1% compared to the peak, of which half fell enough to change color. FPT, TCH, SHB, DGC, GMD, VHM are the stocks that have declined significantly and turned down. Most of the other most liquid stocks are still holding their prices in the green zone, indicating that there is sufficient support (in the case of high liquidity) or weak selling pressure (in the case of low liquidity).

Looking at the distribution of cash flow, the positive breadth on the up-price side also corresponds to the level of liquidity concentration. Specifically, nearly 71% of the trading value on the HoSE this morning is concentrated in the group of stocks with increasing prices, while more than 24% is concentrated in the group with decreasing prices. In addition, the entire floor has only 34 stocks decreasing by more than 1% and a group with extremely low liquidity. Only BAF, with a decrease of 1.06% and VND46.7 billion, is significant; the rest are only a few billion to a few tens of million VND.

The market’s gradual rise on low liquidity is raising significant concerns. The “sell in May” story is not necessarily true in the Vietnamese market, but investors still have reasons to worry. The support factor from business results is having a more isolated impact on stocks rather than driving a new general uptrend across the market. With the liquidity plummeting so much, it is difficult to say that investors have withdrawn money from the stock channel; they may just be reducing their trading intensity and not being greedy.